Market Sense for the week ended April 18, 2025

Short Week, Big Gains

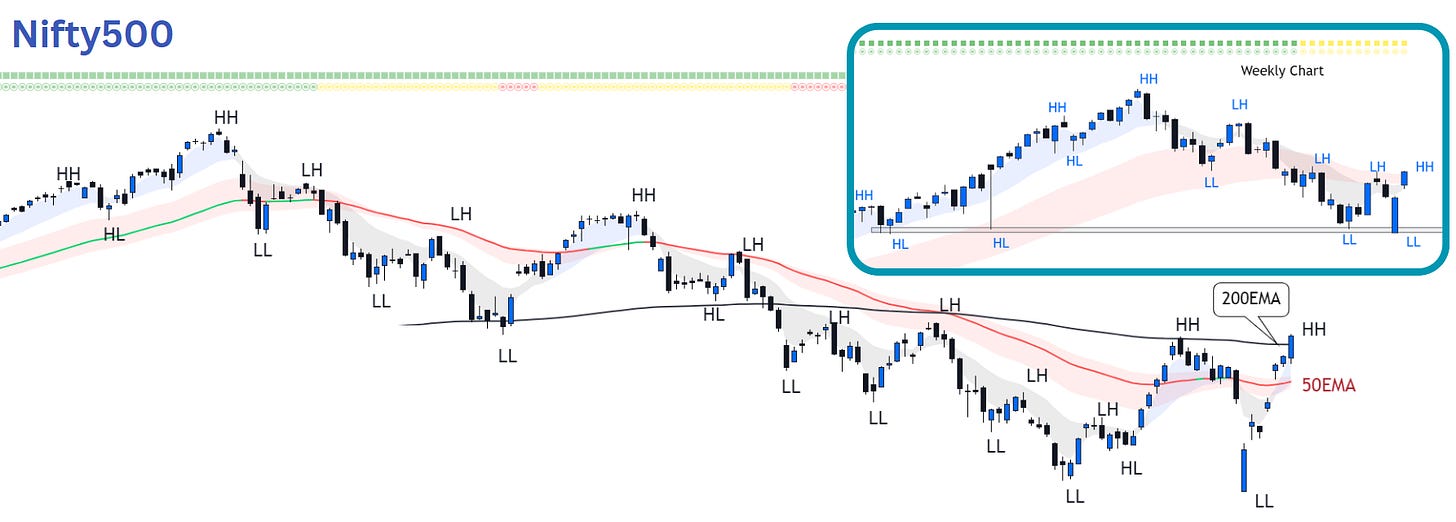

The Indian stock market delivered a standout performance in what was the shortest trading week of the year, notching up its biggest gains in months. The Nifty500 index surged 4.48% for the week, closing above its 200EMA. This rally comes after Nifty500 retested its previous swing low last week, which also coincided with the highly volatile election results day in June 2024, reinforcing that level as a strong support zone. A major driver behind this week’s rally has been the robust return of both foreign and domestic institutional investors after last week's pause of reciprocal tariffs by Trump's government.

The Q4 earnings season has started on a positive note. Of the 15 companies that reported results by Thursday, 6 have had blockbuster & positive impact of results on price with 4 giving Power Earnings Gaps too. Only Wipro disappointed, reflecting broader concerns about the IT sector’s outlook amid global uncertainties.

However, risks remain. US businesses face headwinds from renewed tariff plans, and recession fears are mounting among American analysts and any slowdown in the world’s largest economy could spill over to India as well. Despite these global concerns, Nifty500 has breached its previous swing high, closed above 200EMA, its 10EMA has crossed over 20EMA, overall valuations have softened, reciprocal tariffs have been paused, Q4 2025 results season has started with a positive note. While we will to react to whatever market gives us, the near-term trend is now bullish.

Market breadth surged this week, signaling robust participation in the rally. The % of stocks above 10EMA have reached the overbought zone, while those above 30EMA & 50EMA have room to grow. We also had crossover of Nifty500's 10EMA over its 20EMA, a positive sign for staying long. The broad-based momentum supports a bullish near-term outlook.