Market Consolidation Phase Amid Trade Tensions

GST reforms provide support while US tariff escalation to 50% creates headwinds for Indian equities.

Indian equity markets showed mixed performance during the week ending September 6, 2025, with the Nifty500 gaining over 1.63%.

Key Drivers This Week

GST Council Reforms: Major restructuring announced with 12% and 28% tax slabs eliminated, most items moved to lower 5% and 18% brackets, effective this month. The new 40% slab targets luxury cars, tobacco, aerated drinks, and gambling.

Both Midcap and Smallcap indices rose by over 2% each.

Traders continue to keep a close watch on US-India trade tensions as any development on this front is likely to shape near-term market direction. The upcoming RBI meeting date (Sept 29-Oct 1) will also be a key event to watch in coming month.

Technical Perspective

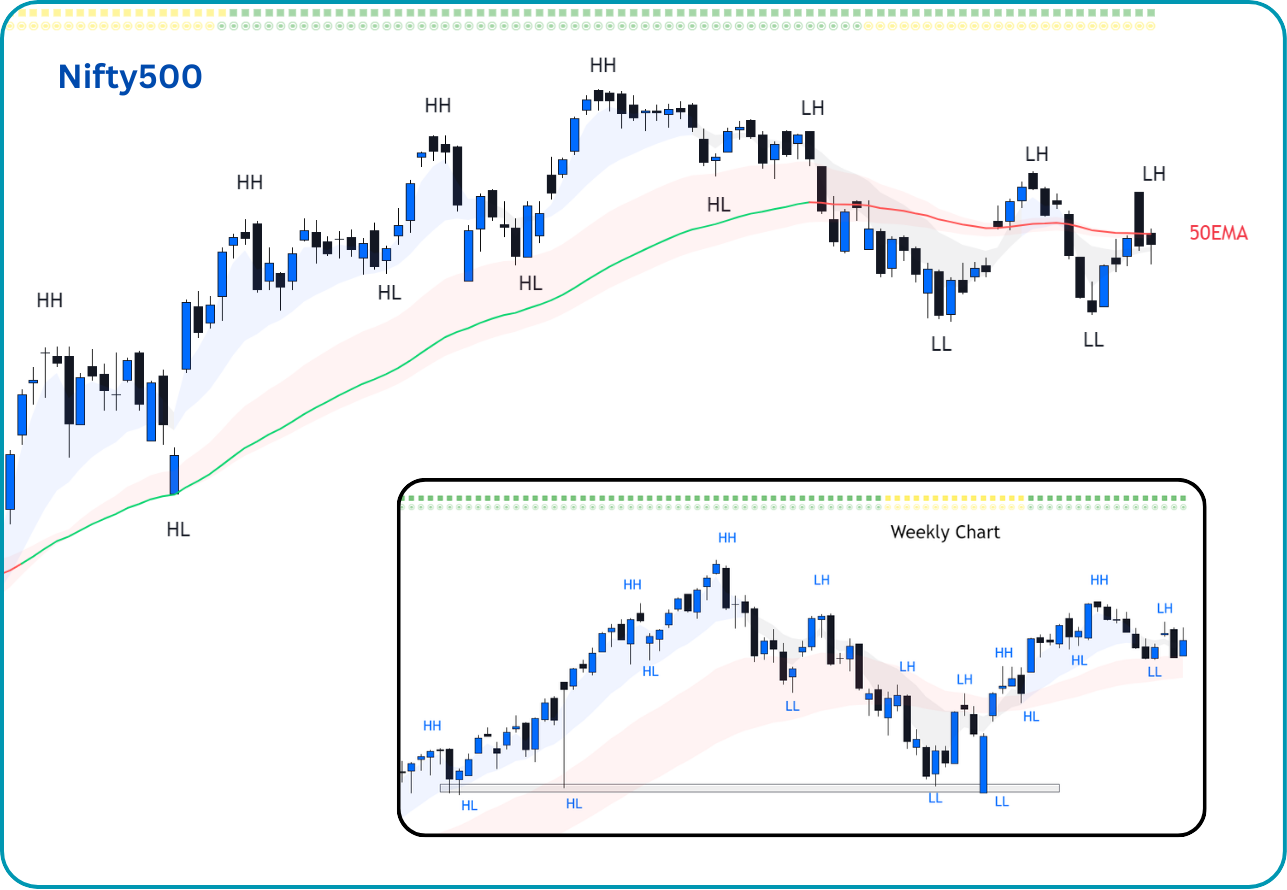

Nifty500 Trend: The Nifty500 defended its previous swing low this week, the same low levels it hit during the week of August 11, which is a crucial support area. A break of this level it would have signaled further weakness.

Short-Term Levels: For the market to turn positive again, the Nifty500 needed to break above the 23,200 resistance level.

Technical Changes Needed for Bullish Character: The 50EMA needs to be reclaimed and held as support rather than acting as resistance. At the moment, Nifty500 is oscillating around 50EMA, with no clear direction. Once the index moves back above this level and stays there for a few sessions, it would indicate the short-term trend is improving. Plus, the 20EMA and 50EMA should start sloping upward instead of pointing down. Additionally, instead of creating Lower Highs, the market needs to form a Higher High.

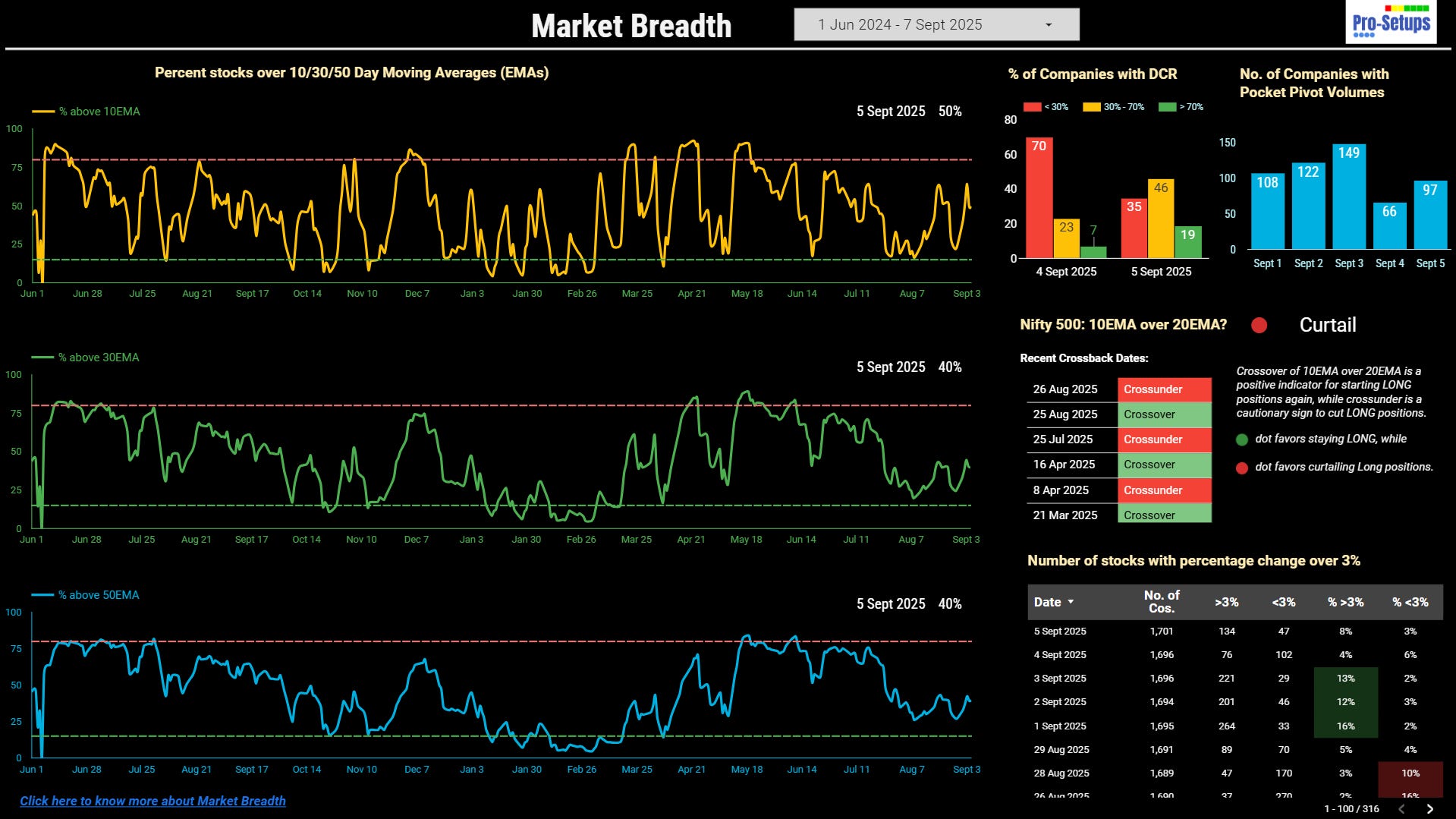

Market Breadth: The % of stocks above all key short-term moving averages bounced this week. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts. We currently have a Crossunder signal on Nifty500’s 10EMA over its 20EMA. Crossunder is a cautionary sign to cut LONG positions.

Accessing Market Breadth on Pro-Setups Dashboard is now available for free for all readers. Click on the link below.

Trading & Investment Strategy

Swing Traders: Better to have a defensive approach as all key moving averages are still bearish.

Positional Traders: Positional traders may want to focus on stocks showing strong relative strength in this tougher market phase.

A simple approach to get back into trading is to watch for when the Nifty500’s 10EMA crosses above its 20EMA, then increase exposure once the 50EMA starts trending upward.

Summary

The current environment remains challenging with consolidation phase dominating market sentiment. Trump's tariffs, which doubled to 50% last week, remain the primary catalyst driving weakness. Swing traders must maintain defensive positioning in this volatile environment. Positional traders should concentrate on stocks demonstrating strong relative strength during market weakness.

Watch for Nifty500 reclaiming 50EMA support, moving averages reversing their downward trajectory, and the formation of Higher Highs replacing the current pattern of Lower Highs - these technical shifts will signal the market’s transition back to a bullish phase.