Market Sense as on 14th March 2023

Negative stance continues. We are facing resistance from declining 50EMA, and until this situation changes, it is wise not to consider swing trades on the long side.

In my previous market sense update of 1st March 2023 (click here to read), I talked of how we can face resistance from the declining 50-day EMA and whatever longs we are making should only be considered for trading bounces. That’s what actually happened. We had a rally till 8th March and then slipped.

Lets see what’s in store now.

Market Breadth

We have come back near the oversold territory, but we are still not extremely oversold. It might take one big bad nasty shakeout to do so. And in my opinion, a good shakeout is very important too for a good sustained run upwards.

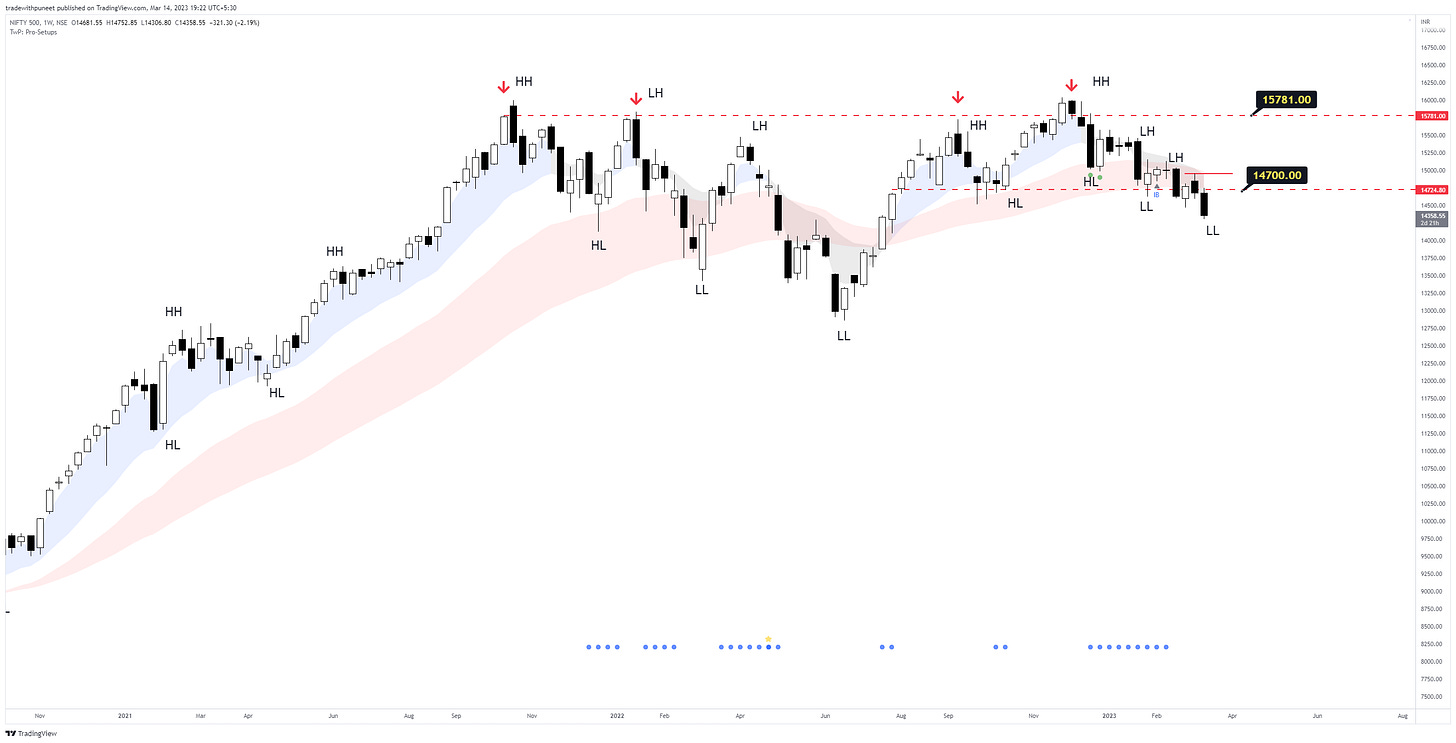

Nifty500

On weekly chart, we are making Lower Highs & Lower Lows. The chart is only looking bearish.

Daily timeframe chart: The support from 200EMA is long gone. We went near 50 & 200EMA (on 8th March), but both of them rejected our friendship offer. They are bullying us now.

We made a death cross on Nifty500 today. I mentioned of the likely death cross in my previous update (a death cross is a situation when 50EMA crosses under 200EMA, and it is considered negative in trading community). Not celebrating the forecast made. But I believe that now it’s time to check your wardrobe for the party that could be starting soon in a month or two.

Here is what Investopedia says about a death cross.

50EMA and 200EMA are not magic lines, but they’re important because traders worldwide scan and take action based on them.

Here’s what I wish/expect: The next time when we meet declining 50EMA, we will neither pierce it hard, nor we will fall from there. But we will start consolidating near it, and will eventually bounce off from there. Once 50EMA starts rising again (i.e. turn green), we will get the best of the long setups and will witness 🚀🚀🚀 on twitter again. However, if the declining 50EMA acts as resistance again, it will be better to stay away from the market.

Now, what I mentioned above is what I want to happen. It need not happen, either this way or at all. So, until this happens or another situation arises, we will remain in sell-on-rise market.

The case of rising and declining 50EMA (repeating again in this update).

One simple hack is to restart trading or increase exposure once 50EMA starts to trend upwards again. Just look at this chart with 50EMA printed on it. The green line represents rising 50EMA and red line represents declining 50EMA. If one had simply stopped/curtailed trading when 50EMA line turned red, he/she could have avoided losses too. It ain’t so difficult. By the way, some of my recent trades have failed too, so this reminder is applicable to me too.

Conclusion (again a repeat from the previous update)

Except the above-mentioned facts and my wish, I do not have anything to change since the last update. Negative stance continues. If you’re a swing/positional trader (like me), you will be noticing that some of your positions will be making gains, while others will be taking away those gains. Breakouts have consistently failed. It is difficult to hold gains for a longer duration. Remember that if you plan to enter longs right now, you will just be trading the bounce.

Till the time we do not take control of 50EMA, it is better to not take fresh trades or if you cannot stop that itch, keep tight stops, even tighter trailing stops, and lesser expectations of higher gains. Avoid leverage, avoid revenge trading, do not believe in profit screenshots, in fact avoid twitter. Take what market gives you and try not to give back to the market. Do not be overly bullish. We are still in a sell-on-rise market.

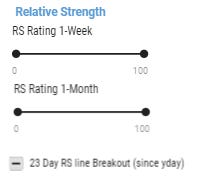

Also don’t forget to prepare a watchlist of those stocks that are showing high Relative Strength (RS). There is no point of using RS filter in rising market. It is now when you should be using it. Please use this filter on the Dashboard.

Recently announced quarterly financials + Relative Strength must be checked in order to not enter into those stocks which are already weak.