Indian Equities Stabilize After Weakness, But Trend Unclear

Nifty500 shows recovery, yet remains locked in a broad range with no decisive trend.

The Indian stock market staged a remarkable recovery during the week ended October 3, 2025, with the Nifty500 gaining approximately 1.4% after experiencing significant weakness in the previous week. In its Monetary Policy Committee meeting, the RBI kept the repo rate unchanged at 5.5% for the second consecutive time. This dovish decision helped calm nerves and restore investor confidence.

Our Pro-Setups community met this weekend for an online session on ‘Trading Pullbacks’. Here is a short video on insights shared by one of our experienced members - Mr. Basker Ramachandran - on trading Undercuts. Do have a look.

Key Drivers This Week

Key market indices Nifty50 and Sensex gained around 1% each. Both Midcap and Smallcap indices gained by over 2% each. Nifty500, an index that we track at Pro-Setups, gained around 1.4% for the week.

RBI Policy Support: The RBI’s neutral tone and steady rates were the biggest drivers of sentiment this week.

Looking Ahead: The earnings season begins next week, starting with TCS results on October 9. Being the first major IT company to report, its performance will set the tone for the sector and influence broader market direction. Investors will be keenly watching revenue growth trends and margins.

Technical Perspective

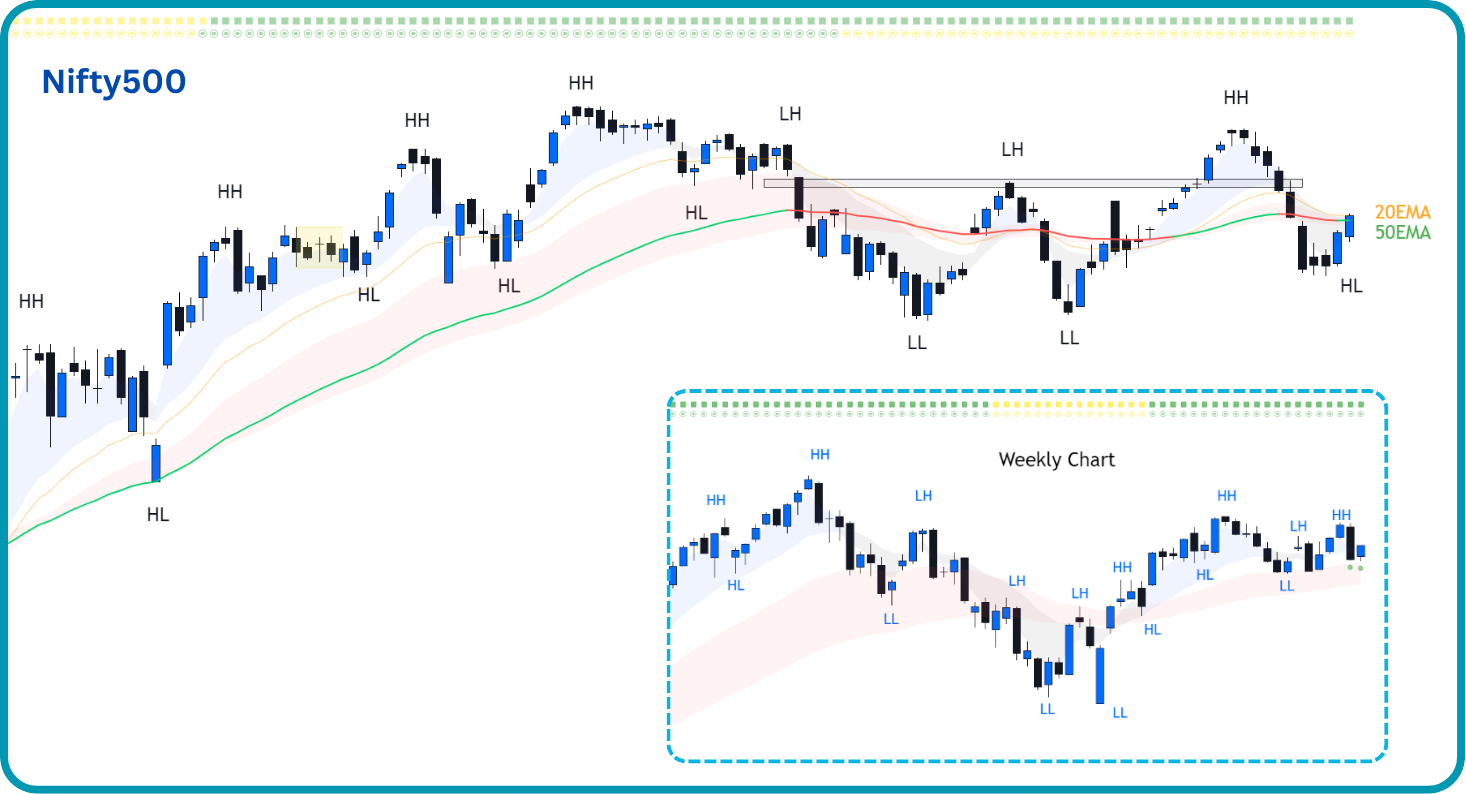

Nifty500 Trend: After last week’s heavy fall, the index recovered but remains stuck in a wide trading range. On the daily chart, the market looks sideways. On the weekly chart, it appears like a potential handle of a cup pattern, waiting for a breakout that could extend the bull market.

The reason we track Nifty500 is because it represents over 90% of the free float market capitalization, making it a comprehensive barometer of market health.

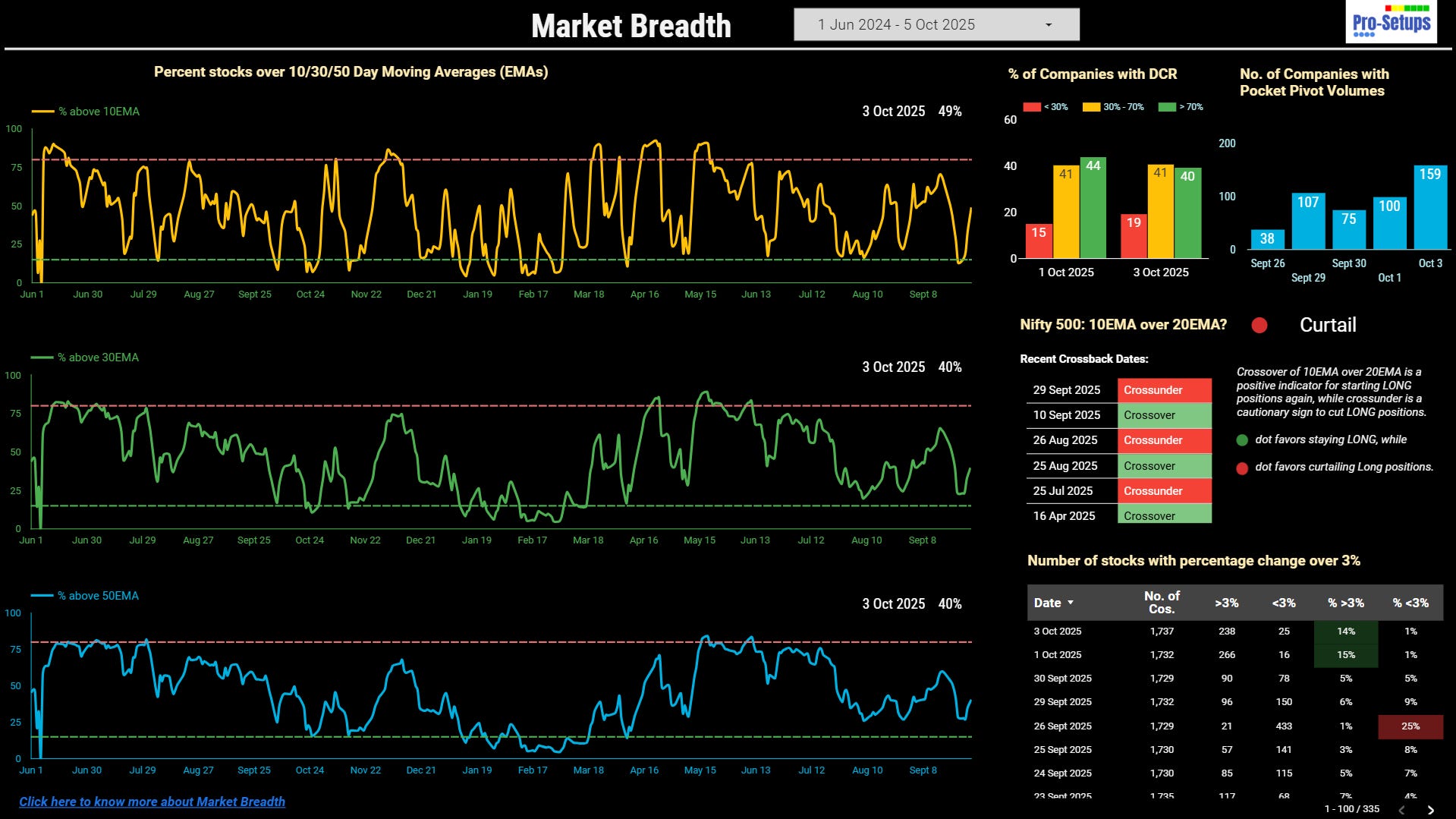

Market Breadth improved this week, with the percentage of stocks trading above key short-term moving averages rising sharply. It is important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.

The Nifty500’s 10EMA crossed below its 20EMA, triggering a Curtail signal (a warning for long positions). These signals will come and go during sideways market, a phase we are currently in.

Accessing Market Breadth on Pro-Setups Dashboard is now available for free for all readers. Click on the link below.

Trading & Investment Strategy

We are currently experiencing a sideways market, and it is proving more dangerous than a clear bear market. In a sideways market, stock prices bounce up and down within a range without going anywhere meaningful. The current swings that our market is experiencing are wide.

Sideways markets are trickier than bear markets. In a bear market, the direction is clear - everything is falling, so we simply stay away and keep our money safe. But in sideways markets, prices keep giving false signals - they go up a bit, making us think it is time to buy, then they fall back down, making us think that it is time to sell.

Last week, the Nifty500 slipped back into the 22,400–23,230 range after failing to sustain a bullish breakout. This week’s recovery looks more like a rebound than a trend change.

Swing Traders: Market mood is cautious. With the index just at the key moving averages, it’s best to have limited exposure and stay alert.

Positional Traders: Positional traders may want to focus on stocks showing strong relative strength in this tougher market phase.

Summary

The market remains in a sideways phase with no clear trend. The failed breakout above 23,230 has added to uncertainty, trapping bullish traders. Until the Nifty500 breaks decisively above this range, the strategy should remain defensive with strict risk management.