Bad Results? Stock Up! Good Results? Stock Down! What's Going On?

A look at why seemingly good results don’t guarantee green candles, and vice versa.

Most of us assume that if a company reports strong earnings and sales growth, its stock price will go up. After all, better financials mean the business is doing well, so why would not the market reward it? On the flip side, we also expect a company to be punished if it shows declining numbers. But in reality, the stock market doesn’t always behave this way.

Consider these recent examples, based on Q4FY25 results:

Vardhman Special Steels reported a 3% decline in revenue, 40% drop in net profit and on April 22, 2025. Ideally, the stock should be seeing negative reaction to price since revenue, profit & margins declined. Well, the stock hit the 20% upper circuit the very next day. Similarly, Hindustan Aeronautics announced a 7% decrease in revenue and an 8% fall in net profit, yet its stock price surged over 11% following the results. Alok Industries saw a sharp 35% decline in revenue and a 66% drop in net profit, but its share price gapped up and closed 18% higher the next trading day.

On the other hand, Indian Hotels Company posted a robust 27% increase in both revenue and net profit, but its stock price fell by more than 6% after the results. Associated Alcohols & Breweries experienced a 12% drop in its share price despite reporting an over 80% jump in net profit. Jagsonpal Pharmaceuticals also saw its stock gap down and close around 9% lower, even after declaring a 35% rise in revenue and an 85% increase in net profit.

Stock prices do not always move in direct response to reported numbers; instead, they react to how those results compare to investors’ expectations. If a company does better than what investors expected, its stock often rises. If it disappoints, the stock may fall even if the company is still growing. Imagine a company reports a 10% increase in sales and profits. Sounds great, right? But if investors were expecting a 20% jump, the result is seen as a disappointment. Good results may not be “good enough” if expectations are too high.

Why is this important?

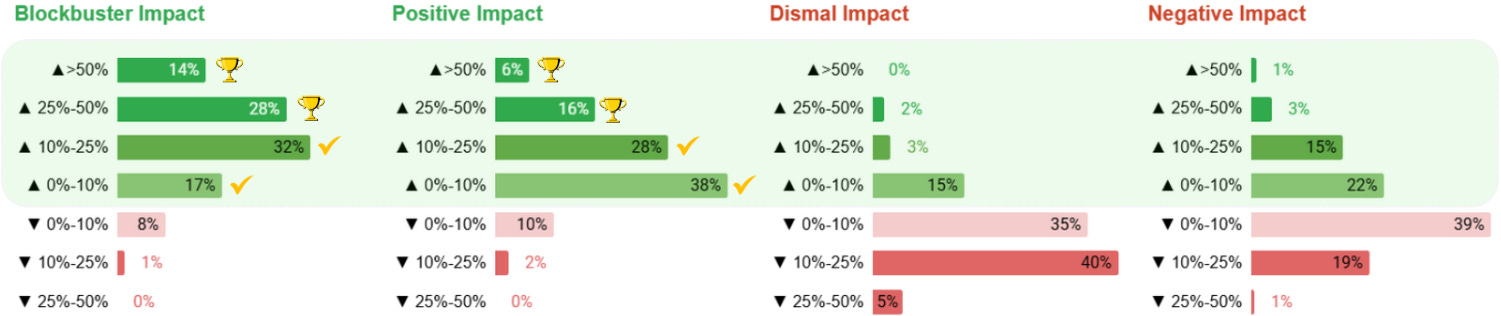

Our December 2024 study on Q2FY25 results tells us that companies that had a positive reaction after declaring results stayed positive after two months of results declared. This at a time, when our markets had already started the bear phase since October. On the other hand, companies that had negative reaction after results were still negative after two months. Under 'Blockbuster & Positive impact', many stocks gained 25%-50%, with some exceeding that, while returns in 'Dismal & Negative impact' were negligible. Even for 0%-25% gains, 'Blockbuster & Positive impact' significantly outperformed. Additionally, very few stocks in this category had negative returns, unlike the large number in 'Dismal & Negative impact’.

So while trading (swings or positional), why not stay with the companies that had positive reaction to the stock price immediately after declaring the results. At Pro-Setups, we have the solution.

With so many results getting announced during the earnings season, it makes life of a trader really hard to concentrate on winning stocks. Pro-Setups makes your life easier by classifying earnings impact based on how stocks react to earnings.

To assess the immediate price action after earnings reports, we have Results’ Impact on Price filter in our Dashboard. This filter indicates whether the stock experienced a blockbuster, positive, negative, dismal, or no impact immediately after the results announcement. The filter takes into account the size of the company based on its market capitalization as well as the percentage change the stock witnesses immediately after the results are declared.

Conclusion

In conclusion, the evidence from our study is clear: stocks that show a positive or blockbuster reaction immediately after their earnings announcements tend to outperform, even in challenging market conditions. On the other hand, companies that receive a negative response after results often continue to lag behind. As a trader or investor, focusing your attention on stocks with strong post-earnings reaction can significantly improve your chances of capturing meaningful gains.

Our Results’ Impact on Price filter helps you quickly identify which stocks are attracting positive attention after their results, allowing you to concentrate on potential winners and avoid those likely to underperform.

Give Pro-Setups a try and see how our tools can help you make smarter, more confident trading decisions.