2026#01: Indian Equities Kick Off 2026 with Broad Participation

Nifty500 breaks consolidation to hit fresh 52-week highs as market breadth shifts from defensive to offensive. Plus, earnings season kicks in next week.

Indian equities kicked off 2026 on a strong note with benchmark indices Nifty50 scaling fresh all‑time highs, broader participation remained constructive and Nifty500 extended its uptrend for another week.

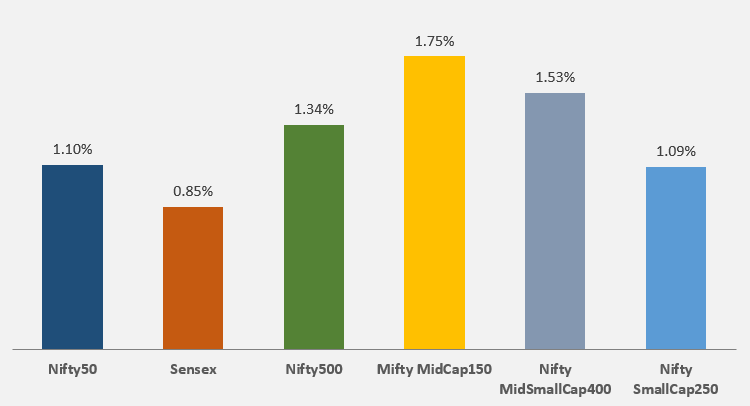

Key Indices Performance:

It was a strong week for the broader and midcap universe, with Nifty500, Nifty MidCap150 and Nifty MidSmallCap400 all outperforming the frontline Nifty50 and Sensex. This points to a constructive participation widening beyond largecaps. Nifty SmallCap250 at 1.09% still did well but lagged the midcaps, suggesting investors are currently favoring relatively higher‑quality midcaps over the more volatile smallcaps.

Key Drivers for the Market

Optimism around upcoming earnings: Corporate profitability is the single most critical factor as we move in to 2026. Markets are entering the Q3 FY26 earnings season next week with a clear sense of optimism, as investors look for confirmation of strong domestic demand, healthy credit growth and margin stability. Corporate India’s performance will be the ultimate test for the market mood going forward.

Pre-Budget 2026 Positioning: With the Union Budget usually presented on February 1, January is the peak month for ‘Budget trades’.

Global Trade Policy: Delays or negative developments regarding India-US trade deal, remain the primary external headwinds.

Technical Perspective

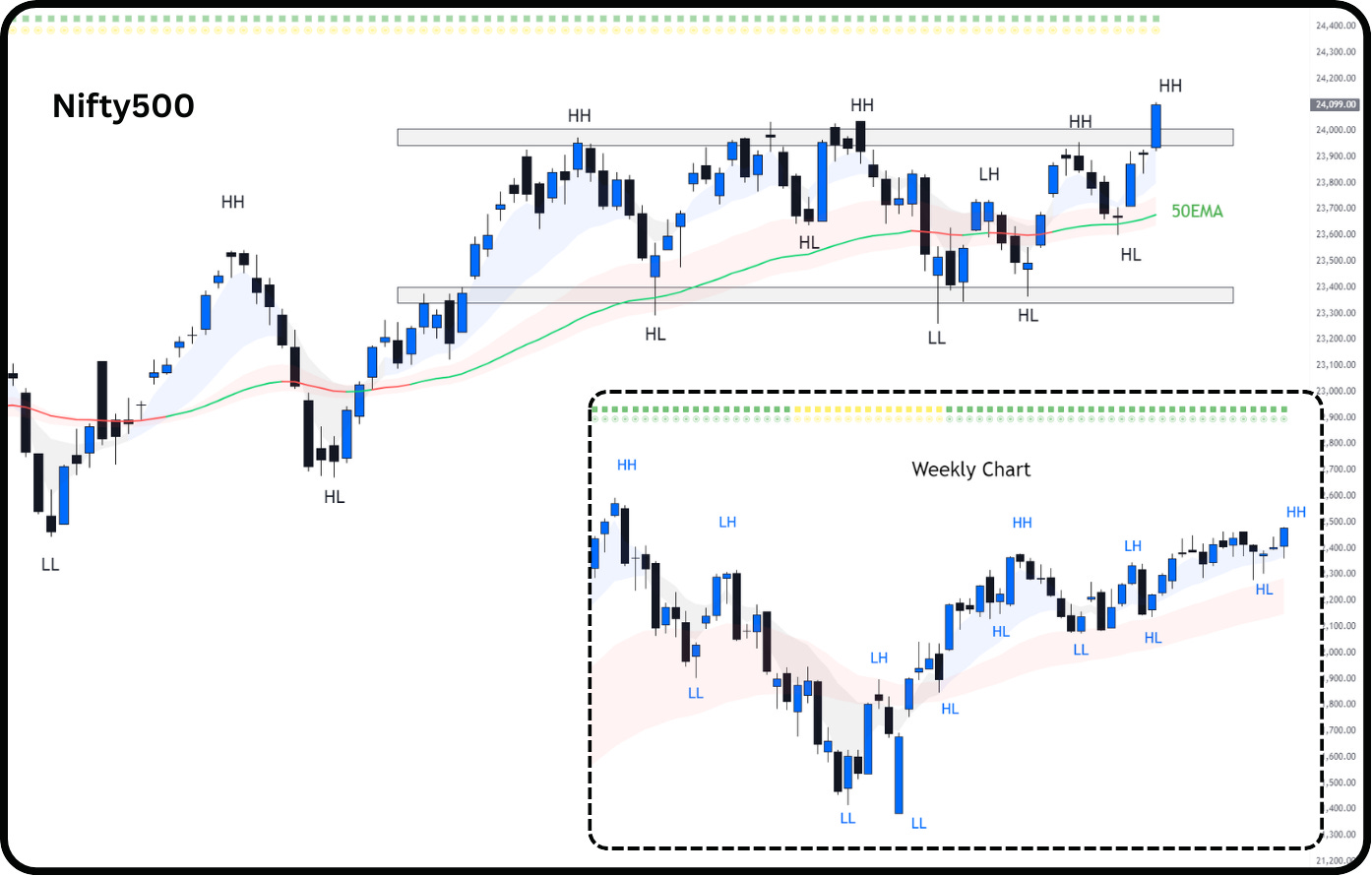

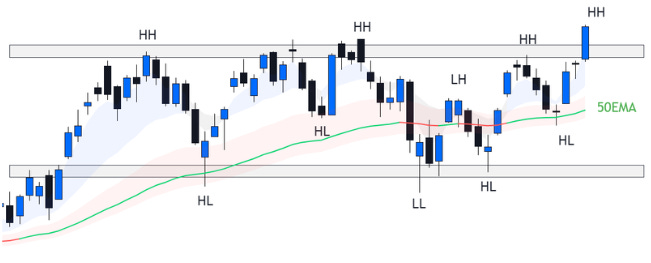

Nifty 500 Bullish Breakout: Nifty500 has made a significant structural breakthrough, shifting from a sideways consolidation phase to a fresh bullish breakout of the horizontal channel.

New 52W High: The latest candle is a strong bullish breakout that has set a new 52-week high, surpassing the previous resistance near 24,035. The pattern of Higher Lows (HL) and Higher Highs (HH) has resumed.

Weekly Perspective: The weekly chart reinforces this strength, showing a clear HH formation that confirms the primary bullish trend remains intact and is gaining fresh acceleration.

50EMA: The index is now trading comfortably above the 50EMA, which is beginning to slope upward again, signaling renewed short-to-medium-term strength. Staying above 50EMA keeps the “Buy on Dips” sentiment alive.

Momentum Signal: The 10EMA over 20EMA ‘Stay’ signal triggered on December 23 stays intact. Nifty500 maintained its footing and successfully challenged the previous overhead supply.

Key Risks: Failure to sustain above the 24,000 level could lead to a retest of the Rising 50EMA dynamic support. This will lead to a fallback in the consolidation range.

The reason we track Nifty500 is because it represents over 90% of the free float market capitalization, making it a comprehensive barometer of market health.

Nifty500’s 10EMA crossed over its 20EMA on 23rd December triggering a ‘Stay’ signal that suggests holding onto existing long positions.

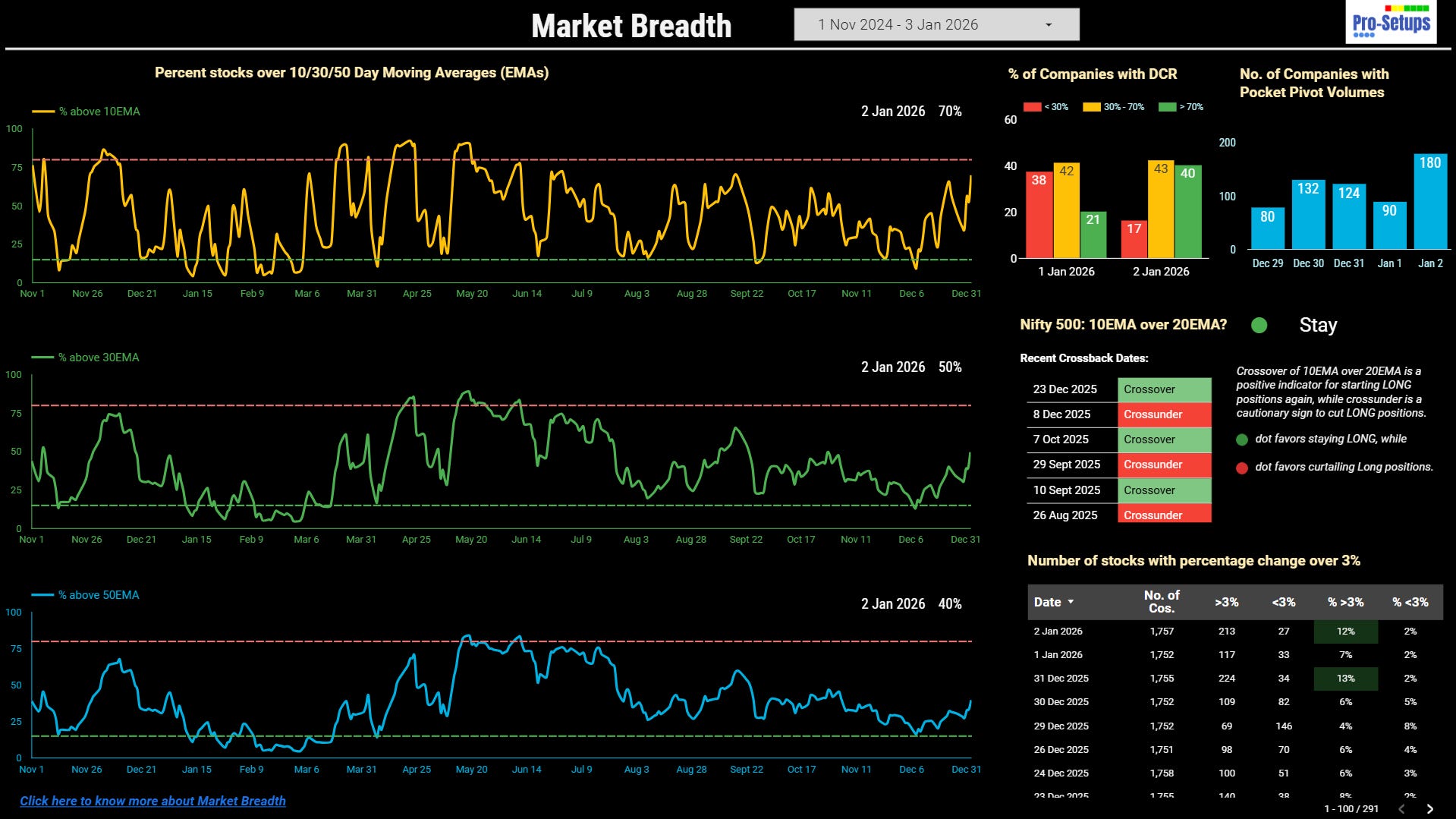

There has been a sharp surge in the number of stocks participating in the current uptrend.

10-Day EMA: 70% of stocks are now trading above their 10EMA, a substantial jump from 47% in late December.

30-Day EMA: 50% of stocks are above their 30EMA, finally hitting the critical midpoint.

50-Day EMA: 40% of stocks are above their 50EMA (up from 31% last week).

While the short-term trend is now robust, the medium-term structural stability (50EMA) is still recovering but is no longer "weak," showing a clear upward trajectory.

With the majority of stocks (70%) now above their short-term averages and nearly half above their medium-term averages, the market breadth has shifted from defensive to offensive. The 50EMA breadth is currently at 40%. A move above 50% would confirm a structural recovery for the broader market. Until then, the broader market cannot be said to have fully transitioned back into a confirmed uptrend.

It is important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.

Accessing Market Breadth on Pro-Setups Dashboard is available for all readers. Click on the link below.

Summary

The Nifty 500 has ended its period of uncertainty by breaking out of its consolidation range. This move, characterized by a fresh 52-week high, suggests that the ‘Buy on Dips’ sentiment is firmly back in control. For the first time in several weeks, short-term breadth (10EMA) is back in healthy territory (>60%), and the medium-term breadth (30EMA) has touched the 50% midpoint. However, the 50EMA reading remains below 50%, indicating that the broader market has not yet fully transitioned back into a confirmed uptrend. Investors should now watch for the index to sustain levels above 24,000 to confirm that this is not a ‘fake-breakout’, though the broad-based participation and Higher High formation make a continuation of the bull run the more likely scenario.