Situational Awareness as on 6th Feb 2023

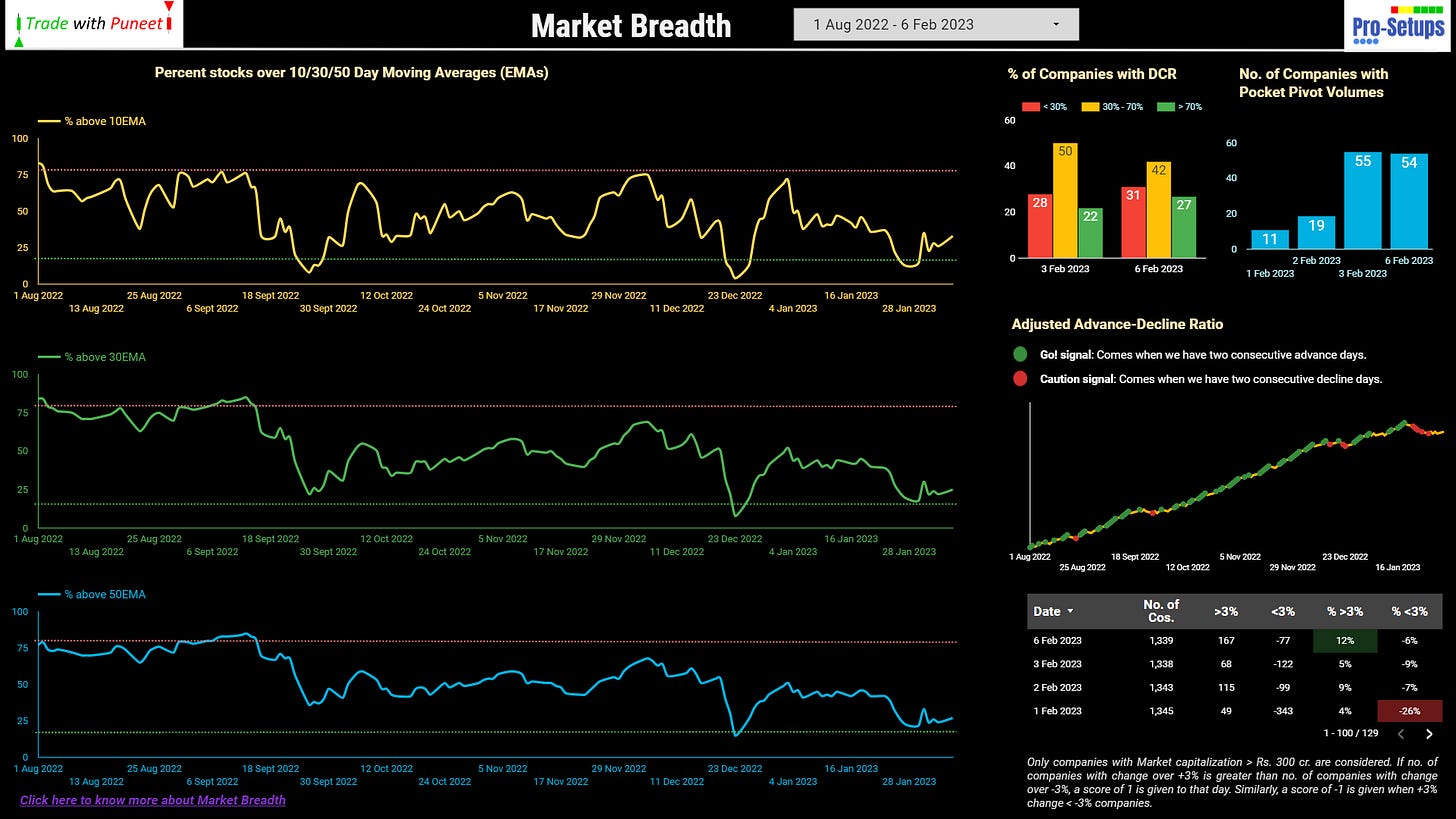

Market Breadth

We are still near the bottom where the key short-term moving averages are close to the oversold zone. There are some positive signs visible, such as rise in pocket pivot volume candles two days in a row. Moves from here on tend to be sharper, but you cannot rule out the possibility of further fall too. As of now, the upmove (if that has to happen) has not happened as sharply as we experienced in the previous two downfalls of September 2022 and December 2022.

Nifty500 Weekly chart

No change today as we had a tiny insignificant candle.

Following text from previous note continues:

We had a positive white candle for the week. Important, because it is coming near the support zone. It is important for us to move upwards now. We are still in a sell-on-rise market and any further fall will be a signal to quickly close open positions. On charts, the weekly Nifty500 chart also looks like an Inverted H&S pattern after an uptrend.

We should be able to take the high of the previous week’s (23rd Jan) black candle convincingly for a good run upwards. (Just to recall - we were not able to breach the high of 19th Dec weekly candle for over 3-4 weeks, and what followed was 23rd Jan black weekly candle.)

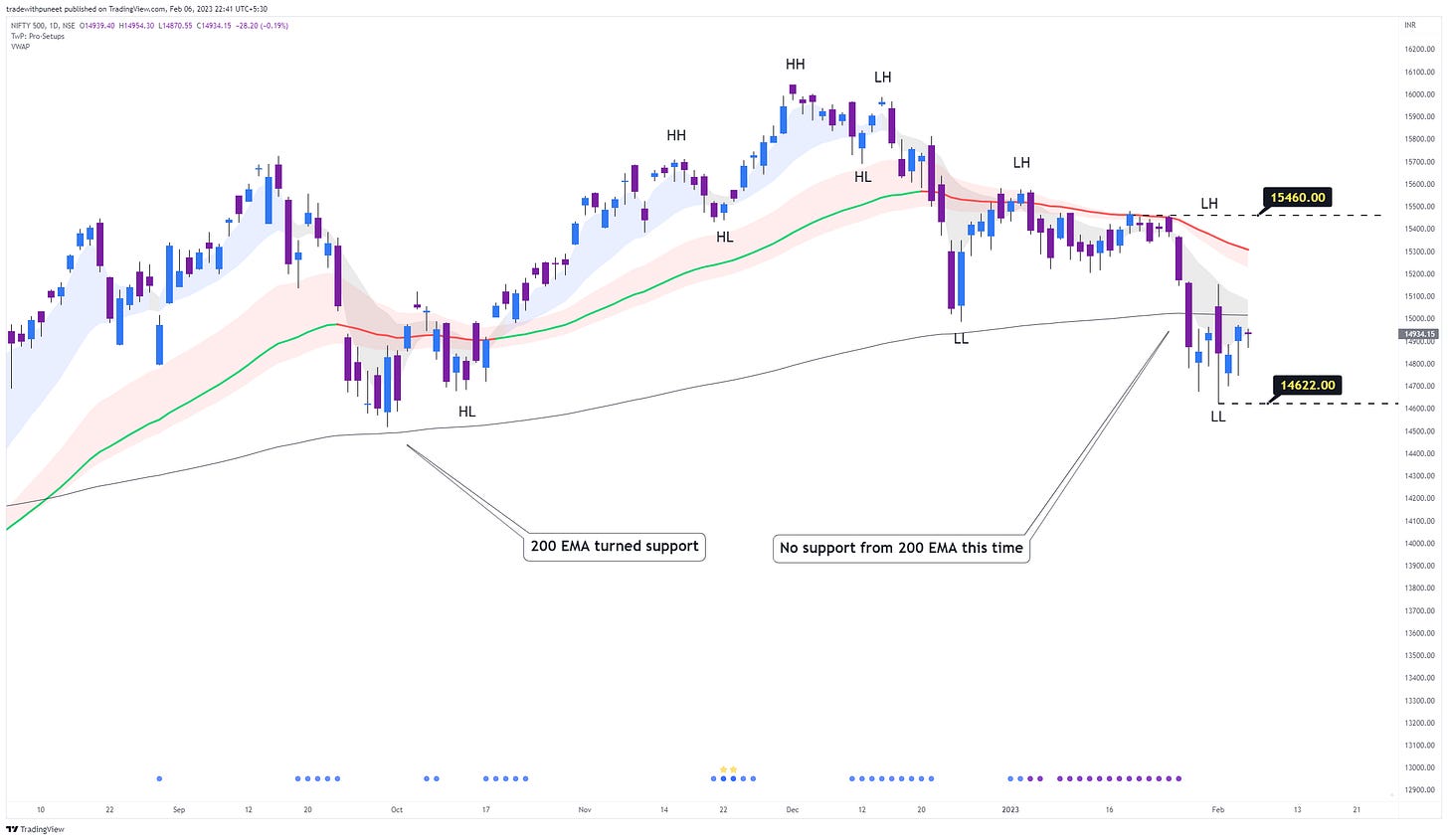

Nifty500 Daily chart

Following text from previous note continues:

We have a new lower high (15460) and lower low (14622), a sign of clear downtrend. We just didn’t get rejected by 50EMA, even 200EMA didn’t give us much needed support like last time. These are not magic lines, but they’re important because traders worldwide scan and take action based on these lines.

The conclusion remains same: This is not a market to enter longs if you’re planning to build a position for medium term. For swings, you should not consider holding for over 2-5 days at max, because a profitable position build over few days can vanish in no time. Do not have more than 3-4 open positions at this time, because during the sell off, a higher number of positions can cause brain freeze. And another sell off is not ruled out.

Current exposure - 50% invested, with 5 open positions (sold partially from previous 3 open positions, and added one).