Market Correction Deepens Amid Trade Tensions

Nifty500 Loses Key Support of 50EMA as 50% Tariffs Take Effect

The Indian equity markets faced intense selling pressure this week, with benchmark indices witnessing sharp declines amid India-US trade tensions and persistent profit-booking.

Key Drivers This Week

Last week’s downward trajectory extended into this week, with the Nifty500 falling 2.3% to test its previous swing low levels. The market selloff was not confined to just large caps, as both Midcap and Smallcap indices fell by over 3% each.

Trump's 50% tariffs on Indian goods took effect this week. The tariffs, doubled from the initial 25% imposed earlier, target critical Indian export industries.

The Indian rupee faced significant depreciation pressure against the US dollar.

Flows: FIIs remained net sellers in August, keeping sentiment cautious; DIIs cushioned on select days.

Traders continue to keep a close watch on US-India trade tensions and the ongoing US-Russia talks over the Ukraine conflict, as both developments are likely to shape near-term market direction.

Technical Perspective

Nifty500 Trend: The Nifty500 extended its decline this week, reflecting broad-based selling. The index is now testing the same low levels it hit during the week of August 11, which is a crucial support area. If this level breaks, it would signal further weakness. All the important short-term trend moving averages are now pointing downward, confirming the bearish mood in the market.

Short-Term Levels: For the market to turn positive again, the Nifty500 needed to break above the 23,200 resistance level, but it failed to do so. Instead, it created another Lower High. It also lost its ground of 50EMA support level this week leading to further weakness.

Going forward, any time the market tries to bounce back to this 50EMA level, traders should be careful as this area is now likely to act as a selling zone rather than support.

Technical Changes Needed for Bullish Character: The 50EMA needs to be reclaimed and held as support rather than acting as resistance. Once the index moves back above this level and stays there for a couple of sessions, it would indicate the short-term trend is improving. Plus, the 20EMA and 50EMA should start sloping upward instead of pointing down. Additionally, instead of creating Lower Highs, the market needs to form a Higher High.

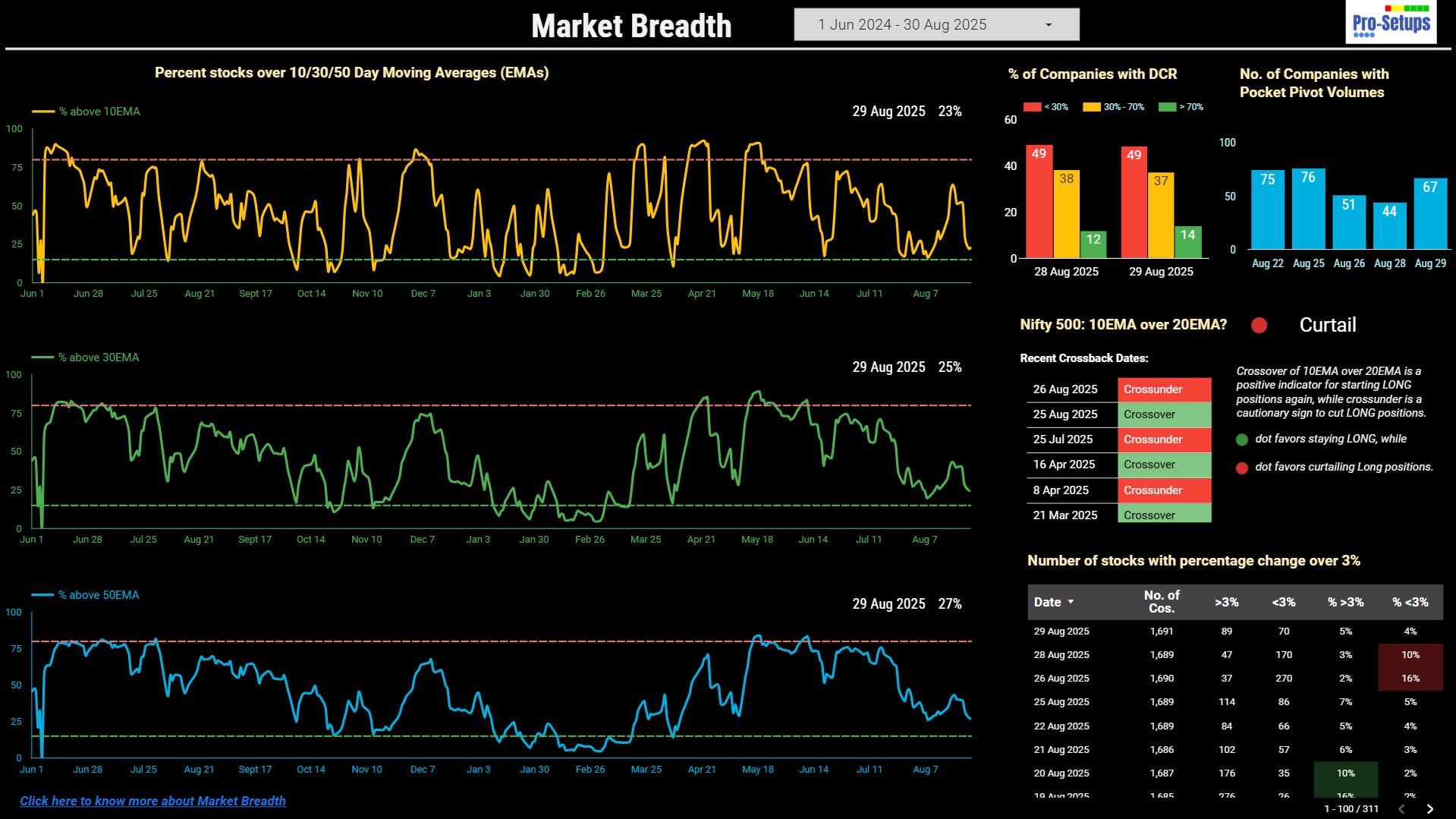

Market Breadth: The % of stocks above all key short-term moving averages declined this week after bouncing from near-oversold levels last week. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts. We got a signal on Crossover of Nifty500’s 10EMA above its 20EMA on 25th Aug, which immediately changed to Crossunder next day. Crossunder is a cautionary sign to cut LONG positions.

Accessing Market Breadth on Pro-Setups Dashboard is now available for free for all readers. Click on the link below.

Research During Market Downturns

When markets turn unfavorable for trading, smart investors use this time for fundamental research and learning. This week, we analyzed the Flexible Workspaces sector and published a report on our Pro-Setups Dashboard.

The report covers business models and financial comparison of key players like Awfis, Smartworks, Indiqube and WeWork - helping subscribers prepare for opportunities when the next bull phase arrives.

Trading & Investment Strategy

Swing Traders: Better to have a defensive approach as all key moving averages have turned bearish. With volatility increasing it's better to be very cautious for swing traders to not get caught and get "Death by Thousand cuts".

Positional Traders: Positional traders may want to focus on stocks showing strong relative strength in this tougher market phase.

A simple approach to get back into trading is to watch for when the Nifty500’s 10EMA crosses above its 20EMA, then increase exposure once the 50EMA starts trending upward.

Summary

The market has entered a correction phase with bearish momentum dominating sentiment. Trump's tariffs, which doubled to 50% this week, remain the primary catalyst driving weakness. Swing traders must maintain defensive positioning to avoid the ‘death by thousand cuts’ scenario in this volatile environment. Positional traders should concentrate on stocks demonstrating strong relative strength during market weakness.

Watch for Nifty500 reclaiming 50EMA support, moving averages reversing their downward trajectory, and the formation of Higher Highs replacing the current pattern of Lower Highs - these technical shifts will signal the market’s transition back to a bullish phase.

During this corrective phase, investors should utilize the downtime for learning and sector research - as we did this week with our analysis of the flexible workspaces sector, preparing for opportunities when favorable market conditions return.