Newsletter for the week ended May 16, 2025

Equities Soar; Broader Markets Outperform

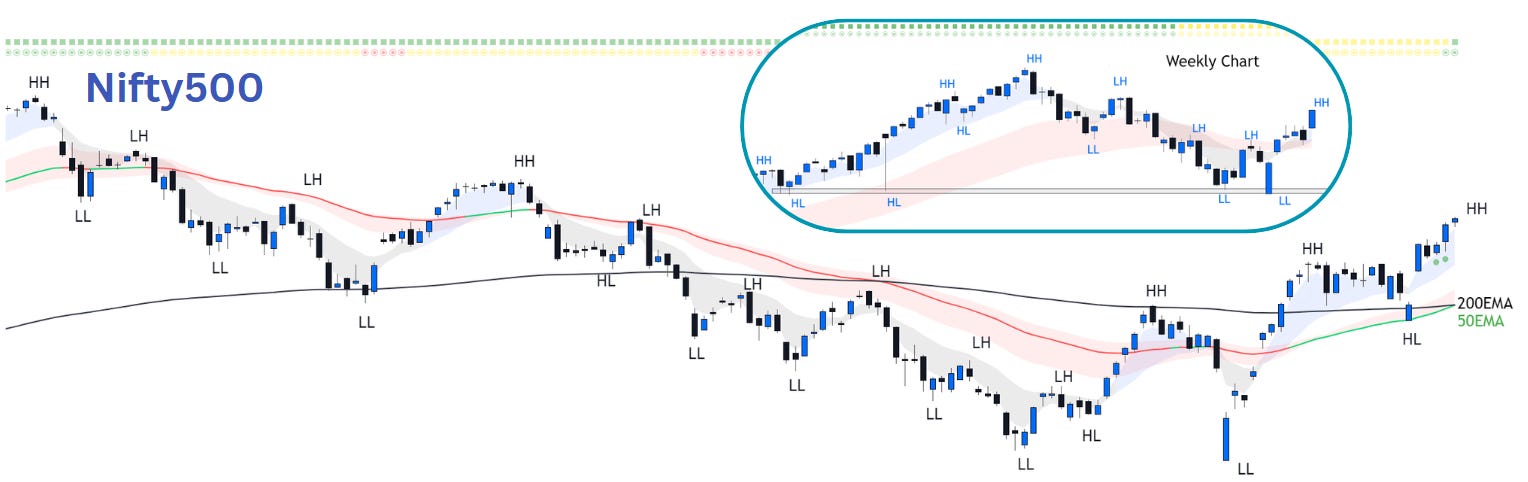

Last week, Nifty500 managed to retest and close above its 50EMA. This week, it not just broke the range it was making since mid-April, but also made a new YTD high. It was a strong week for Indian equities with Nifty500 rising over 5.5%. The index kicked off the week with a strong rally, after an India-Pakistan ceasefire and a 90-day US-China tariff pause boosted global sentiment. Broader markets also rallied sharply, with most stocks advancing. We saw some profit booking in between the week, though broader markets remained resilient. In fact, the market regained momentum midweek, buoyed by steady buying.

The previous reasons for stock market underperformance (global trade uncertainties, FII selling, high valuations, corporate underperformance, geopolitical tensions) have eased.

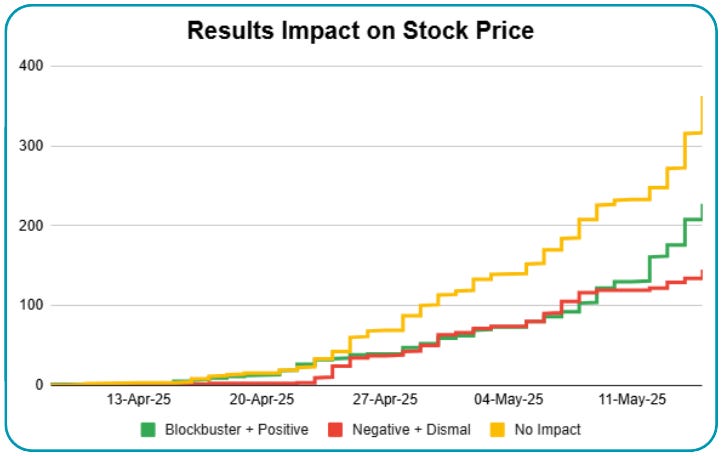

As more companies reported results this week, the number of companies with positive impact have crossed over the ones with the negative impact. We believe that March 2025 could be the last quarter of underperformance for most companies, with an expected uptick from June onwards.

Overall, broader markets continued to outperform on the back of strong institutional flows, easing geopolitical risks, and optimism on trade deals. The environment has again become positive for swing trading.

The high number of pocket pivot volumes throughout the week indicates aggressive institutional accumulation and widespread participation in the rally. The trend remains firmly up, and it is favorable to holding long positions.

The market breadth indicators reflect an extremely strong and broad-based rally, but also signal that the market is in an overbought zone. While % of stocks above all key short-term EMAs signify powerful momentum, it also suggest that the market may be vulnerable to a potential moderation in momentum through a short-term pullback or consolidation.

Please note that references to overbought or oversold levels are particularly relevant for swing traders, as these signals pertain to short-term momentum shifts. Positional traders, on the other hand, should focus on identifying opportunities to add to their existing holdings rather than as signals for immediate action.