Markets this Week: Early Surge, Midweek Pause, Strong Close

Despite a strong opening and closing, the market spent much of the week with cautious sentiment amid global uncertainties.

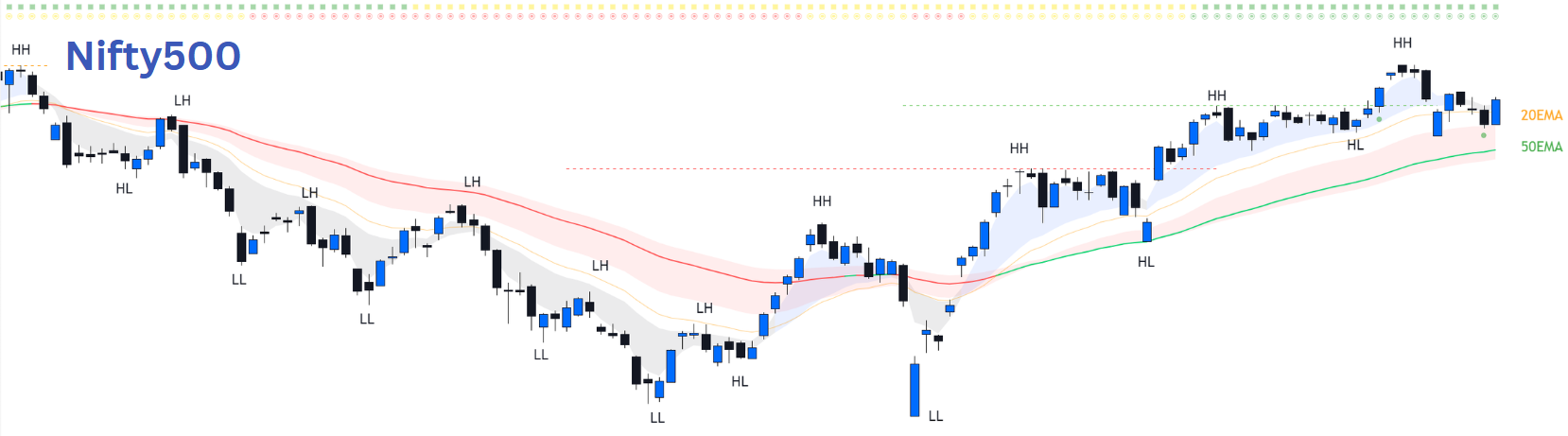

This week, the Nifty500 index remained largely unchanged, posting a modest gain of just 0.5%. On the weekly charts, the index formed an inside bar, signaling consolidation after a period of volatility. The week opened with a robust rally, but optimism quickly gave way to caution due to intensifying geopolitical tensions in the Middle East, which kept the broader market subdued for most of the week. Despite these headwinds, the market managed to close the week on a positive note buoyed by strong inflows from institutional investors. While geopolitical risks persist, focus is shifting back to underlying fundamentals. As highlighted in previous newsletters too, we expect June quarter to be better than the previous ones with more positive earnings surprises. And we continue to say that the medium to long-term outlook remains positive as long as indices stay above the rising 50EMA.

In any uptrend, pullbacks and corrections are inevitable. Markets never move up in a straight line. Swing traders typically lock in profits at the first sign of a pullback, sometimes even moving 100% to cash, which is a valid approach. Positional traders, on the other hand, often view these pullbacks as buying opportunities rather than reasons to exit. The problem arises when we have not clearly defined our trade type from the start. Mixing trades or hoping for reversals lead to poor decisions later on. For more on this, refer to our earlier blog post discussing the differences between swing and positional trading.

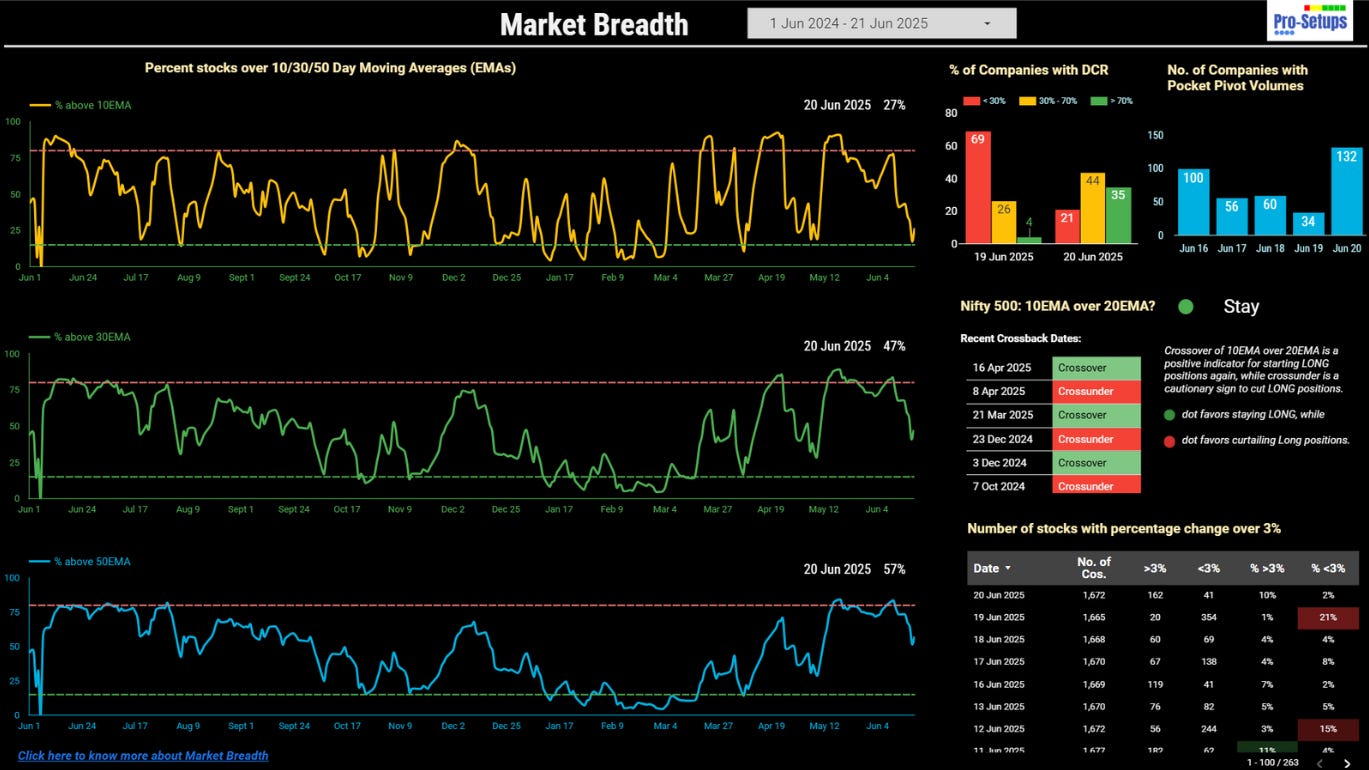

Market Breadth

The week had a notable decline in short-term momentum. While the % of stocks above 10EMA bounced back from oversold levels, the % of stocks above 30EMA and 50EMA are somewhere in between. These readings work best when all three moving averages are seen at extreme levels at the same time. It will be wrong to make any conclusion from these readings at the moment. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts. Yet, Friday saw the highest count of pocket pivot candles in the past five days, indicating a surge in stocks showing strong buying interest.