Mixed Market Moves: Largecaps Lag, Broader Markets Hold Steady

Largecaps underperformed, but strength in smaller stocks kept the market outlook stable.

Nifty500 remained flat this week, while Nifty Small-cap and Mid-cap indices posted gains. On the other hand, Nifty50 witnessed a decline, highlighting the underperformance of large caps compared to small and mid caps. Cautious investor sentiment prevailed along with a subdued start to the earnings season.

Key Drivers This Week

Profit booking: After a strong run-up in previous weeks, traders continued to lock in gains. Large caps underperformed, as reflected by the Nifty50’s dip, while midcap and smallcap indices attracted buying interest and posted gains.

Global Trade Uncertainty: There are still concerns around U.S. tariffs and global trade tensions, which kept investors cautious.

Earnings in Focus: Early Q1 corporate results have been mixed.

No Major Domestic Headwinds: Apart from uncertainties around the US trade deal and ongoing Earnings releases, there seems to be no significant domestic factors impacting the market.

Technical Perspective

Nifty500 Trend: Nifty500 reclaimed 20EMA earlier this week, but closed below it by the end of week. Small cap and Mid cap indices are still above 20EMA, while Nifty50 is testing 50EMA.

The Nifty500 chart continues to show an uptrend, with potential support at the rising 10-week EMA (equivalent to 50EMA on daily charts).

Short-Term Levels: The market’s reaction to the 20EMA and 50EMA in the coming sessions will be key for short-term sentiment.

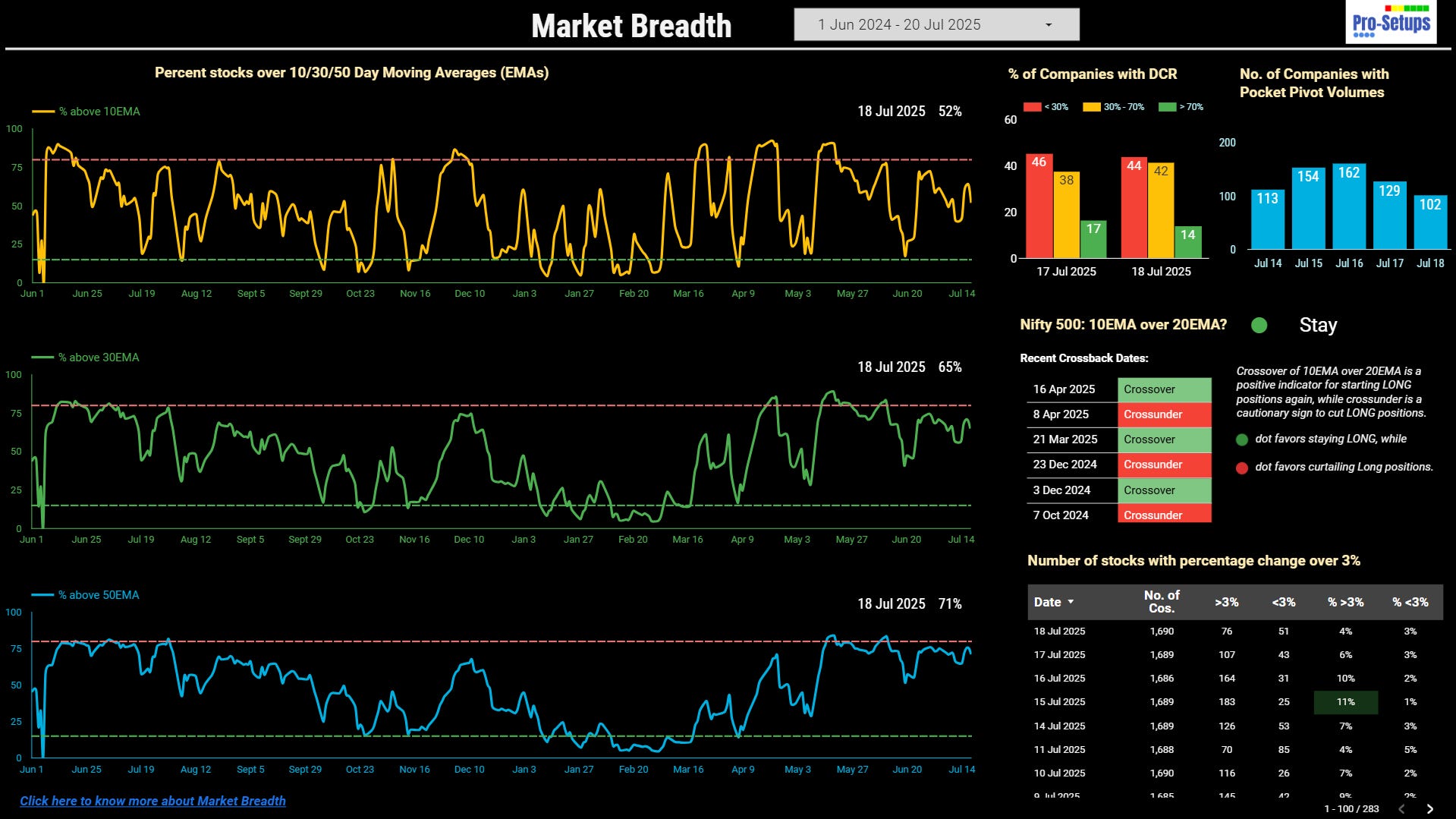

Market Breadth: The % of stocks above all key short-term moving averages rose this week. Midcap and smallcap stocks outperformed large caps, suggesting rising risk appetite. Tracking only the Nifty50 would have missed this underlying strength. While the market bias remains positive, further profit booking can be expected.

Trading & Investment Strategy

Pullbacks are normal: In any uptrend, pullbacks and corrections are inevitable. Markets never move up in a straight line. Like last week, we continue to believe that the recent pressure is a healthy pause rather than a trend reversal.

Swing Traders: Likely found limited opportunities this week, plus would have exited positions amid volatility.

Positional Traders: Monitoring how holdings react around the 50EMA levels for signs of trend continuation or reversal.

Key triggers:

If the Nifty500 manages to move back above its 20EMA, it would signal renewed short-term strength. This would be a bullish trigger again for swing traders.

Alternatively, if it pulls back to retest its 50EMA and finds support there, this would also be a constructive sign, marking the resumption of the uptrend and offering fresh trading opportunities.

Further profit booking can be expected, but medium to long-term bias remains positive.

If you relied solely on the Nifty50 to track market movement, the week may have felt negative due to blue-chip underperformance. However, watching midcap and smallcap indices would have conveyed a much more positive view. The Nifty500 index is apt to know how the overall market is doing.

That’s it for this week. Stay tuned for our next update, which we will bring to you next weekend.