Incremental ROCE & ROE: The Secret Ingredients Behind Multibagger Stocks

Read Why Incremental Metrics Outshine Headline Ratios for Identifying Long-Term Winners

Investors rely on metrics like Return on Capital Employed (ROCE) and Return on Equity (ROE) to gauge a company’s profitability and efficiency. While these traditional ratios offer valuable insights, their incremental counterparts (i.e. Incremental ROCE and Incremental ROE) measure the returns generated from new capital invested, providing a deeper, forward-looking perspective on capital allocation effectiveness. In this article, we will understand why Incremental ROCE & ROE are important.

Understanding ROCE

ROCE measures how efficiently a company generates profits from its total capital (equity + long-term debt). It reflects overall operational efficiency and is calculated as:

ROCE = EBIT / Average Capital Employed * 100

where, EBIT = Earnings Before Interest and Tax; and

Capital Employed = Shareholders' Equity + Long-Term Debt (or Total Assets – Current Liabilities)

Use ROCE to judge how well a company is using all available capital to generate profits.

Understanding ROE

ROE measures a company's profitability in relation to the equity invested by its shareholders. It assesses how effectively equity investments generate profits, and is calculated as:

ROE = Net Profit / Average Shareholders’ Equity * 100

where, Net Profit = Profit After Tax; and

Shareholders' Equity = Equity Share Capital + Reserves & Surplus

Use ROE to assess how effectively management is delivering value to equity shareholders.

Both metrics (ROCE and ROE), when analyzed together, provide a comprehensive view of a company’s capital efficiency and profitability. Consistently high or improving ROCE and ROE indicates strong management and operational efficiency. On the other hand, a declining ROCE & ROE may signal inefficiency or poor capital allocation. Negative or low ROCE suggests the company is not earning enough to cover its cost of capital, which is a red flag for investors. ROCE and ROE should be compared to industry averages to assess relative performance. A company with ROCE and ROE above its industry peers is often considered better managed.

Incremental ROCE & ROE

When a business expands, incremental ROCE and ROE help the owner and investors judge whether the additional capital is being used as efficiently as before. Consistently high incremental returns signal smart growth; whereas declining incremental returns could be a warning to reconsider further expansion or refine the investment strategy.

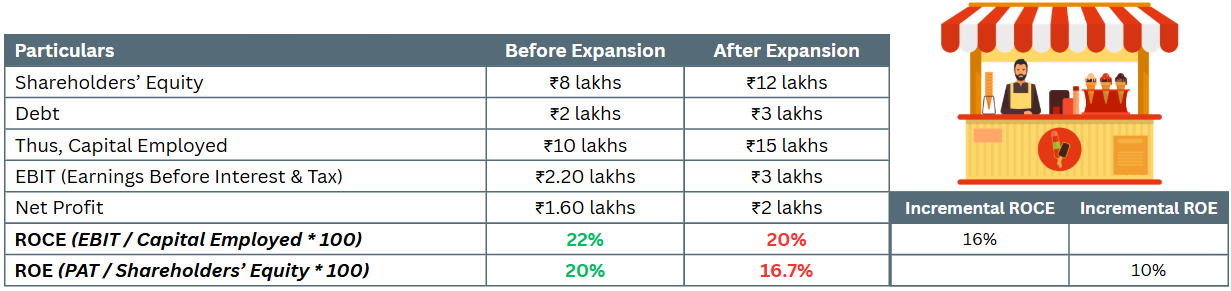

To understand incremental ROCE and ROE, let’s use the story of a neighborhood ice cream shop. The owner decides to open a second shop with an investment of ₹5 lakh (₹4 lakhs from equity and ₹1 lakh from Debt).

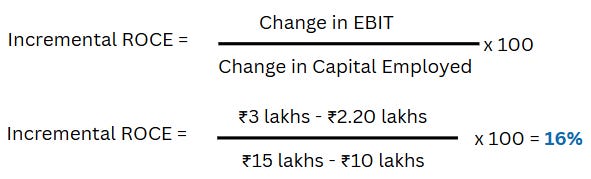

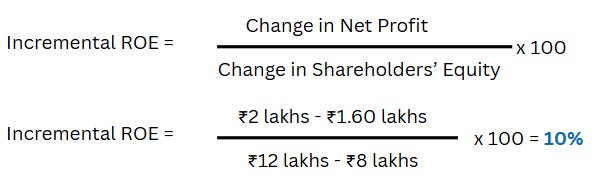

Clearly, the ROCE & ROE declined subsequent to expansion. Let’s see how the new investment performed.

The Incremental ROCE (16%) and ROE (10%) are lower than before expansion ROCE (22%) and ROE (20%), indicating that the new shop is less efficient than the first one. While the company is growing, the declining incremental ROCE and ROE raise concerns about the quality of its expansion and its ability to create value for shareholders.

Why Incremental ROCE & ROE Matters to Investors

For investors, tracking incremental ROCE and ROE offers an edge in identifying early signs of operational improvement, management quality, and future wealth creation. Companies that can sustain high incremental returns are often the ones that deliver the best long-term shareholder value. In summary, these metrics should be an essential part of every investor’s toolkit for spotting both risks and opportunities in the market.

Application of Incremental ROCE & ROE for Different Company Scenarios

1. Analyzing Profitable Companies Growing Well with High ROCE & ROE

For a company that is generating good profits and has good growth, incremental ROCE and ROE help investors assess whether management is effectively deploying profits for continued growth. High incremental returns (above 15-20%) indicates the company is finding profitable reinvestment opportunities. Comparing incremental returns with historical returns tells us if the company is maintaining or improving capital efficiency. High growth, but poor incremental returns creates negative value for shareholders. Warren Buffett wrote about it in Berkshire Hathaway 1992 Shareholder Letter.

So, if a company shows traditional ROCE of 20% but incremental ROCE of 30%, it indicates the management is deploying new capital more efficiently than the existing business, suggesting accelerating wealth creation potential. But if the same company has incremental ROCE of 14%, it erodes shareholders’ value.

2. Analyzing Loss making Companies with Turnaround potential

For companies in losses but showing signs of recovery, incremental returns can identify early turnaround signals. Positive incremental returns during loss periods indicate effective restructuring or rising incremental returns suggests the company is moving toward sustainable profitability. If a loss-making company shows improvement in incremental ROCE or ROE, it suggests that new capital is being used more efficiently than in the past, providing an early indication that the business could soon become profitable.

3. Non-Capital Intensive Companies that Do Not require High Capital for Growth

It becomes imperative for non-capital intensive high ROE companies (such as technology, services or asset-light businesses) to not hoard a lot of cash in their Balance Sheet, unless there is a clear and imminent need for it. Instead, surplus cash should be efficiently returned to shareholders or redeployed only into projects that meet or exceed the company’s high incremental return thresholds.

Lets see How Capital Efficiency Drove TVS Motor to a multi-bagger

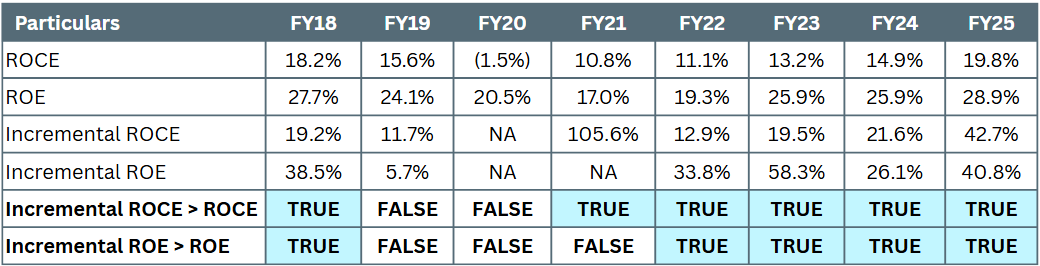

TVS Motor Company’s (NSE: TVSMOTOR) performance between FY18 and FY25 highlights the power of incremental ROCE and ROE as early indicators of business momentum and stock price action.

From FY18 to FY20, both ROCE and ROE steadily declined (ROCE from 18.2% to negative 1.5%, ROE from 27.7% to 20.5%), with incremental returns often lagging headline metrics. This period saw the stock price halve, reflecting market concerns about deteriorating capital efficiency and profitability.

The turnaround began in FY21, with ROCE and ROE rebounding sharply - reaching 19.8% and 28.9% by FY25. Incremental ROCE and ROE consistently exceeded headline metrics, signaling highly effective capital deployment. The market responded with a dramatic rerating with its price soaring more than sixfold from its 2020 lows.

Incremental Returns and Pro-Setups

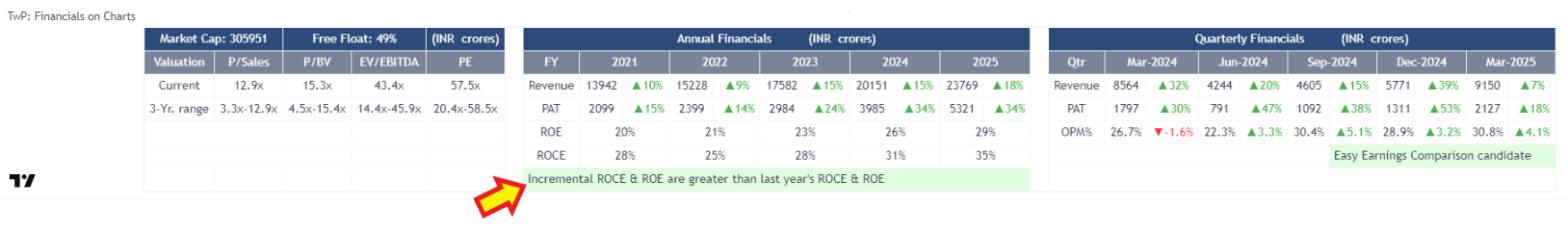

Our ‘Financials on Charts’ indicator on TradingView is designed to give you Key Notes on companies. ‘Incremental ROCE & ROE greater than last year’s ROCE & ROE’ is one of those notes, in addition to Easy Earnings Comparison, Code 33, Earnings Acceleration etc.

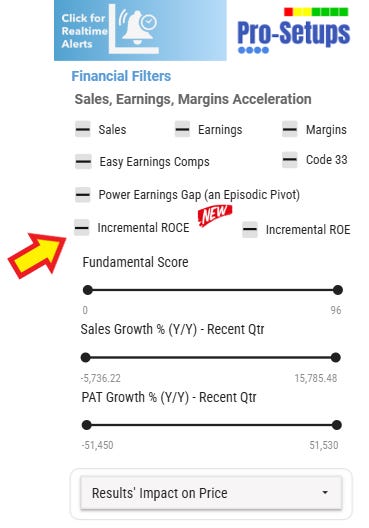

With Pro-Setups Dashboard, you can also scan for stocks that have Incremental ROCE and ROE higher than last year’s ROCE and ROE.

In summary, focusing on incremental ROCE and ROE gives investors a sharper edge in identifying companies with superior capital allocation and true multibagger potential. With the Pro-Setups Dashboard, you can efficiently screen and track stocks based on these powerful metrics, making your investment process smarter and more data-driven. For even greater conviction, combine these financial insights with technical analysis directly on the Dashboard. It’s time to head over to the Dashboard and start scanning for your next big opportunity.