Markets Start Strong, End Flat in Diwali Week Trading

Nifty500 gains amid festive optimism, but late profit-taking caps upside, while overall bullish structure remains intact.

Indian equity markets delivered a mixed performance during the Diwali week, with indices initially surging to fresh 52W highs before ending on a subdued note. The Nifty500 was up by approx. 1.4% for the week, but profit-taking emerged towards the end, with the index closing with mere 0.38% gain.

Key Indices Performance:

Nifty50: +0.33%

Sensex: +0.31%

Nifty500: +0.38%

Nifty Midcap150: +0.18%

Nifty Smallcap250: +0.83%

Nifty Midsmallcap400: +0.62%

Key Drivers This Week

Reliance and IT stocks dominated: Reliance and IT stocks, particularly Infosys, dominated the week’s performance as both companies contributed more than half of the net positive contribution to Nifty500’s 0.38% gain this week.

Festive demand optimism boosted investor confidence this week as India recorded historic Diwali sales. Strong consumer spending, driven by GST cuts gave investors hope that corporate earnings would improve in coming quarters.

President Trump announced on October 21 that he held discussions with PM Modi primarily focused on trade, where PM Modi assured him that India would limit its oil purchases from Russia.

Technical Perspective

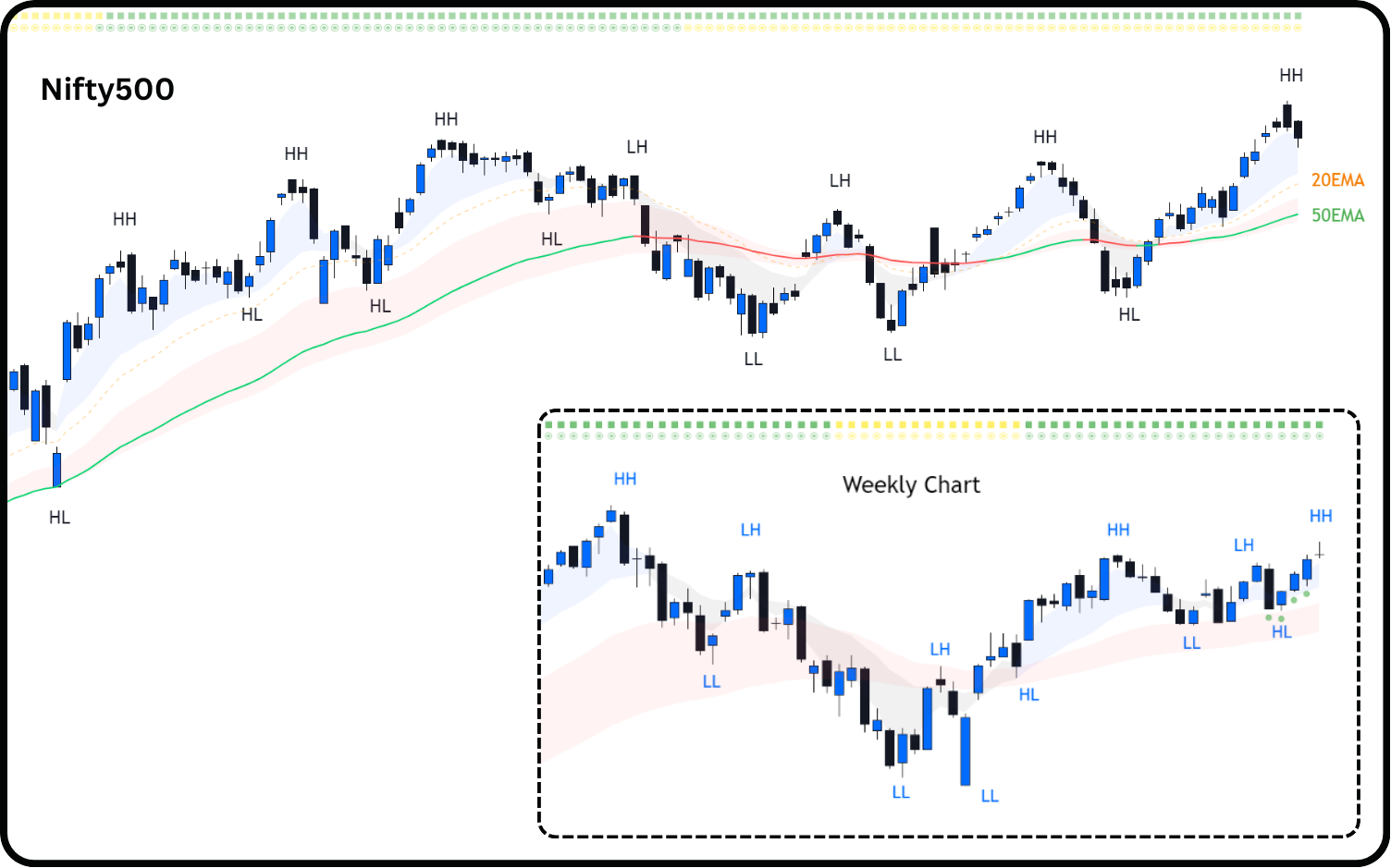

Nifty500 Trend: The Nifty500 advanced 0.38% during a shortened Diwali week, extending its winning streak to four consecutive weeks despite late-session profit-booking that capped gains.

The index established a fresh higher high this week and successfully closed near the upper boundary of its consolidation range, signaling potential upward momentum.

The sideways consolidation pattern since June 2025 has evolved into a more bullish structure, with the index creating a series of higher highs and higher lows that suggests strengthening underlying momentum.

Any retracement toward the 20EMA could provide a healthy pullback within the consolidation zone, potentially acting as dynamic support before the next leg higher breaks the index out of its current range.

As mentioned in the previous newsletter, on weekly timeframe, the Nifty500 index seems to be forming the handle portion of a Cup-and-Handle pattern, with volatility tightening, which is a sign of pressure building up before a breakout. When this handle resolves, it could be explosive. This setup often precedes a strong breakout, and if that materializes, it could set the tone for a highly rewarding 2026.

The reason we track Nifty500 is because it represents over 90% of the free float market capitalization, making it a comprehensive barometer of market health.

Nifty500’s 10EMA crossed above its 20EMA on 7th October triggering a ‘Stay’ signal that suggests holding onto existing long positions.

Market Breadth: The % of stocks above all key short-term moving averages remained flat this week. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.

Accessing Market Breadth on Pro-Setups Dashboard is available for all readers. Click on the link below.

Summary

Markets are displaying signals of breaking out from their consolidation phase, with positive momentum gaining traction. The broader outlook appears increasingly favorable as fundamentals lay the groundwork for a stronger 2026. The Nifty500 continues to navigate its evolving cup and handle formation. In the upcoming week, maintaining focus on earnings quality will be critical. The overall direction seems more optimistic compared to recent weeks.