Indian Markets Cool Off

Nifty500 Slides Over 1% as Global Trade Tensions and Profit Booking Weigh on Markets

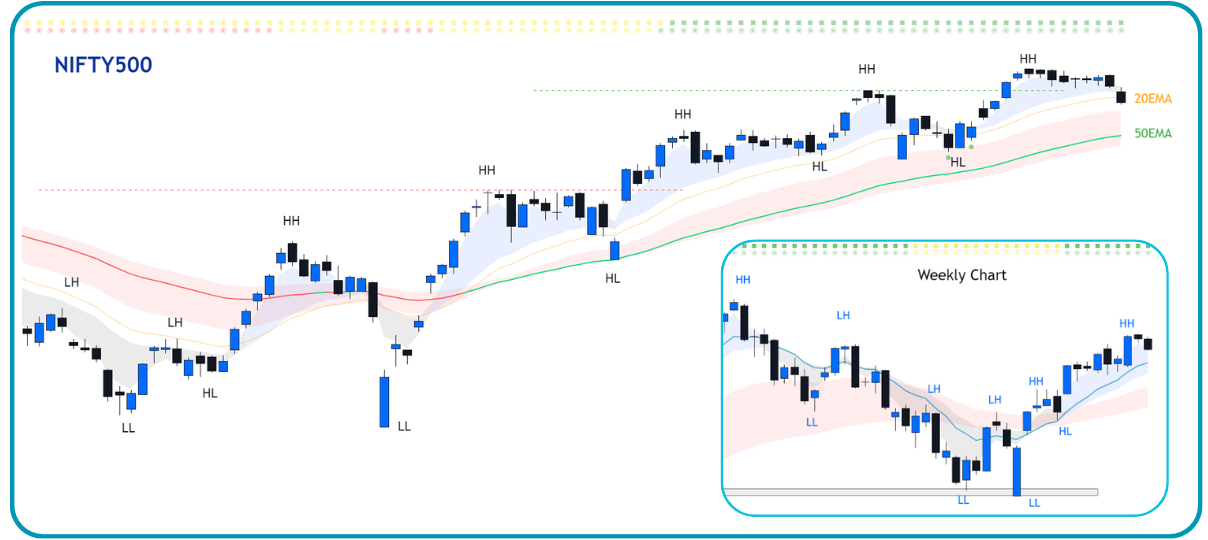

The Indian stock market experienced a broad-based decline this week, with the Nifty500 falling over 1%. After a strong run-up in previous weeks, traders locked in gains, plus the announcement of new tariffs by US on some countries has created a cautious environment for equities globally. However, such short-term swings are normal in markets and do not change the long-term outlook, which remains positive as long as key indices hold above their rising 50EMA.

Key Drivers This Week

Profit booking: After recent gains, investors locked in profits, leading to the market’s decline.

Global Trade Tensions: New US tariffs on multiple countries weighed on sentiment.

No Major Domestic Headwinds: Apart from uncertainties around the US trade deal, there seems to be no significant domestic factors impacting the market.

Technical Perspective

Nifty500 Trend: The Nifty500 chart continues to show an uptrend, with potential support at the rising 10-week EMA (equivalent to 50EMA on daily charts).

Short-Term Levels: The market’s reaction to the 20EMA in the coming sessions will also be closely watched.

Market Breadth: The % of stocks above all key short-term moving averages declined this week. While the market bias remains positive, further profit booking can be expected.

Trading & Investment Strategy

Pullbacks are normal: In any uptrend, pullbacks and corrections are inevitable. Markets never move up in a straight line. We believe that the recent pressure is a healthy pause rather than a trend reversal.

Swing Traders: Likely exited positions amid volatility.

Positional Traders: Monitoring how holdings react around the 50EMA levels for signs of trend continuation or reversal.

Key triggers:

If the Nifty500 manages to move back above its 20EMA, it would signal renewed short-term strength. This would be a bullish trigger again for swing traders.

Alternatively, if it pulls back to retest its 50EMA and finds support there, this would also be a constructive sign, marking the resumption of the uptrend and offering fresh trading opportunities.

Further profit booking can be expected, but medium to long-term bias remains positive.

Earnings Season Begins

The earnings season began this week. Heavyweight TCS disappointed with muted revenue growth.

Brokerage company ANANDRATHI reported the first Power Earnings Gap of the season.

As highlighted in previous newsletters too, we expect June quarter to be better than the previous ones with more positive earnings surprises.

During earnings season, traders should prioritize stocks with the potential to deliver blockbuster results in upcoming announcements. Our Pro-Setups Dashboard features a dedicated filter called 'Easy Earnings Comps', designed to help you identify such high-potential opportunities.

That’s it for this week. Stay tuned for our next update, which we will bring to you next weekend.