Market Momentum Pauses: Consolidation After October Surge

Broader markets cool off after October’s rally, but Nifty500’s structure stays bullish.

Indian equity markets went through a phase of consolidation and shakeouts this week, as profit booking and mixed global cues led to a pullback from recent highs. The Nifty500 also slipped, mirroring the cautious tone across broader market segments. The last trading day of the week saw a sharp fall followed by a swift recovery, reflecting ongoing volatility. For the week, the Nifty500 fell 0.8%, testing support near its 50EMA.

Key Indices Performance:

Nifty50: -0.89%

Sensex: -0.86%

Nifty500: -0.80%

Nifty Midcap150: -0.09%

Nifty Smallcap250: -1.70%

Nifty Midsmallcap400: -0.66%

Key Drivers This Week

Markets witnessed persistent profit booking after a strong October rally, particularly in the midcap and small-cap segments.

Global equities also turned weak, with US and Asian indices recording declines, driven by profit-taking in technology and AI stocks.

Despite the choppy sessions, the Indian market continues to trade within close range of its all-time highs.

Technical Perspective

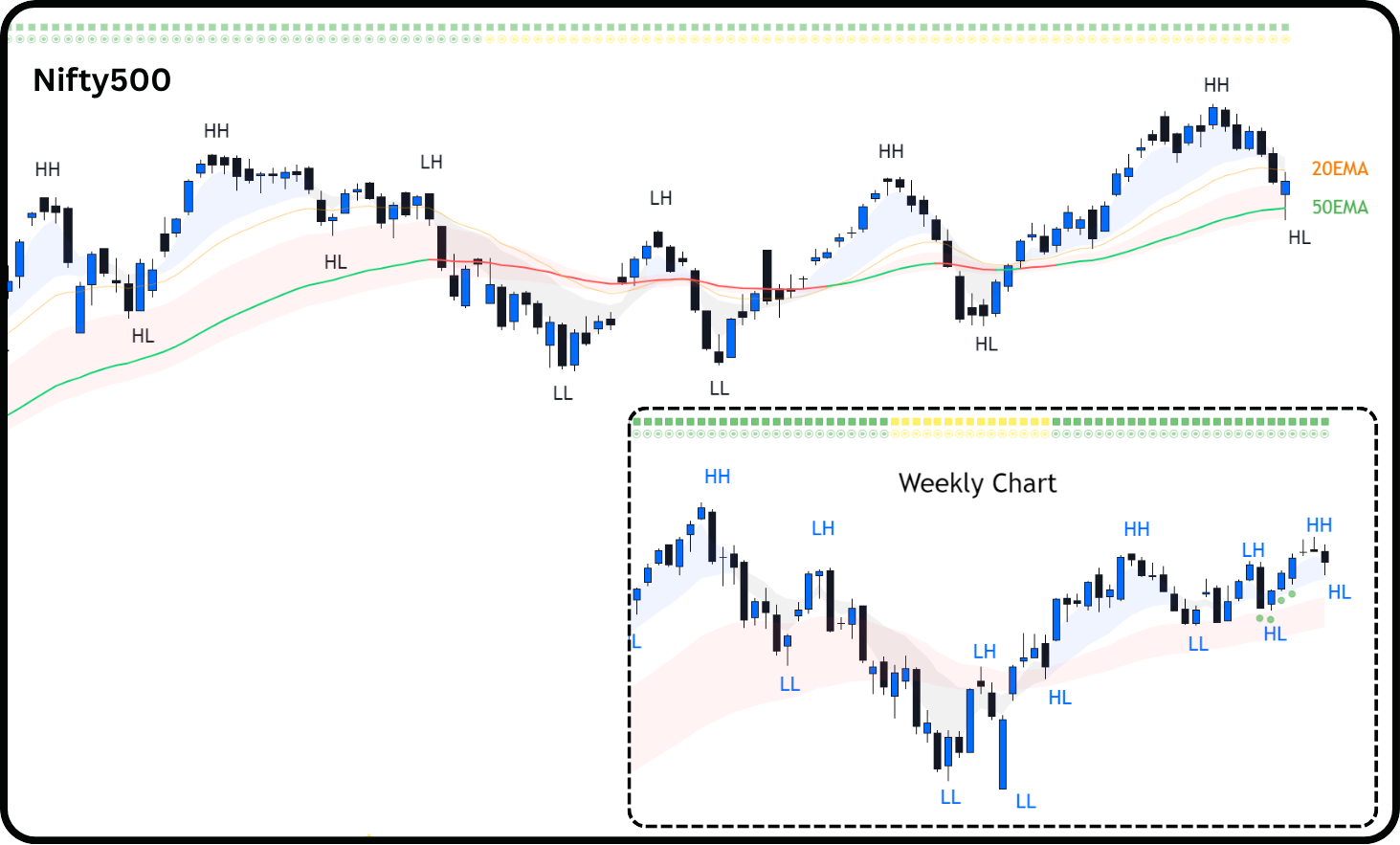

Nifty500 Trend: The Nifty500 slipped 0.8% for the week. While the weekly chart shows a relatively normal pullback, swing traders faced sharp volatility as the index made wild swings. On Friday, the index was down nearly 1% intraday but recovered strongly to close positive, forming a bullish reversal candle.

Although the index briefly lost its 20EMA support, breaking the short-term momentum built after October’s rally, it found strong buying interest at the rising 50EMA. This test held successfully, reinforcing the bullish structure and triggering a reversal candle by the week’s close.

The week carried a bearish undertone, with several stop-loss triggers for swing traders. The current market phase favors a more selective, stock-specific approach especially in names delivering strong quarterly results.

Going ahead, a sustained move above the 23,700–23,800 zone for Nifty500 remains critical for renewed bullish momentum. Failure to hold this zone may prolong the ongoing sideways phase, turning it into a “death by a thousand cuts” environment for short-term traders.

The index continues to make higher highs on the weekly chart and is consolidating near the upper boundary of its previous range - a sign of resilience despite recent volatility.

As mentioned in the previous newsletter, on weekly timeframe, the Nifty500 index seems to be forming the handle portion of a Cup-and-Handle pattern, with volatility tightening, which is a sign of pressure building up before a breakout. When this handle resolves, it could be explosive. This setup often precedes a strong breakout, and if that materializes, it could set the tone for a highly rewarding 2026.

The reason we track Nifty500 is because it represents over 90% of the free float market capitalization, making it a comprehensive barometer of market health.

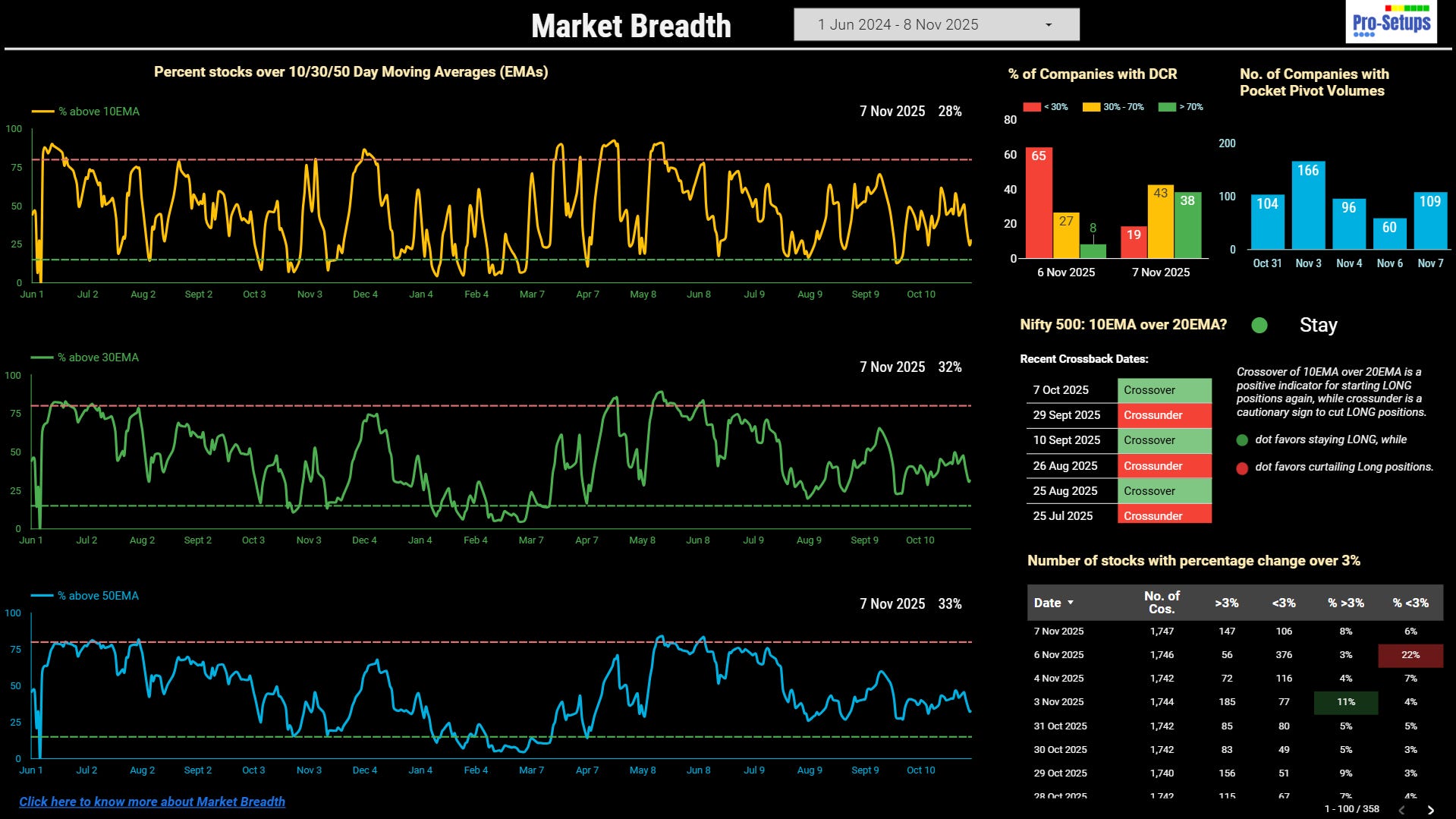

Nifty500’s 10EMA crossed above its 20EMA on 7th October triggering a ‘Stay’ signal that suggests holding onto existing long positions.

Market Breadth: The % of stocks above all key short-term moving averages fell this week. Only 28% of stocks are above their 10EMA, 32% above the 30EMA, and 33% above the 50EMA as of November 7, 2025. These readings are all below the midpoint (50%), signaling that the majority of stocks are trading below short-to-medium-term trend levels, which is typically a corrective sign for the broader market.

Market breadth remains weak, and we are still not in the oversold zone. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.

Accessing Market Breadth on Pro-Setups Dashboard is available for all readers. Click on the link below.

Positives for the next rally

Several positive factors are coming together to support the next market rally in India.

RBI projects India’s GDP growth at 6.5% for FY 2025-26, which means that our domestic economy is doing well.

Interest rate cuts will make it cheaper for businesses to borrow money.

Reduce GST rates and income taxes, would put more money in people’s pockets and boost spending.

A potential trade deal between the US and India could bring in foreign investment, giving the market the push it needs to move higher.

The Q3 (December quarter) earnings season should showcase strong performance in consumption-driven sectors.

Summary

Throughout the week, Indian markets entered a phase of tactical consolidation after a notably strong rally in October. Momentum has paused, with near-term volatility expected to persist, yet the broader outlook remains constructive. Investors are likely to closely monitor developments on the India-U.S. trade agreement, while also paying attention to ongoing Q2 earnings announcements that may influence sentiment in the coming sessions.