Nifty500 Breaks Out: Market Rally Gains Steam

Nifty500 broke out from its consolidation range after 4-week sideways move. Technical signals potential for continued upward momentum in coming weeks.

Indian equity market extended its winning streak for the third consecutive week, with the Nifty500 delivering over 1.28% weekly gains. The week witnessed a broad-based rally across market segments, supported by domestic institutional buying and positive sentiment around potential GST reforms and US-India trade developments negotiations and US Federal Reserve rate cuts.

Our Pro-Setups community met for a Breakouts scanning session this weekend where we focused on breakout strategies and specifically swing-high setups. Do check out the meeting video.

Key Drivers This Week

GST reform optimism: Investor sentiment remained buoyant on expectations of GST reforms effective from September 22, 2025.

Key market indices like Nifty50 and Sensex gained around 0.8% each. Both Midcap and Smallcap indices outperformed largecap indices as they rose by over 2% and 1.5% respectively.

The Federal Reserve's 25 bps rate cut on September 17, 2025 boosted Indian markets.

The upcoming RBI meeting date (Sept 29-Oct 1) will be a key event to watch next week, as it may provide guidance on domestic interest rate trajectory and liquidity conditions.

Technical Perspective

Nifty500 Trend: Nifty500 is currently demonstrating resilience by maintaining levels above key short-term moving averages (10EMA, 20EMA and 50EMA) while building upward momentum.

Short-Term Levels: The Nifty500 successfully broke its consolidation range of 22,400-23,230 showing strong bullish momentum. This could trigger strong upward momentum and create favorable conditions for significant portfolio gains.

Support-Resistance Flip: The breakout above 23,230 has converted this former resistance into potential support on any pullbacks.

The reason we track Nifty500 is because it represents over 90% of the free float market capitalization, making it a comprehensive barometer of market health.

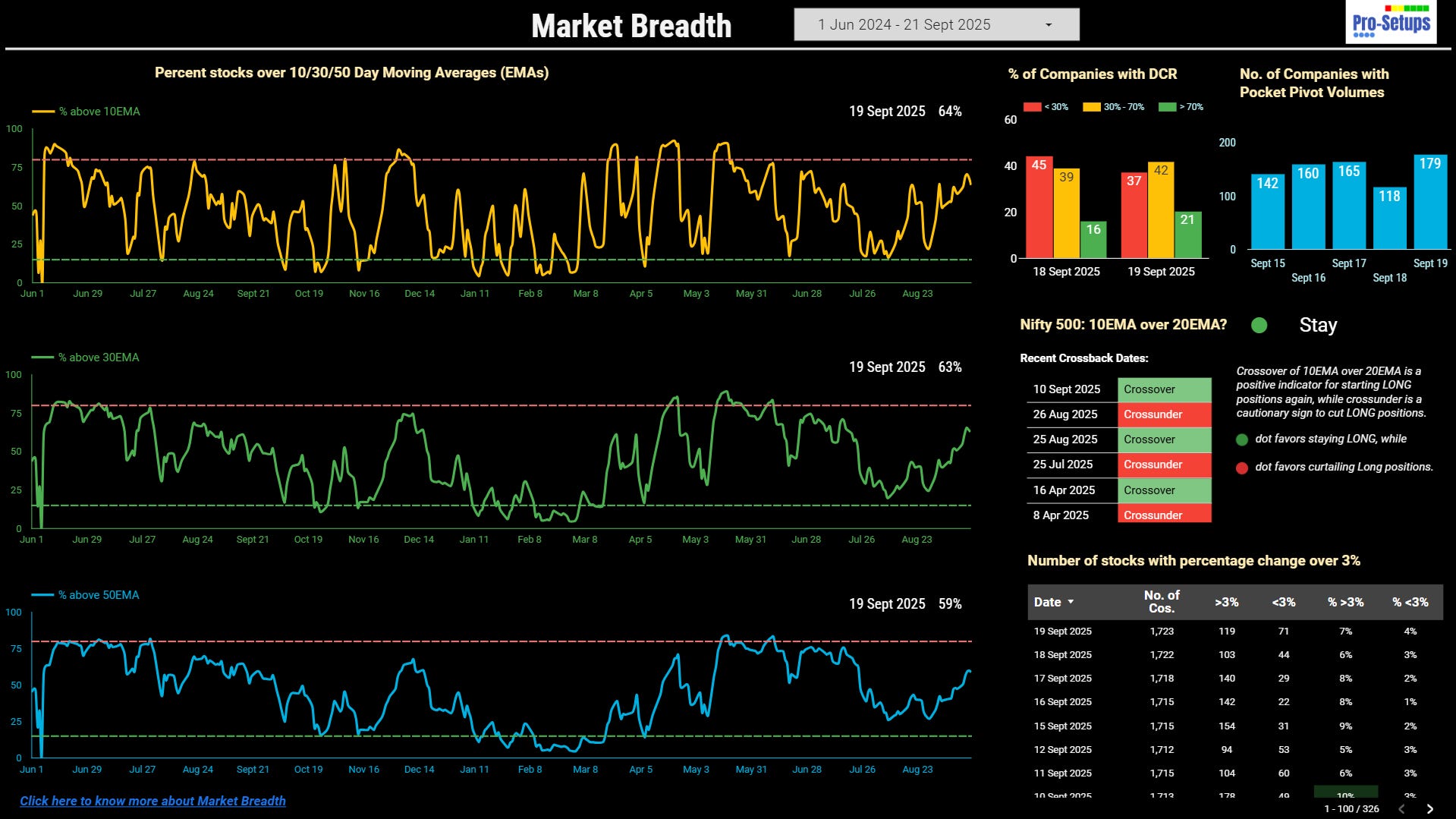

Market Breadth: The % of stocks above all key short-term moving averages gained further this week. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.

Based on the percentage of stocks above key short-term EMAs, the market is neither overbought nor oversold. However, if you just look at the Nifty500 index, it might be slightly extended and can give room for 10EMA or 20EMA to catchup.

Accessing Market Breadth on Pro-Setups Dashboard is now available for free for all readers. Click on the link below.

Trading & Investment Strategy

Swing Traders: The trading environment has changed from bearish to bullish. The Nifty500 index has decisively moved above the 22,400-23,230 consolidation zone that persisted for 4-5 weeks and has created a new higher high structure. The successful breakout from the consolidation range, combined with the new higher high formation, does create favorable conditions for continued upward momentum and potential portfolio gains.

Positional Traders: Positional traders should focus on dual-approach positioning by capturing both breakout opportunities and pullback entries in fundamentally strong sectors that have witnessed temporary corrections.

Summary

The market is in a good mood right now, with companies of all sizes doing well. The Nifty500 index has broken out of its consolidation range and is now ready to move higher. For swing traders, this is a great time to participate aggressively in the market since the trend is clearly upward. For positional traders, the market will offer both breakout as well as pullback buy opportunities.