Nifty500 Slides on Earnings Disappointment

Broader markets skid as Q1 earnings disappoint and global trade uncertainty persists. Traders eye Nifty500’s reaction around Rising 50EMA for fresh cues.

This week, Indian equities saw a sharp downturn, with the Nifty500 falling over 1% as selling pressure intensified across broader markets. Weak quarterly earnings, persistent foreign investor outflows, and caution ahead of global trade deals awaiting final decisions by August 1, dragged broader indices lower.

Key Drivers This Week

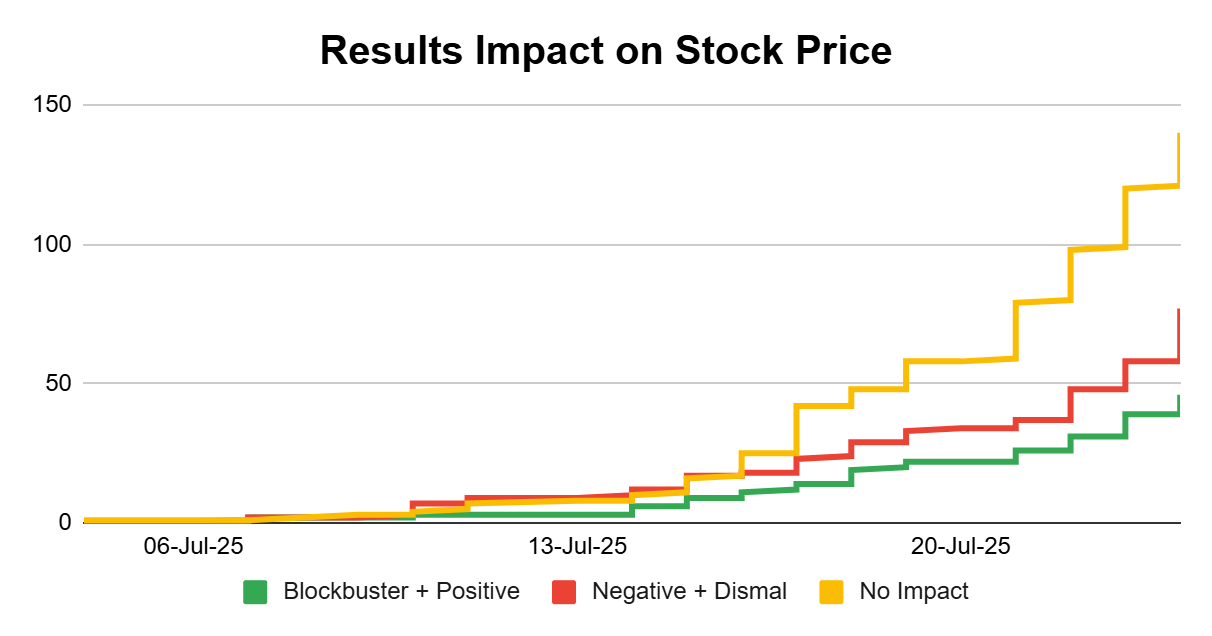

Earnings in Focus: Q1 corporate results have been a drag so far. With over 260 companies that have got market reactions on their results till Friday, 25th July 2025, there have been higher number of companies reporting negative or dismal reaction to results compared to blockbuster or positive reaction.

Profit booking: Traders continued to lock in gains in July after a strong run-ups in the previous four months.

Global Trade Uncertainty: There are still concerns around U.S. tariffs and global trade tensions awaiting final decisions by August 1, keeping investors cautious.

No Major Domestic Headwinds: Apart from uncertainties around the US trade deal and ongoing Earnings releases, there seems to be no significant domestic factors impacting the market.

Technical Perspective

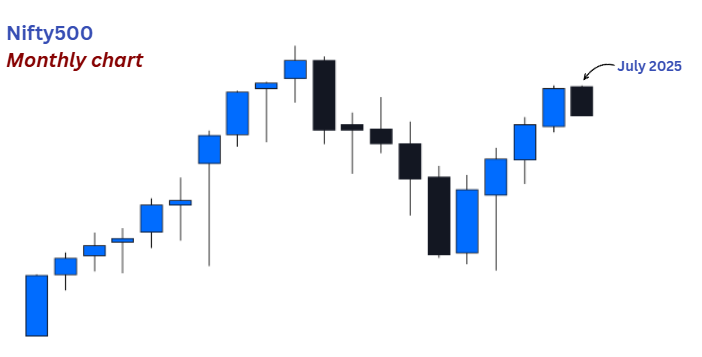

Nifty500 Trend: The Nifty500 closed at 23,014.80 on July 25, down 1.2% for the week, trading near one-month lows.

The Nifty500 chart continues to show an uptrend, and will now be testing its rising 10-week EMA (equivalent to 50EMA on daily charts).

Short-Term Levels: The market hovered around its 20EMA but gave a breakdown on the last day of the week. Its reaction to 50EMA in the coming sessions will be key for short-term sentiment. Short-term trend remains negative with risk of further correction towards the 22,600-22,680, if Nifty500 could not hold on to its Rising 10-week EMA.

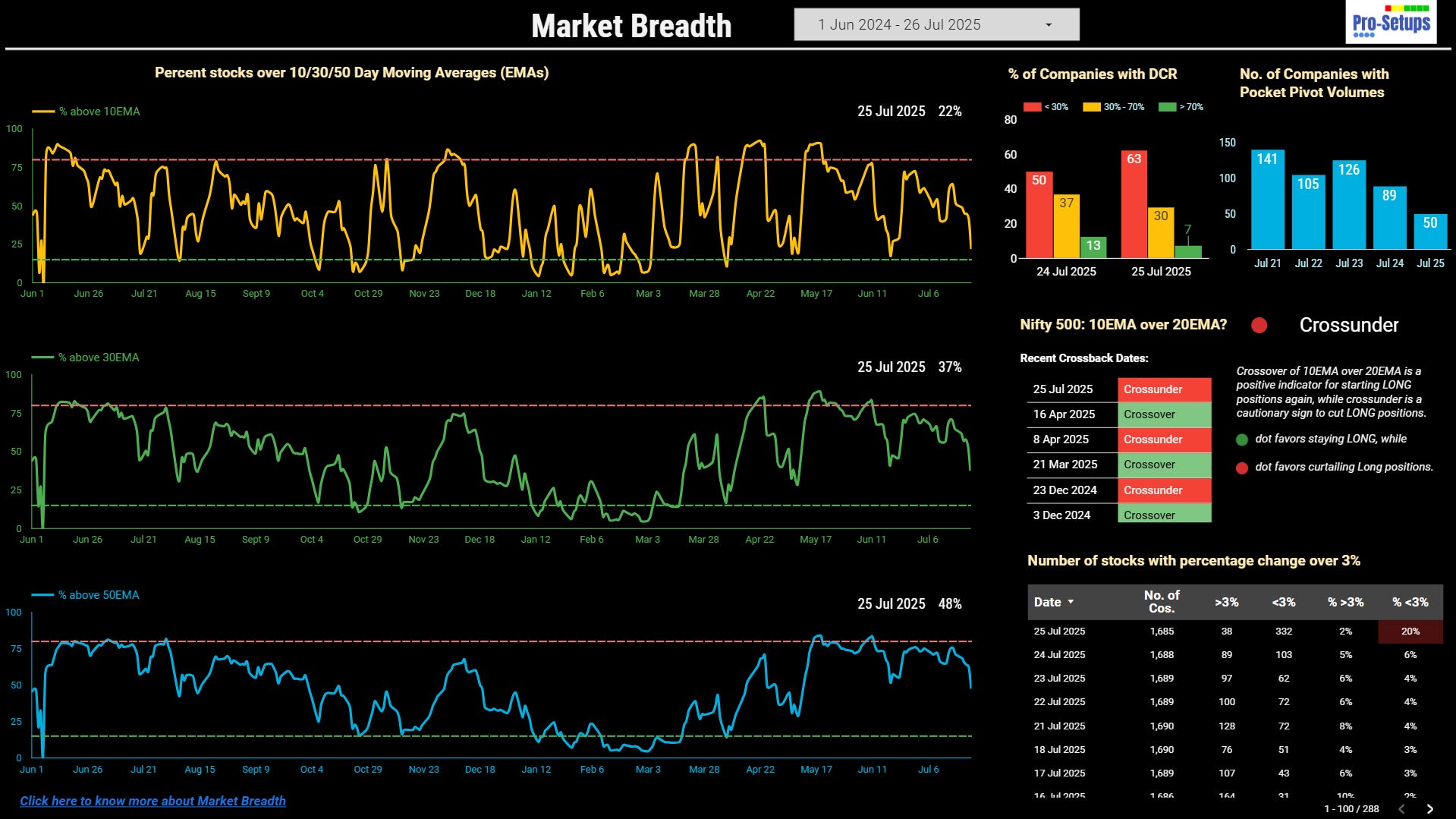

Market Breadth: The % of stocks above all key short-term moving averages declined significantly this week, and is yet to reach the oversold levels. We also got a signal on Crossunder of Nifty500’s 10EMA below its 20EMA. Crossunder is a cautionary sign to cut LONG positions. Accessing Market Breadth on Pro-Setups Dashboard is now available for free for all readers. Click on the link below.

Trading & Investment Strategy

Swing Traders: Likely found limited opportunities this week, plus would have exited positions amid volatility.

Positional Traders: Monitoring how holdings react around the 50EMA levels for signs of trend continuation or reversal.

Key triggers:

If Nifty500 finds support at 50EMA, this would be a constructive sign, marking the resumption of the uptrend and offering fresh trading opportunities.

However, further profit booking can be expected, but medium to long-term bias remains positive.

22,600–22,680 remains crucial support zone for Nifty500.

Earnings This Week

Major disappointments: Bajaj Finance, AU Small Finance Bank, Zensar Technologies, Nestle India, ACC, Adani Energy Solutions, and IT companies namely Persistent Systems, Coforge & Hexaware Technologies, led downside after underwhelming Q1FY26 numbers.

Positive surprises: ICICI Bank, HDFC Bank, Eternal (Zomato), Paytm, Dr. Reddy, Force Motors, real estate companies namely Phoenix Mills & Ajmera Realty had positive reaction to their reported results and saw relative strength.

Power Earnings Gaps (PEG): Infobean, SML Isuzu, Senores, Thyrocare, Tatva Chintan were some of the companies, among others, that had power earnings gap-ups next day after reporting their earnings.

In summary, markets are in short-term correction territory, weighed down by disappointing earnings from select large caps. Market breadth has worsened since last week, and technical indicators remain weak unless the Nifty500 finds support at its 50EMA. While swing traders are likely already on the sidelines, positional traders will be closely watching whether their holdings can sustain above t he key 50EMA level.