Market Sense as on 9th Oct 2023

I published the last market sense update on 27th March 2023 (click here to read).

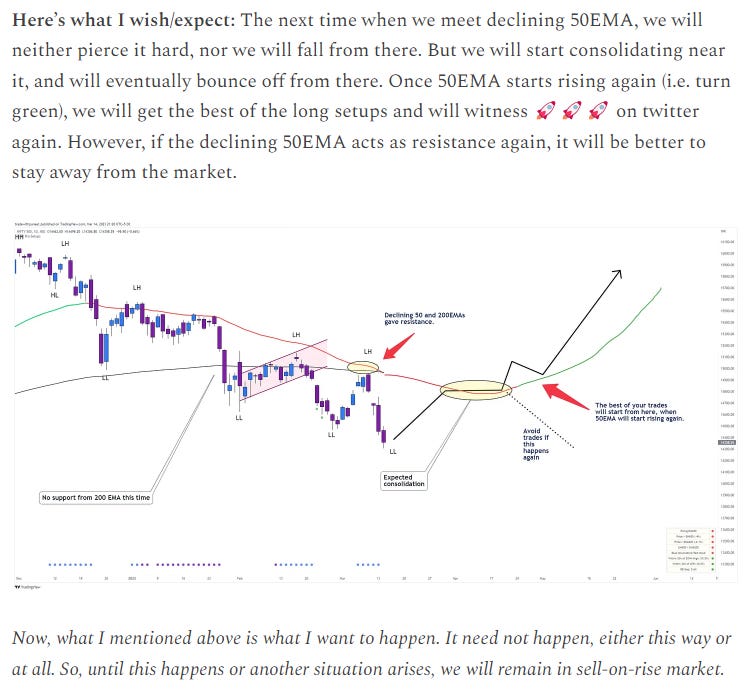

In the note previous to that (14th March 2023), I had mentioned how I expect Nifty500’s 50EMA to turn green, thereby resulting the start of profitable trading. Here is an excerpt of that note:

And it happened almost similar to that. I wish I had updated the Market Sense again in the last week of April 2023, but I guess I had limited time given the bullish scenario all around. Anyway, it has been a good time for all of us for the last 6 months.

But now the question is - Can we expect further rally?

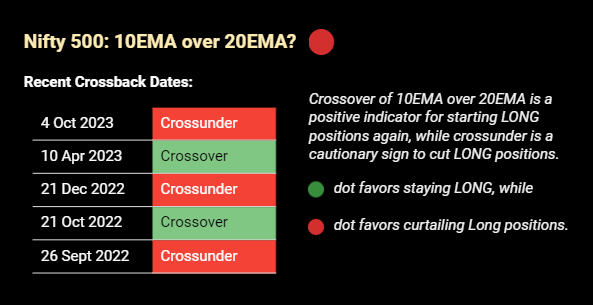

Answering that can be anybody’s guess. To answer that question objectively, we started to use 10EMA & 20EMA on Nifty500 chart in our Market Breadth page of the Dashboard. Simply put, we said that if Nifty500’s 10EMA is trailing above 20EMA, we stay long, and if 10EMA is trailing below 20EMA, we avoid long positions. You may read more about it here.

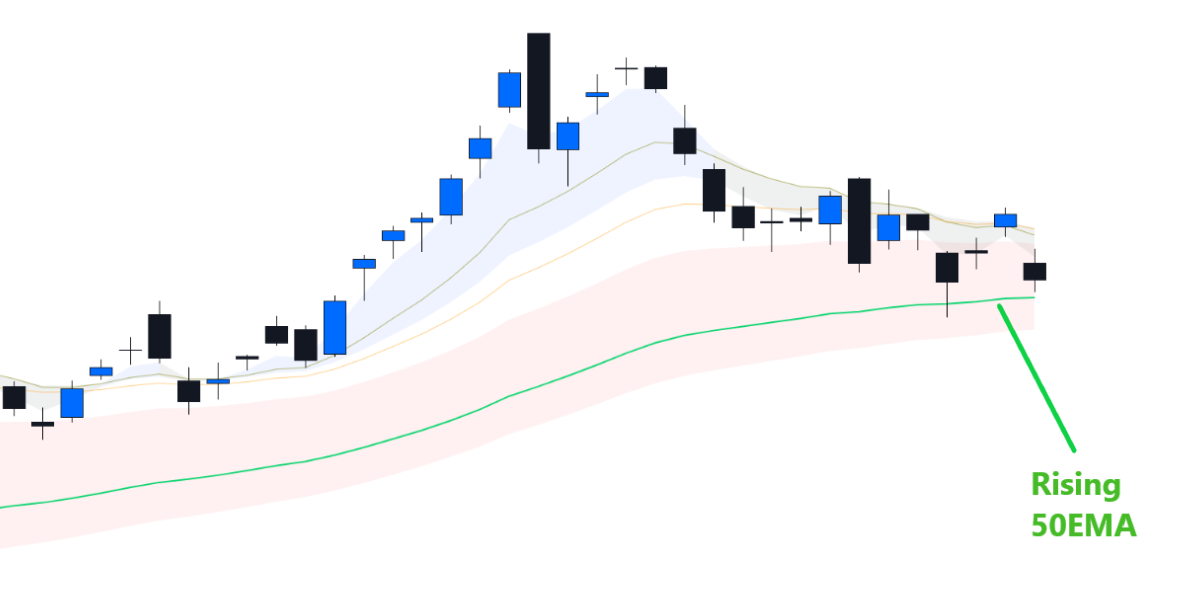

Nifty500’s 10EMA crossed over 20EMA on 10th April 2023, and we had a long period of favorable trading since then. Nifty500 is currently holding steady on the rising 50-day EMA, which is generally considered a positive and bullish sign. This suggests underlying strength in the market.

However, recently on 4th October 2023, 10EMA crossed under 20EMA. This tends to signal a cautious stance on long positions, indicating a certain degree of market uncertainty.

While a bounce from the rising 50EMA is very much possible, it's crucial to note that for a sustained market move, we ideally would want to see the 10EMA crossing over the 20EMA. This crossover will signify a shift in momentum and a potential trend reversal for the overall market. We are not interested in just a handful of stocks making moves here.

In light of these indicators, the recommended strategy for swing trading at this juncture would be to exercise patience and monitor how Nifty500 behaves. Waiting for a clear signal, as simple as crossover of 10EMA over 20EMA, could provide more confidence in the direction of the market. Till then, trade less, and keep tight stop losses.

Keep a check on the Market Breadth page using the Dashboard.

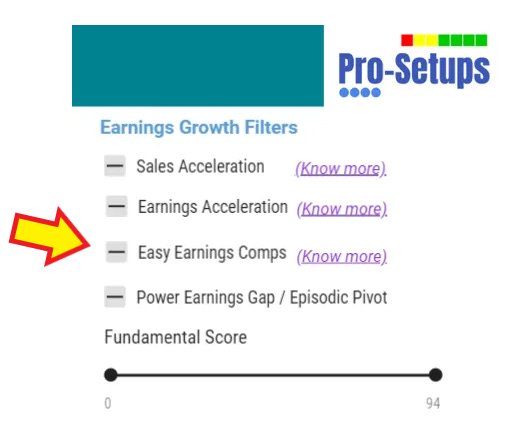

We are also going to enter the Results season this week, so do not miss to check out the Easy Earnings Comps filter of our Dashboard. This will help you to identify stocks that have a better probability of coming out with bumper results.