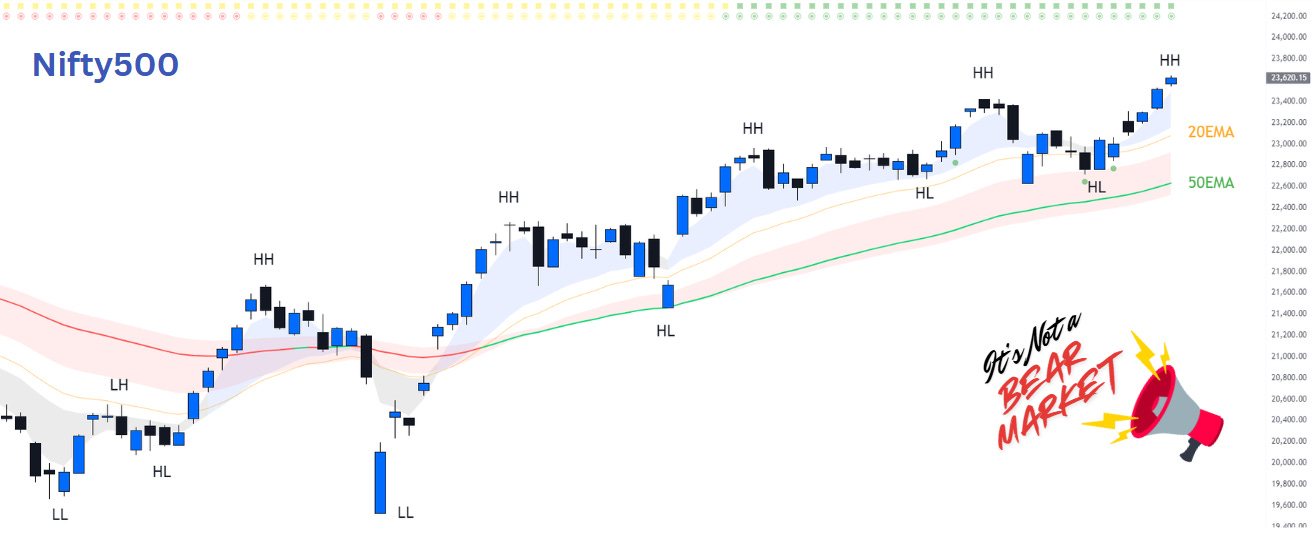

Bullish Momentum Returns: NIFTY500 makes new Higher High

Foreign inflows, easing global risks, and broad-based buying lift Indian markets to fresh multi-month highs.

The Indian stock market posted strong gains this week, with Nifty500 rising 2.5% and making a new Higher High. This rally was fueled by robust institutional investor inflows, positive global cues, and easing geopolitical tensions in the Middle East. Foreign investment remained a key driver, alongside optimism about potential US tariff relaxations and a drop in crude oil prices after a Middle East ceasefire. These factors significantly boosted investor sentiment.

From the lows of April 2025, Nifty500 has surged more than 20%. It’s not a Bear market anymore! You do not have to wait for the indices to hit all-time high before officially calling it a Bull market. A simple hack of Rising 50EMA and monitoring of 10EMA over 20EMA on Nifty500 works. Markets never move up in a straight line. There will be pullbacks on the way. Next pullback will probably retest 20EMA again. But such dips are likely to attract renewed buying interest. Overall, the outlook continues to remain bullish, supported by strong institutional flows and improving global sentiment.

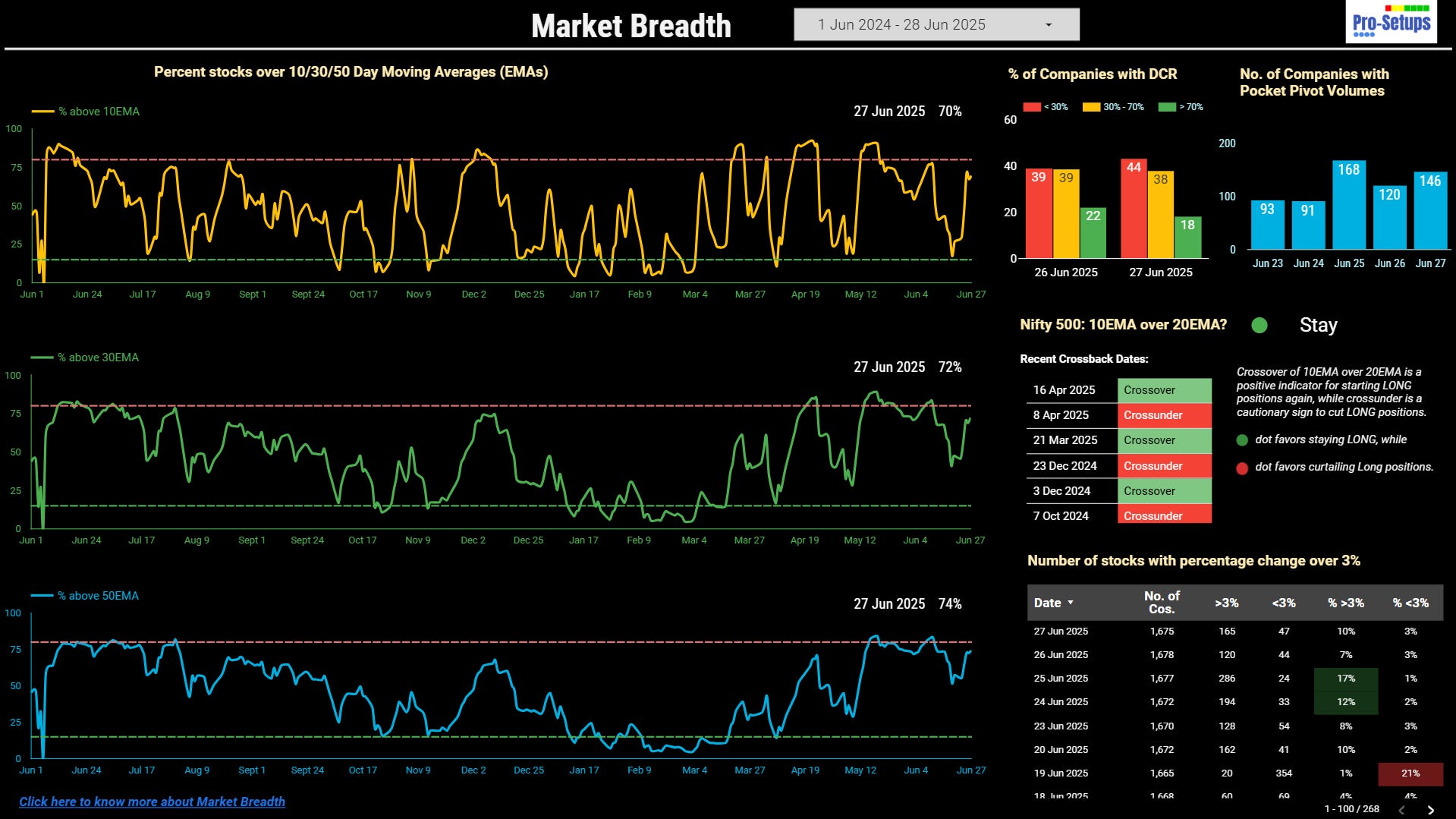

Market Breadth

A clear majority of stocks are currently trading above their short- and medium-term EMAs, signaling broad-based market strength. While the market is not yet in the overbought zone, just a few more days of upward movement could push it into that territory. At that point, swing traders may start locking in profits, which could lead to short-term pullbacks.