Borana Weaves Limited - Quick IPO Note

Unlike many new-age businesses, Borana is a traditional manufacturer that has generated profits and delivered strong profitability for its owners.

You can download the One Pager IPO Note of Borana Weaves by clicking here.

Sector: Textiles

Industry: Textile - Yarn/Fabric/Processing

Market Cap: ~₹575 crores

Issue size: ~₹145 crores

IPO price: ₹205–₹216per share

Issue Dates: May 20 - May 22, 2025

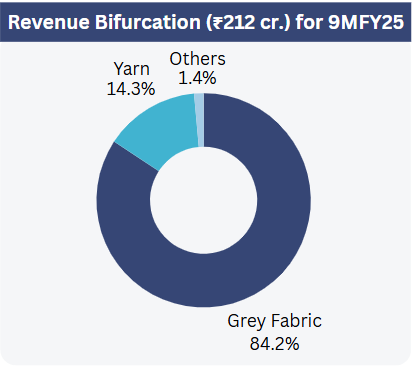

Company Description: Incorporated in October 2020, Borana Weaves manufactures unbleached synthetic grey fabric and polyester textured yarn (PTY) at its manufacturing units in Surat, Gujarat. The company serves various industries including fashion, technical textiles, home décor, and interior design, with the synthetic grey fabric acting as a fundamental material for further processing like dyeing and printing. The company is part of a business group that includes R&B Denims Ltd. (listed on BSE with Market Cap of ~₹800 cr.)

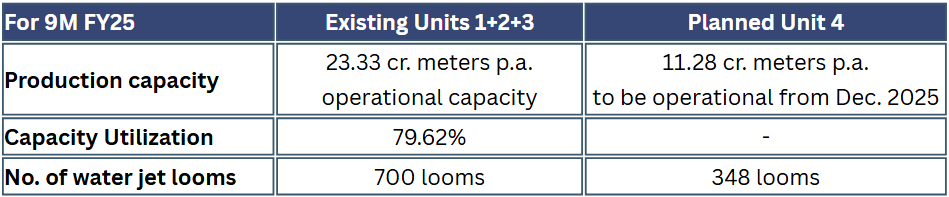

Manufacturing: All the three operational manufacturing facilities, as well as the planned facility, are located in Surat, which is the major textile and apparel manufacturing hub in South Gujarat. The company benefits from this strategic location, since it provides easy access to raw materials & customers.

Objects of IPO:

Capex for Unit 4 : ₹71 cr.

Working capital: ₹27 cr.

IPO expenses: ₹15 cr.

General corporate exp: ₹32 cr.

Analysis: Borana specializes in synthetic grey fabrics, a fast-growing industry sub-segment, and is led by a highly experienced promoter & management team with a proven track record in value creation through their other listed company. The company is operating near full capacity and is expanding by over 50% with a new manufacturing unit. Its focused Surat-based sourcing and customer strategy provides cost and supply chain efficiencies, while deep local relationships further strengthen its position.

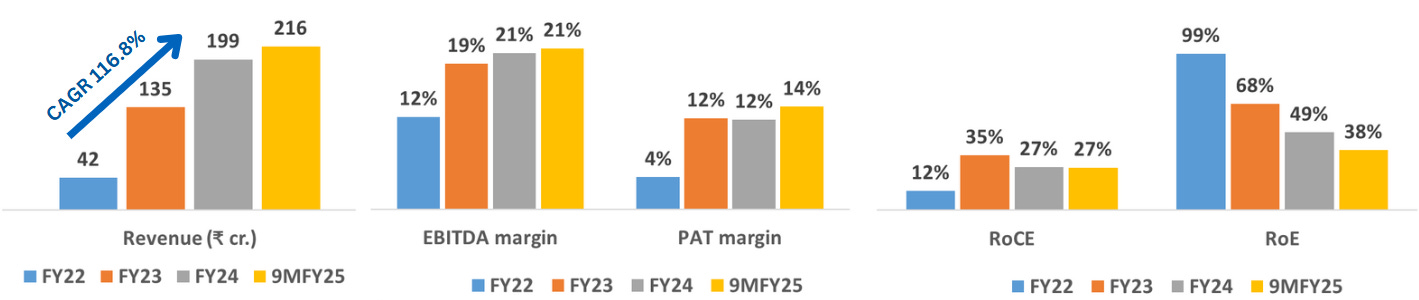

Financially, Borana has delivered outstanding results, achieving a 117% revenue CAGR from FY22 to FY24, with EBITDA margins rising from 12% to 21% and PAT margins from 4% to 12%, alongside consistently strong ROE and ROCE. However, its grey fabric is a commodity with no pricing power or brand moat. And its margins rely heavily on Gujarat’s subsidies (₹7.5 crore in FY24 alone), so any reduction in these benefits could quickly erode profitability.

Unlike many new-age businesses, Borana is a traditional manufacturer that has generated profits and delivered strong profitability for its owners.

Valuation: Borana is issuing shares at a P/E multiple of 14.7x, based on annualized 9MFY25 PAT. Its competitors KPR Mill, Vardhman Textiles and Jindal Worldwide trade at a TTM P/E of 51x, 16.5x and 76x respectively.

Unlike many new-age businesses, Borana is a traditional manufacturer that has generated profits and delivered strong profitability for its owners.

Financials

Thank you for detailed note.