Newsletter for the week ended May 23, 2025

Nifty500 Holds Uptrend Despite Pullback. Any dips or weakness will likely attract strong buying interest.

Weekly Market Update: Nifty500 Holds Uptrend Despite Pullback

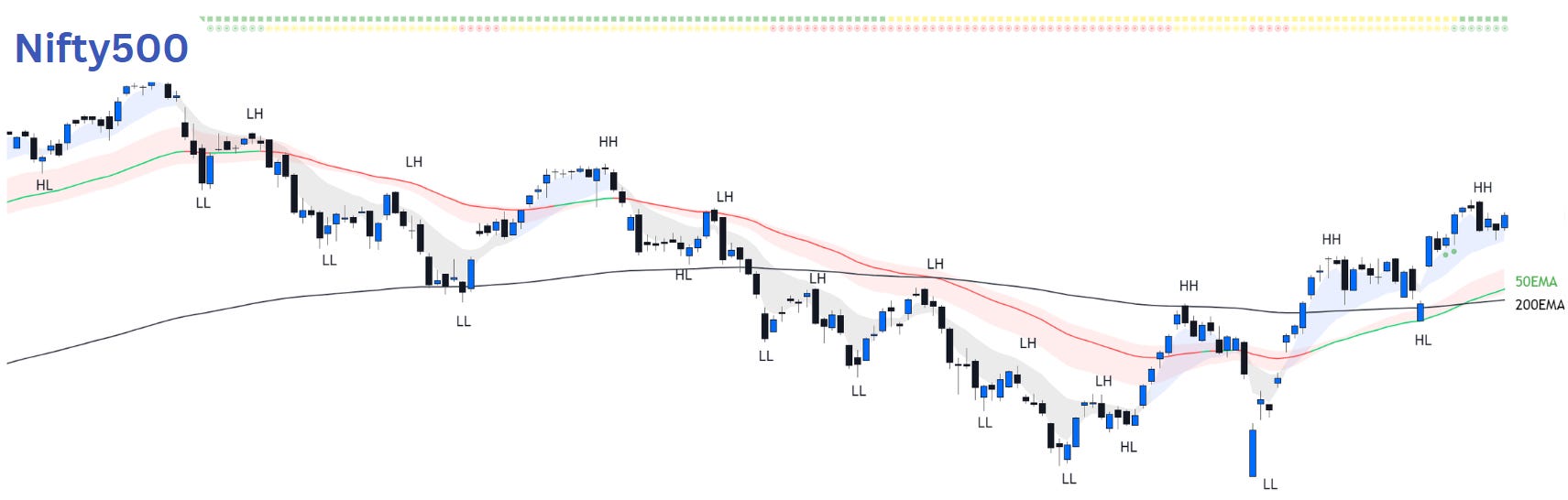

Nifty500 ended the week with a modest 0.39% decline, despite slipping over 1.2% midweek. After a strong month-long rally, some profit-taking was expected, but the broader trend remains upward. We continue to follow this trend until clear signs of reversal emerge. At Pro-Setups, we emphasize the importance of the rising 50EMA. By staying in the market when Nifty500's 50EMA is rising (green) and avoiding long positions when it is declining (red), swing traders can significantly improve their returns (read our blog on this topic). Combine it with the crossovers & crossunder of 10EMA & 20EMA to get Stay & Cautious signals. That's a simple hack.

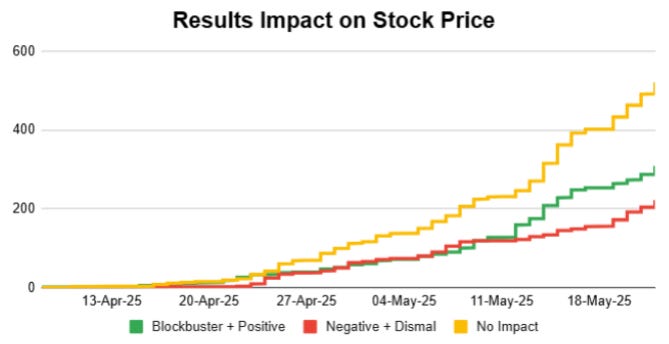

Market sentiment saw little change this week. The earlier concerns - global trade issues, FII outflows, high valuations, weak corporate performance, and geopolitical risks have eased. Earnings season continued to drive stock-specific moves, with more companies posting positive impact after results than negative ones. We believe that March 2025 could be the last quarter of underperformance for most companies, with an expected uptick from June onwards.

The outlook has once again become positive for swing trading. As we head into next week, we expect that any dips or weakness will likely attract strong buying interest.

Building on last week’s trend, the high percentage of stocks trading above their 10EMA, 30EMA, and 50EMA indicates that the market remains overbought in the short term. Historically, such overbought conditions are often followed by a period of pause, consolidation, or a pullback. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts. Positional traders, meanwhile, should use these periods to look for opportunities to add to strong existing positions, rather than treating these signals as cues for immediate action.