Nifty500 Reclaims 50EMA Amid GST 2.0 Optimism

From GST 2.0 catalyst to Friday profit-booking: A week of mixed signals

During the week of August 18-22, 2025, the Nifty500 gained 1.37% overall but faced volatility, ending on a mixed note.

Key Drivers This Week

GST 2.0 announcement: Prime Minister’s GST 2.0 announcement on Independence Day was one of the most significant market catalysts this week. The announcement promised a simplified tax structure with only two principal slabs of 5% and 18%, eliminating the existing 12% and 28% brackets, to be implemented by Diwali 2025.

Rally stall & profit-booking: After opening the week with a gap-up, the indices lost momentum in the latter half, giving up part of their gains. At one point during the week, the Nifty500 was trading more than 2.5% higher compared to last week’s close.

Despite the fall on Thursday and Friday, individual stocks help up quite well. Midcap and Smallcap indices outperformed.

Flows: FIIs remained net sellers in August, keeping sentiment cautious; DIIs cushioned on select days.

Traders continue keeping a close watch on U.S.-India trade tensions and the ongoing U.S.-Russia talks over the Ukraine conflict, as both developments are likely to shape near-term market direction.

Rate Cuts, Tax Reforms & GST 2.0 Could Ignite India's Consumption Boom

While we’re not economists, it’s easy to see that the combination of RBI rate cuts, GST 2.0, and Income Tax reforms is clearly strengthening India's growth story. The combination of these three is creating a powerful triple stimulus that could supercharge India’s consumption story in the near future. When RBI cuts interest rates, home and car loans become cheaper, making it easier for people to buy houses, vehicles, and other big-ticket items. At the same time, if the Finance Bill reduces personal income tax rates, people will have more money in their pockets each month. Add GST 2.0 to this mix, which will slash prices on cars, air conditioners, washing machines, and many consumer goods, and you get a perfect storm for spending. This triple boost is particularly powerful because it aids consumption from three different angles simultaneously. Although, some consumers might delay purchases until GST 2.0 is fully implemented by Diwali, creating a temporary slowdown before a strong festive season surge.

Technical Perspective

Nifty500 Trend: The broader Nifty500 index showed mixed performance during the week, reflecting the overall market consolidation pattern. At one point during the week, the Nifty500 was trading more than 2.5% higher compared to last week’s close, but ended up only 1.3% up. It faced resistance at higher levels while finding support around key moving averages.

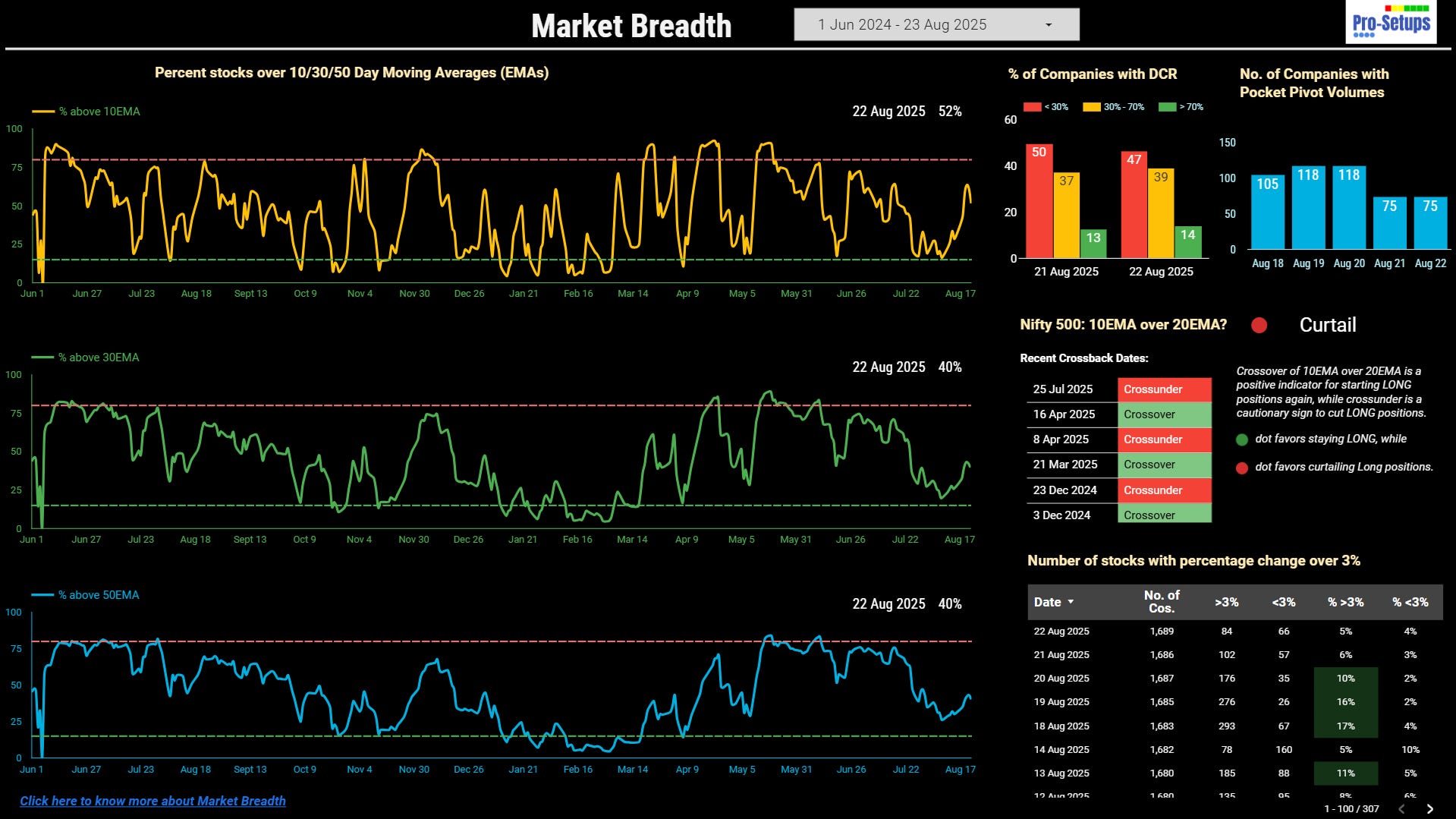

Despite the fall on Thursday and Friday, individual stocks help up quite well, as is evident by the percentage of stocks that rose by over 3% higher than those that fell by over 3% (refer Market Breadth page below). Further, the Midcap and Smallcap indices outperformed on the week (roughly +2.0% each), signaling underlying risk appetite.

Short-Term Levels: The Nifty500 has successfully reclaimed its 50EMA support level, marking a crucial technical recovery. The index is currently trading very close to this dynamic support line and holding above this level would set the stage for a constructive upmove. For the bulls to regain control, Nifty500 needs to decisively break above the immediate resistance zone of 23,200, which appears to be the previous swing high. A sustained move above this level would signal the resumption of the primary uptrend and potentially target the previous highs around 23,600-23,700 levels. However, any failure to hold the 50EMA support could lead to further weakness.

Market Breadth: The % of stocks above all key short-term moving averages rose further this week after bouncing from near-oversold levels last week. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts. We got a signal on Crossunder of Nifty500’s 10EMA below its 20EMA on 25th July. Crossunder is a cautionary sign to cut LONG positions. After a month since the crossunder signal, any upmove from here will give us a Crossover signal in the coming week, since Nifty500’s 10EMA is very close to its 20EMA.

Accessing Market Breadth on Pro-Setups Dashboard is now available for free for all readers. Click on the link below.

Trading & Investment Strategy

Swing Traders: The swing trading environment has notably improved following the recent market stabilization and technical recovery with Nifty500 successfully reclaiming its 50EMA. The environment will improve further if Nifty500 sustains and bounces from its 50EMA support, as this would confirm the resumption of the intermediate uptrend and provide clearer directional bias for swing positions. A decisive bounce from this crucial technical level would restore confidence among swing traders.

Positional Traders: Monitoring how holdings are reacting around the 50EMA levels for signs of trend continuation or reversal. The focus should be on identifying stocks demonstrating strong 1-month and 3-month relative strength compared to the broader market, as these names are likely to emerge as new leaders and outperform during the next leg up. Stocks that have successfully reclaimed their respective 50EMAs with conviction, accompanied by improving relative strength metrics, should be prioritized for fresh positional builds or existing position additions.

Summary

Market conditions have shown notable improvement this week, with the Nifty500 reclaiming its 50EMA - a key technical milestone that suggests the correction may have run its course. The primary concerns that drove the recent selloff have been global trade uncertainty, disappointing Q1FY25 corporate earnings, and profit booking following the previous strong rally. Despite these short-term challenges, India’s long-term economic outlook remains strong. Long-term investors often view sharp market declines as opportunities to accumulate high-quality companies at attractive valuations.