Encouraging Setup: Broader Market Yet to Join the Move

From sideways action to signs of strength. All eyes now on earnings quality and broader participation.

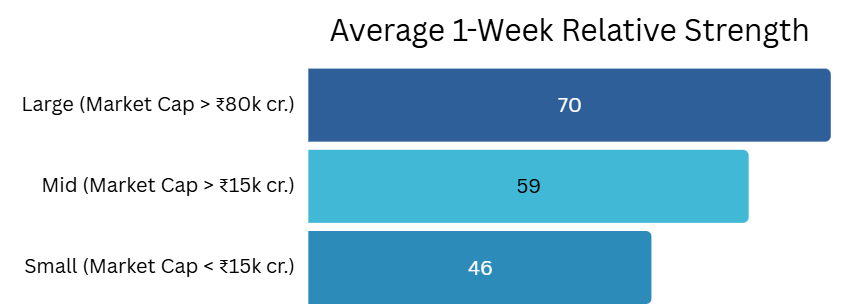

Indian equity markets showcased a clear large-cap dominated rally this week, with Sensex leading the charge at +1.76% gain followed by Nifty50 at +1.68%, while mid and small-cap segments significantly underperformed. The Nifty500 gained 1.12%, reflecting the mixed performance across market capitalizations, with Nifty Midcap150 managing only 0.18% gains, Nifty Smallcap250 declining 0.21%, and Nifty Midsmallcap400 remaining virtually flat at 0.04%.

Use Code DIWALI2025 for 40% Discount and 1-month extra on Annual SubscriptionKey Drivers This Week

Large-cap Concentration: Banking stocks drove benchmark gains while mid/small caps lagged. In fact, benchmark indices Nifty50 and Sensex hit their 52-week highs, and are just few percentages away from their all-time highs.

Mid and small-cap stocks faced selling pressure, while large caps outperformed. Large-cap stocks showed higher relative strength compared to mid-cap and small-cap stocks.

Technical Perspective

Nifty500 Trend: Nifty500 gained approximately 1.12% this week, marking its third consecutive week of gains. While this positive streak is encouraging and suggests improving underlying strength, the index continues to trade within a consolidation range.

The current sideways pattern, however, is taking on an increasingly constructive tone with higher highs & higher lows being established, indicating that the underlying technical structure is building a solid foundation for potential upward movement.

As mentioned in the previous week’s newsletter, on weekly timeframe, the Nifty500 index seems to be forming the handle portion of a Cup-and-Handle pattern, with volatility tightening, which is a sign of pressure building up before a breakout. When this handle resolves, it could be explosive. This setup often precedes a strong breakout, and if that materializes, it could set the tone for a highly rewarding 2026.

The reason we track Nifty500 is because it represents over 90% of the free float market capitalization, making it a comprehensive barometer of market health.

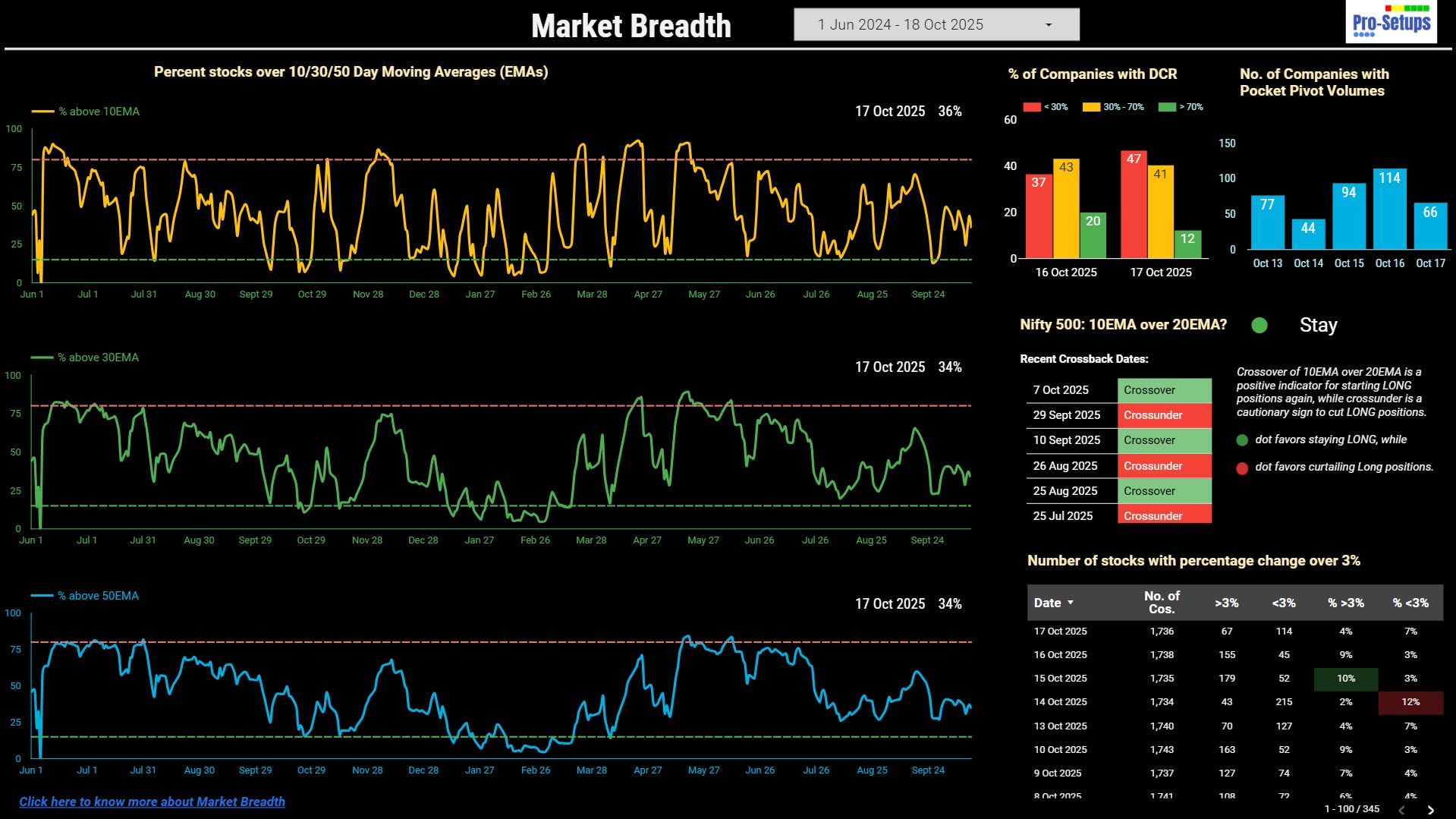

Nifty500’s 10EMA crossed above its 20EMA last week triggering a ‘Stay’ signal that suggests holding onto existing long positions.

Market Breadth: The % of stocks above all key short-term moving averages remained flat this week. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.

Accessing Market Breadth on Pro-Setups Dashboard is available for all readers. Click on the link below.

Summary

The market is showing signs of emerging from its sideways phase, with encouraging momentum building. The larger picture looks increasingly promising as we build a solid foundation for a better 2026. Nifty500 is still working through its developing cup and handle pattern. Going forward to next week, closely monitoring earnings quality will be essential. A broader market participation and sustained earnings quality across all market caps is yet to be seen. The overall trajectory appears more constructive than previous weeks.