Markets Cool Off, But the Trend Still Remains Intact

Indian equities cooled off, but Nifty500 stayed strong above key EMAs and large caps leading the charge. PSU and Private Banks lead, Textiles gains quietly, while Autos consolidate.

Indian equities had a choppy but broadly constructive week, with frontline indices hovering near record highs while broader markets, including the Nifty500, saw profit-taking after an extended rally.

Key Indices Performance:

Nifty50: +0.61%

Sensex: +0.79%

Nifty500: -0.19%

Nifty Midcap150: -0.81%

Nifty Smallcap250: -2.09%

Nifty Midsmallcap400: -1.25%

Key Drivers This Week

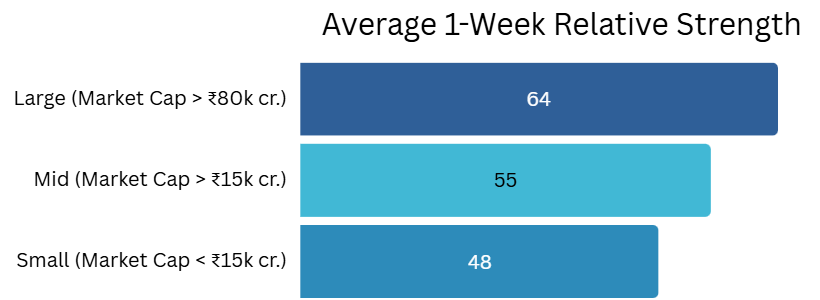

Large-cap stocks displayed stronger relative strength and outperformed mid- and small-cap stocks, this week as well.

Big gains in heavyweight names (Reliance, HDFC Bank) lifted the headline indices mid-week, keeping our markets close to record highs before the Friday pullback.

Technical Perspective

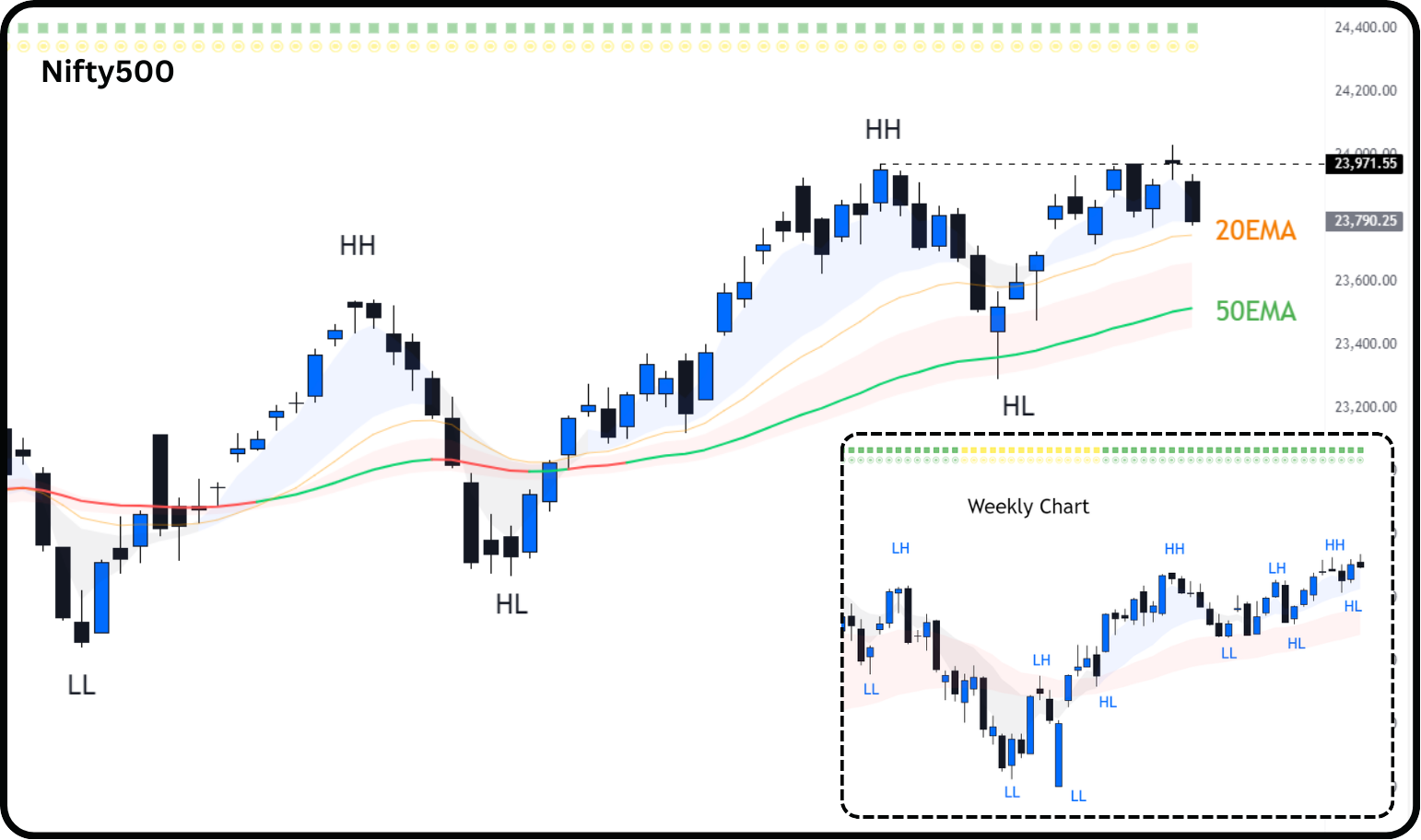

Nifty 500 trend: The index hit a new 52-week high this week and continues to trade comfortably above all key moving averages (20/50/200day EMAs), confirming that the primary trend is still firmly up despite the brief pullback. All major EMAs are also aligned in a bullish sequence (10 > 20 > 50 > 100 > 200EMA), reinforcing the strength of the underlying trend.

Large caps continued to attract steady flows. The decline was modest in magnitude, driven more by profit‑booking rather than by any deterioration in domestic growth or earnings outlook.

With the earnings season now behind us, focus will be on management commentary and anticipated growth in consumer demand driven by the implementation of GST 2.0.

The index continues to make higher highs on the weekly chart and is consolidating near the upper boundary of its previous range, a sign of resilience despite recent volatility.

The reason we track Nifty500 is because it represents over 90% of the free float market capitalization, making it a comprehensive barometer of market health.

Nifty500’s 10EMA crossed above its 20EMA on 7th October triggering a ‘Stay’ signal that suggests holding onto existing long positions.

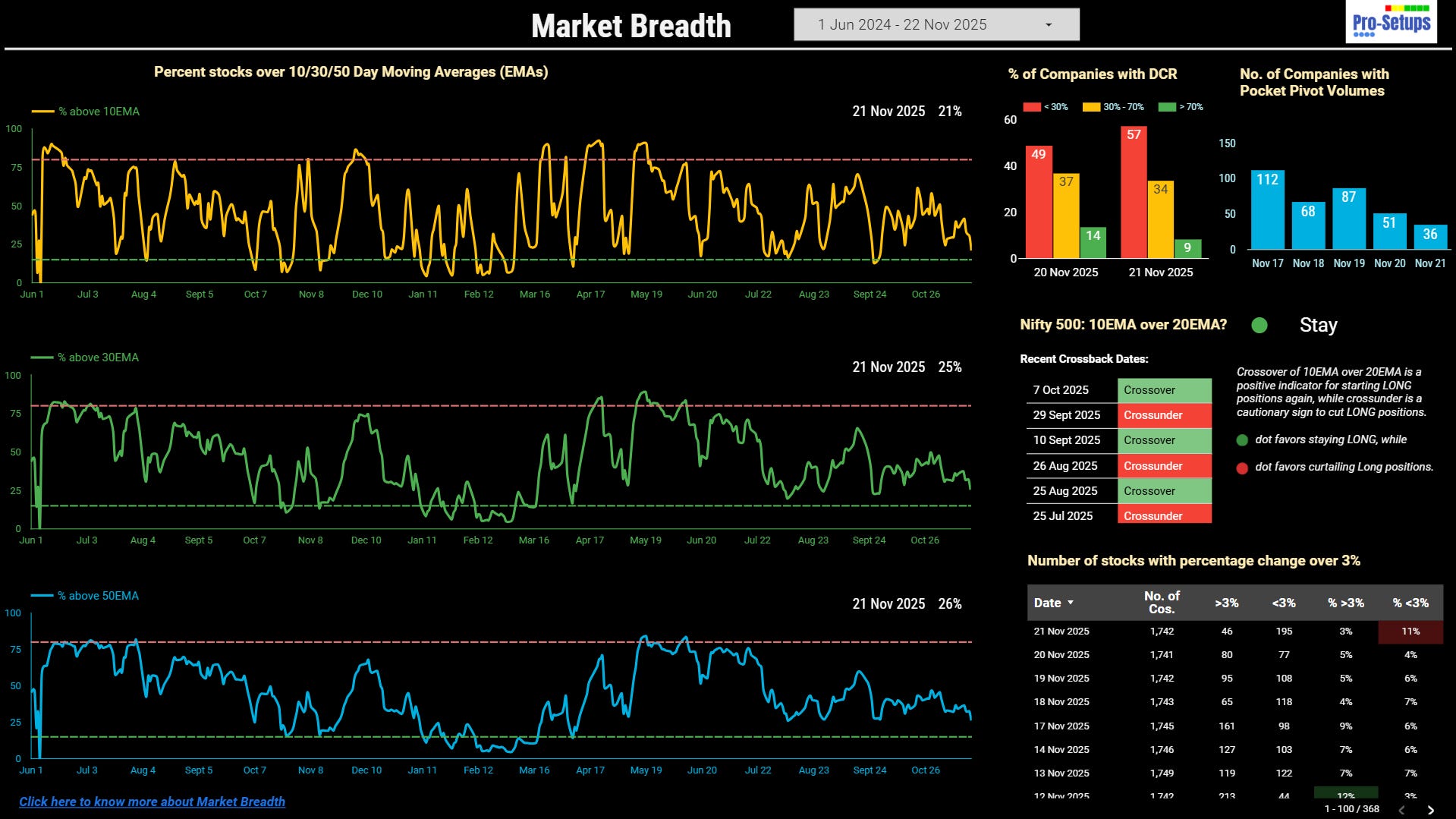

Market Breadth: The percentage of stocks trading above key short-term moving averages declined this week. As of November 21, 2025, only about 21%, 25% and 26% of stocks are above their 10EMA, 30EMA, and 50EMA respectively. While the index looks bullish, the market breadth readings remain below the midpoint (50% mark), signaling that the majority of stocks are trading below short-to-medium-term trend levels, which is typically a corrective sign for the broader market.

Market breadth remains weak, and we are still not in the oversold zone. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.

Accessing Market Breadth on Pro-Setups Dashboard is available for all readers. Click on the link below.

Sectoral Performance

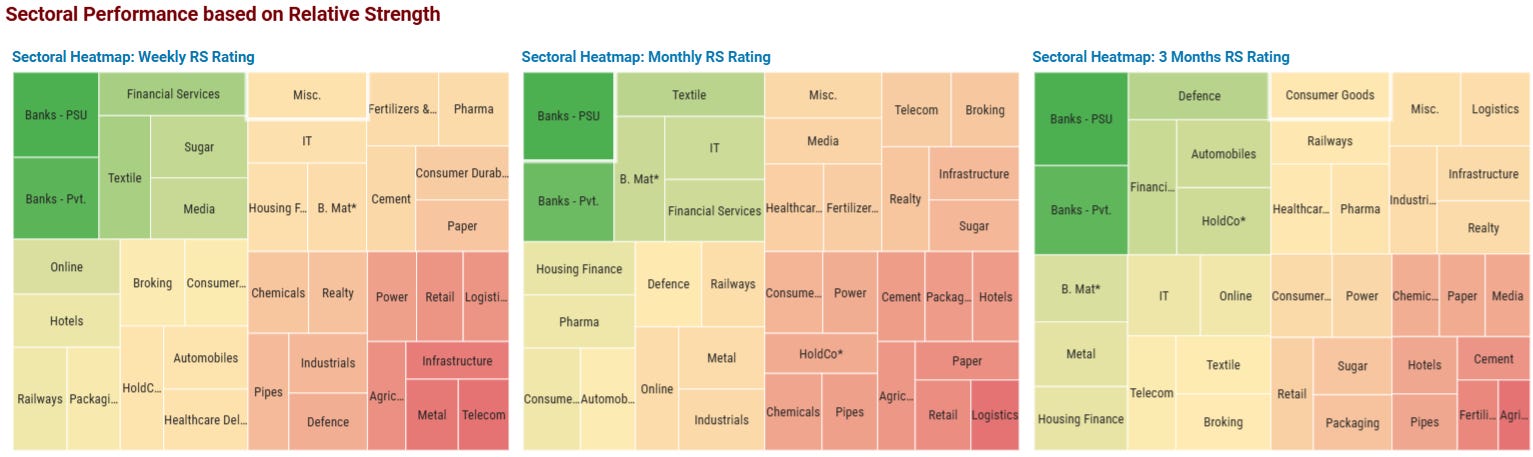

PSU Banks & Private Banks are the strongest sectors across all timeframes.

Financial Services also remains consistently strong.

The Textile sector has shown steady relative strength, moving from neutral on the 3-month view to stronger outperformance on the monthly and weekly heatmaps. It’s quietly emerging as a stable momentum participant. Worth tracking for sustained follow-through.

Automobiles were strong over the past 3 months but have cooled off more recently, reflecting consolidation or profit-taking. These sectors still holds structural strength, but short-term momentum has softened.

Can we step back into the Sideways phase?

Last week, we mentioned that the market could still drift into a sideways zone. It still holds true. You can read more about that in the previous week’s update.

Summary

Indian equities spent the week consolidating, with the Nifty500 finishing slightly lower but still well above key EMAs. Large caps continued to lead, while mid and small caps took a breather. This pullback looks more like a healthy pause in an ongoing uptrend than the start of any reversal. In strong markets, shallow dips like these help reset momentum and open fresh swing-trading setups. Sectorally, PSU & private banks continue to dominate, Financial Services stays resilient, Textiles is quietly gaining momentum, while Autos and Defence consolidate