Newsletter for the week ended May 9, 2025

Weekly Market Update: Navigating Volatility Amid Geopolitical Tensions

This week, Indian equities experienced heightened volatility, with Nifty500 declining by about 1.5%. The index oscillated between gains and losses, ultimately managing to retest and close above its 50EMA. It remains stuck in a range, unable to surpass its previous higher high for the second consecutive week.

The week began on a positive note, supported by encouraging global cues and institutional inflows. However, optimism quickly faded as concerns mounted over India-Pakistan tensions. On Wednesday, after India’s Operation Sindoor, the market opened much lower but recovered some losses. However, cross-border issues led to another sell-off by the end of the week. Broader markets mirrored this with early advances giving way to declines, though some recovery was observed from Friday’s lows.

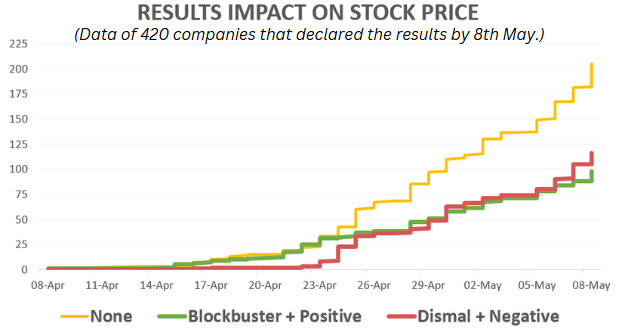

As more companies reported results this week, the number of companies with negative impact have increased the ones with the positive impact.

Since October 2024, markets have been sensitive to global trade uncertainties, FII selling, high valuations, and corporate underperformance, with the latest trigger being geopolitical tensions. On the positive side, tariff uncertainties have eased, valuations have moderated, and FII buying has resumed. March 2025 could be the last quarter of underperformance for most companies, with an expected uptick from June onwards. Key positives include robust domestic inflows, a supportive Union Budget that should boost consumption, and the RBI’s accommodative stance following rate cuts. For market sentiment, the trajectory of India-Pakistan tensions will be the key driver in near term.

While current volatility makes swing trading challenging, the environment remains favorable for mid-to-long term investing in fundamentally strong companies. Do read our Note on How to find beaten down fundamentally sound companies changing trend in this post.

The number of stocks above key short-term EMAs have declined further, and about to reach the oversold zone. The Nifty 500’s 10EMA is above its 20EMA, which is a positive sign for holding long positions. The most recent crossover was on 16 April 2025. However, previous crossovers and crossunders show that the market has been choppy, with several trend reversals since October’24.