RBI lights the market surge, but breadth lags

Policy tailwinds meet global headwinds as RBI’s rate cut and stable macro fail to ignite strong momentum amid rupee weakness, FII caution and volatile global markets.

RBI delivered a 25bps rate cut last week. GDP data released showed stability and inflation is under control. However, these seem to be not enough for a sustained, strong momentum. With the US market volatility high and global bond yields are unstable, FIIs are still hesitant in staying invested in the Emerging Markets.

Key Indices Performance:

Nifty50: -0.06% (made All Time High / ATH this week)

Sensex: +0.01% (made ATH this week)

Nifty500: -0.41%

Nifty Midcap150: -0.84%

Nifty Midsmallcap400: -1.04%

Nifty Smallcap250: -1.42%

Key Drivers This Week

Rate cuts: The RBI delivered a 25 bps repo rate cut, which lifted sentiment on Friday and helped indices recover from mid-week weakness, even as commentary stayed cautious on inflation and liquidity.

Rupee weakens against dollar: A key macro overhang this week was the sharp depreciation in the rupee, which briefly breached the ₹90/dollar mark and stayed near record lows.

Large-cap stocks displayed stronger relative strength and outperformed mid- and small-cap stocks, this week as well.

Technical Perspective

Nifty 500 trend: Moved in a narrow range of 1.64% for the entire week, indicating lack of strong momentum. It opened on Monday at a new ATH but then got sold into and drifted lower during the week. It held above its 20EMA and managed to close the week above this key moving average. The 20EMA above the rising 50EMA indicates larger market is stable. The Crossover of 10EMA over 20EMA that happened on 7th October 2025 is also intact. All major EMAs are also aligned in a bullish sequence (10 > 20 > 50 > 100 > 200EMA), reinforcing the strength of the underlying trend.

Benchmark indices such as Nifty50 and Sensex showed strength compared to Nifty500 by respecting their respective 20EMAs.

Nifty500 slipped below its rising 20EMA early in the week but quickly reclaimed it by the week ended after RBI rate cut announcement. The index continues to make higher highs on the weekly chart and is consolidating near the upper boundary of its previous range.

Nifty MidCap150 is currently trading above its 50EMA but is below its 20EMA.

Nifty SmallCap250 shows a completely different picture. The price is forming a lower high, lower low structure with price just holding above its 200EMA while the 10EMA, 20EMA and 50EMA are all one below the other.

The reason we track Nifty500 is because it represents over 90% of the free float market capitalization, making it a comprehensive barometer of market health.

Nifty500’s 10EMA crossed above its 20EMA on 7th October triggering a ‘Stay’ signal that suggests holding onto existing long positions.

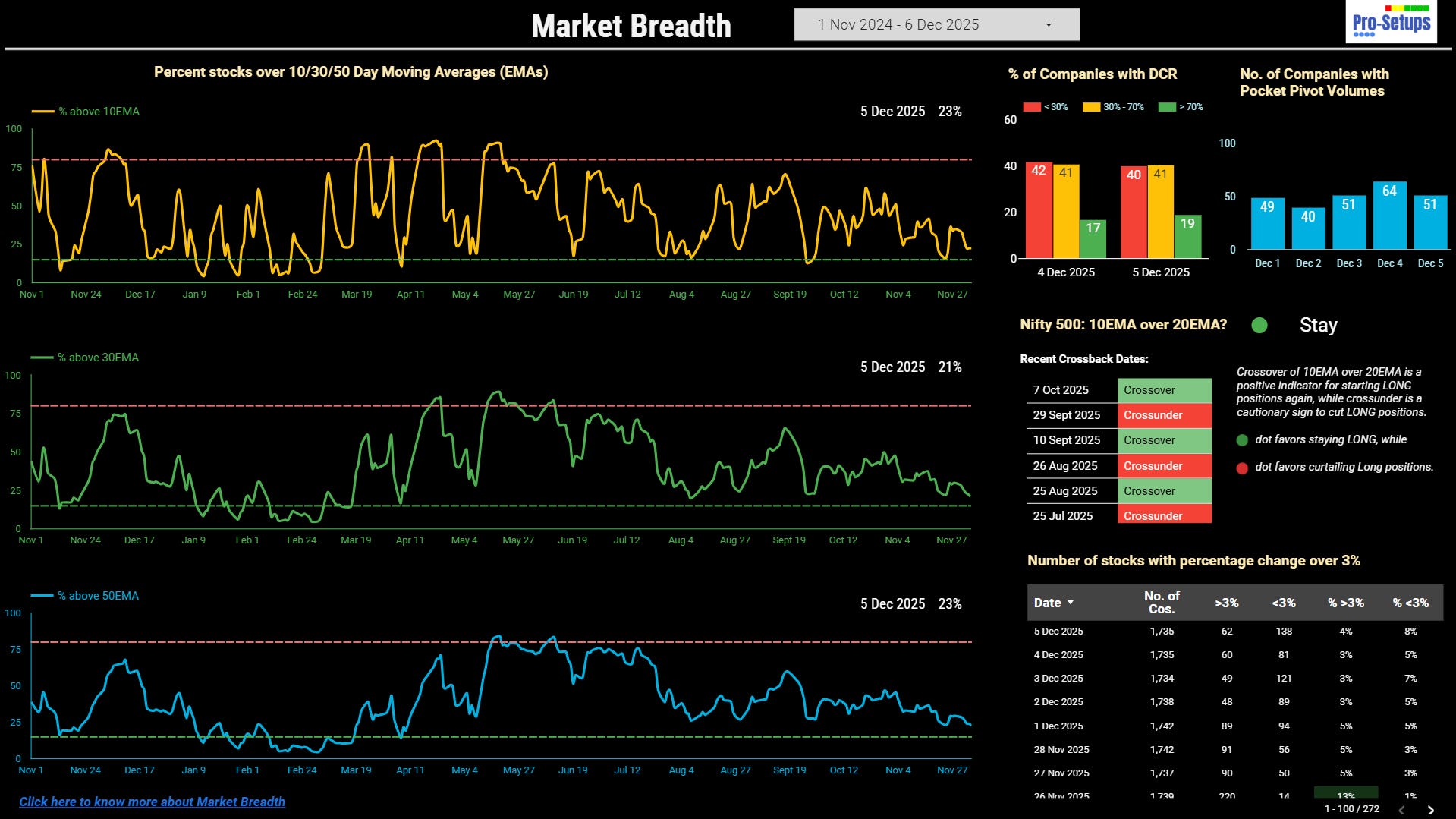

The market breadth shows a grim picture of how the rally has been selective and that the broader market is generally weak. The percentage of stocks trading above the key moving averages continue to decline and it reflects the corrective phase of the market is continuing. The positive is that the crossover of 10EMA over 20EMA that happened on October 7th is still holding good.

As of December 5, 2025, about 23%, 21% and 23% of stocks are above their 10EMA, 30EMA, and 50EMA respectively. The market breadth readings remain below the midpoint (50% mark), signaling that the majority of stocks are trading below short-to-medium-term trend levels, which is typically a corrective sign for the broader market.

Market breadth remains weak, and we are not in the oversold zone. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.

Accessing Market Breadth on Pro-Setups Dashboard is available for all readers. Click on the link below.

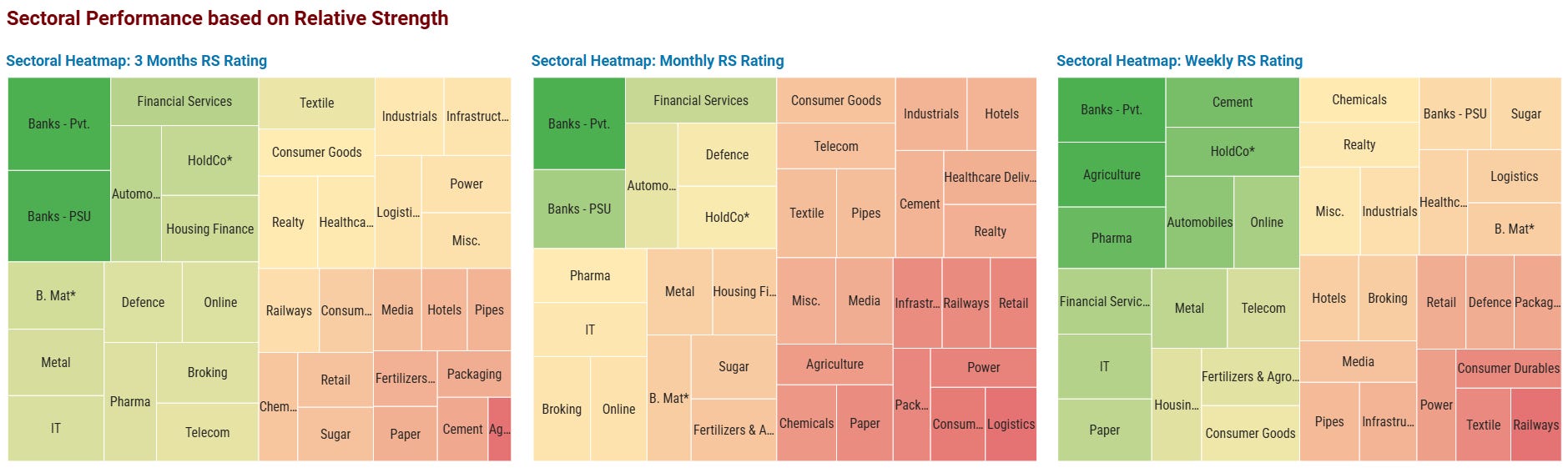

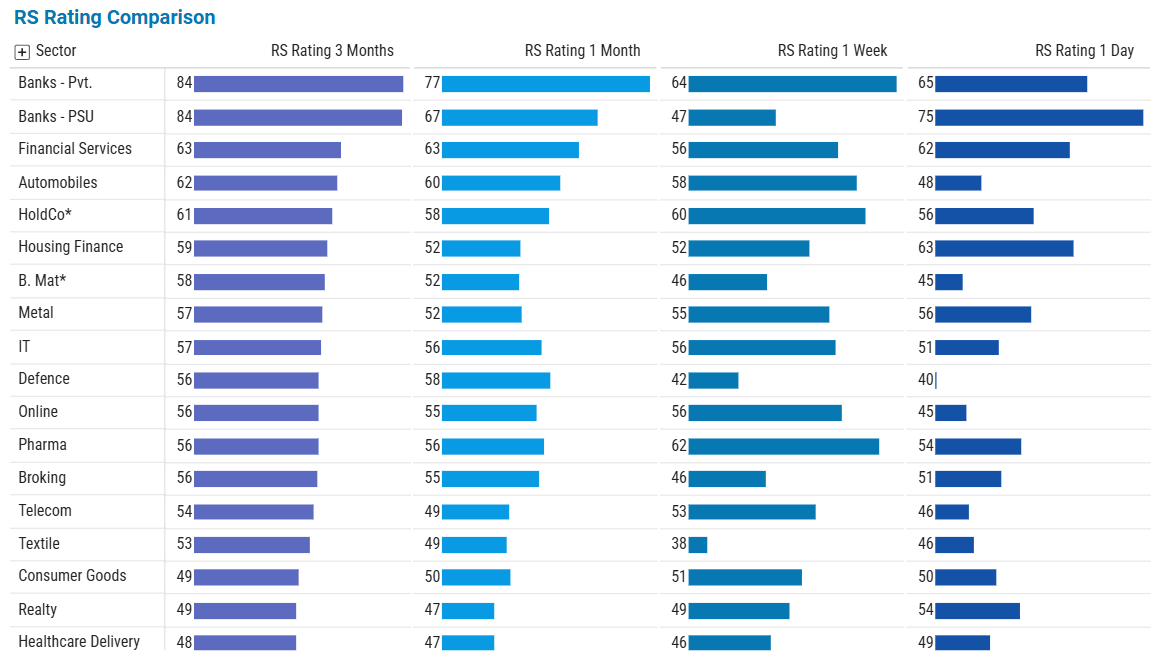

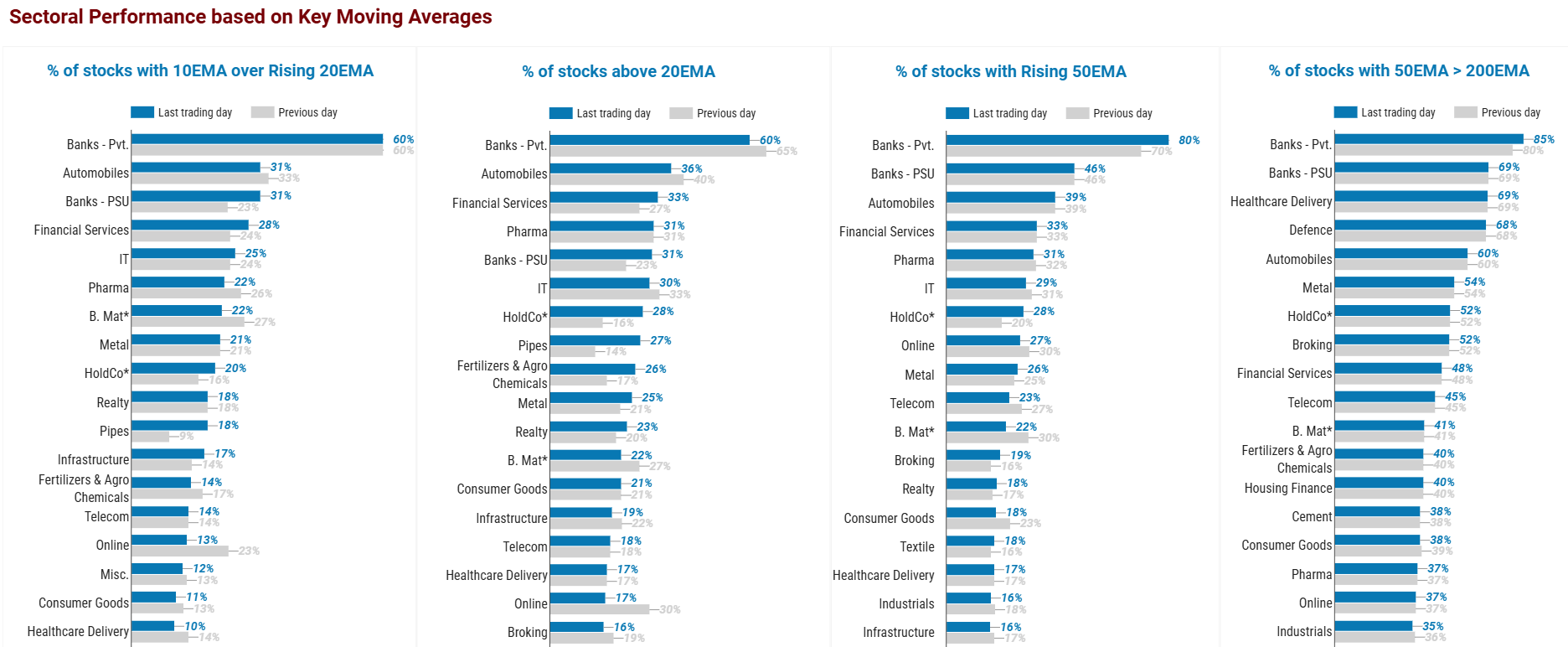

Sectoral Performance

Private Banks seem to be holding the leadership position across weekly, monthly and 3-months time-frame while PSU Banks seems to be cooling off a bit. After a brief period of pause / consolidation, Automobile showed strength last week and Pharma is now appearing to be gaining strength. Private Banks are best positioned post RBI’s rate cut, with strong balance sheet and reasonable valuations. Auto stocks are showing strength with stable demands and probably positive perception due to rate cut.

Summary

While the trend is still up with Nifty500 making Higher Lows, the market is still in a consolidation and is unable to make a decisive uptrend structure of Higher High and Higher Lows.

Portfolios that have heavy tilt towards smallcaps could have seen a visible drawdown. Focusing on gradually accumulating good quality private banks and select auto stocks seem to be the most favored strategy. One needs to stay away from aggressive buying in smallcaps and maintain strict risk management to protect financial and mental capital. Blindly chasing momentum or “story stocks” without proper earnings backing will prove to be a costly decision. It’s better to focus on large and high quality midcap stocks and look to trade pullbacks, while keeping position size smaller and holding period shorter. This is essential as Breakouts seem to be lacking follow through moves and stocks that have run up in the recent past seem to round trip taking back most of the paper profits. Until Market Breadth improves and shows a broad based, sustained moves, it’s safer to stick with quality, leading stocks from the leading groups before getting aggressive.