Equity Markets This Week: Strong Start, Volatile Finish

RBI’s surprise moves lifted markets early in the week, but escalating global tensions and rising oil prices left Indian equities on edge.

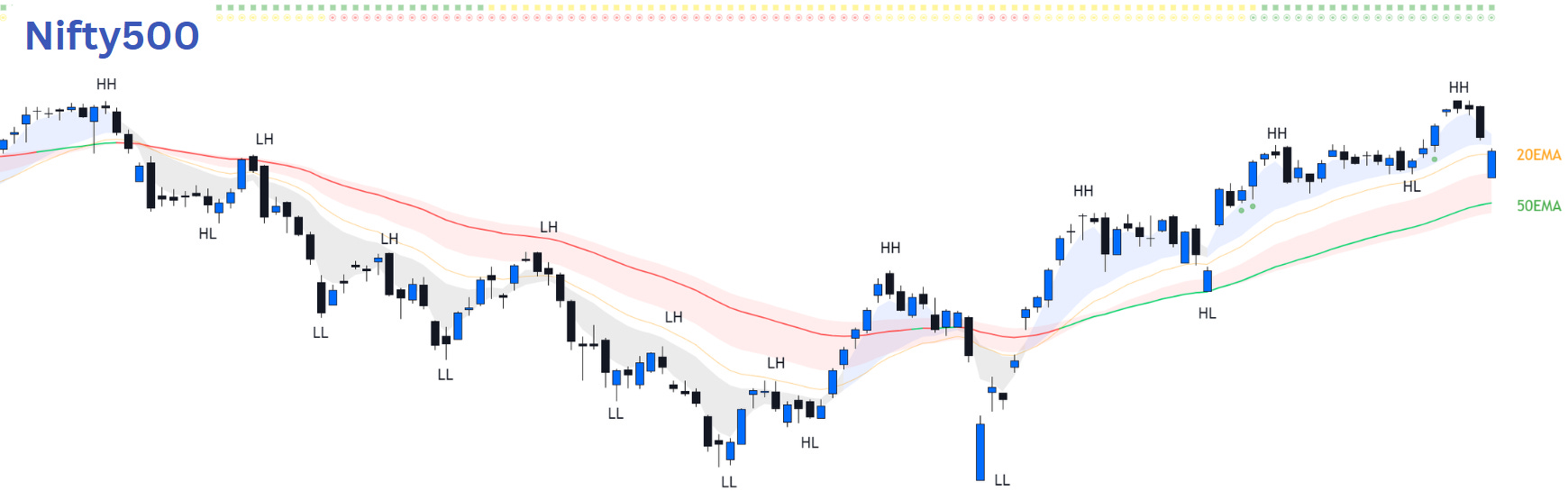

Our condolences go out to the families affected by the Ahmedabad plane crash. Indian equities started the week strongly, supported by the RBI’s larger-than-expected rate and CRR cuts. However, sentiment turned negative later in the week after geopolitical tensions escalated sharply following reports of an Israeli strike on Iran. This led to a spike in oil prices, pressuring markets globally. Reflecting this volatility, the Nifty500 index declined by about 1% over the week.

The medium to long-term outlook remains positive as long as indices stay above the rising 50EMA. Despite Friday’s sell-off, all major indices formed a gap-down reversal bar, which can be seen as a constructive technical signal. Only 12% of total stocks closed with DCR less than 30%. However, ongoing geopolitical risks have made the short-term outlook cautious, especially for oil-sensitive sectors. Swing traders are likely to have exited their positions, while positional traders are monitoring how their holdings react around the 50EMA level.

Overall, our outlook remains bullish, though in the short term, heightened geopolitical tensions could continue to weigh on stocks.

After touching the overbought zone (marked by the horizontal red dashed line on each chart), the breadth indicators (% of stocks above key short-term EMAs) have pulled back, signaling a cooling in short-term momentum. The % of stocks above 30EMA and 50EMA readings remain robust at 68% and 74%, respectively, suggesting that the medium to longer-term trend remains positive. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.