How to Exit Swing Trades: A Structured Mindmap

A visual guide to help you decide how to exit your swing trades effectively.

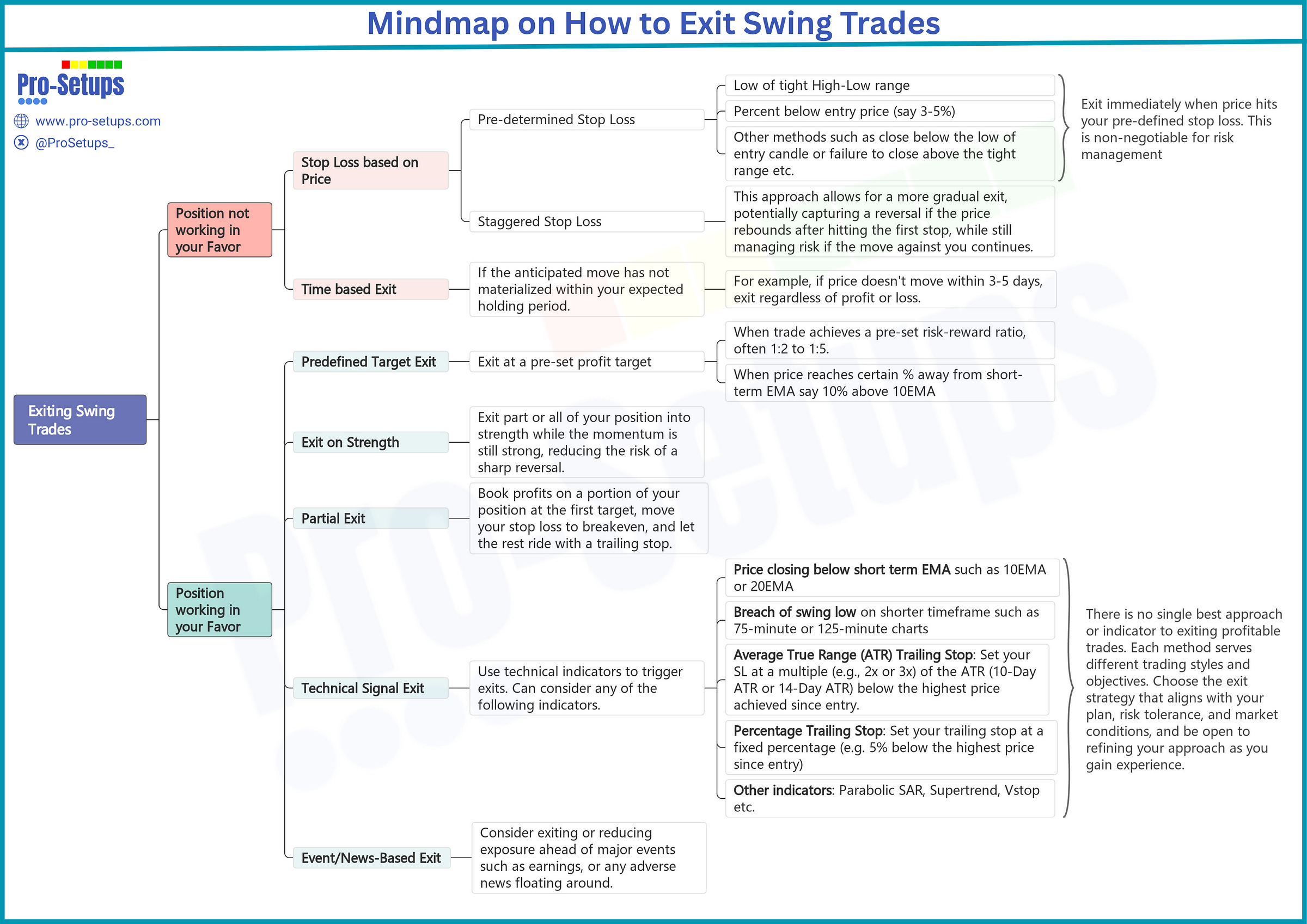

One of the most common questions discussed in our Pro-Setups Discussion Group is: “How do I exit my trades?” To bring clarity to this crucial aspect of trading, we have created a structured mindmap that visually breaks down various exit strategies for swing trades.

What’s Inside the Mindmap?

Position Not Working in Your Favor:

Different stop loss methods, including pre-determined and staggered stops.

Time-based exits for trades that don’t move as expected.

Position Working in Your Favor:

Strategies like predefined target exits, exiting on strength, and partial exits.

Technical signal-based exits using popular indicators (EMA, ATR, Parabolic SAR, Supertrend, Vstop, etc.).

Event/news-based exit considerations.

Why This Matters

When it comes to exiting trades, there truly is no single best approach, and that’s what makes trading both challenging and rewarding. Each trader has unique risk tolerance. What works for one person may not be suitable for another. Hence, the most effective exit strategy is the one that fits with your overall trading plan, allows you to manage risk with confidence, and evolves as you gain experience.

We hope this mindmap helps you define your exit rules more clearly and effectively in your swing trades.

Feel free to share your feedback or questions!

Happy Trading!