Staggered Stop Loss: Don’t Let Volatility Steal Your Winning Trades

Discover how staggered stop loss technique can help you navigate the volatile market conditions.

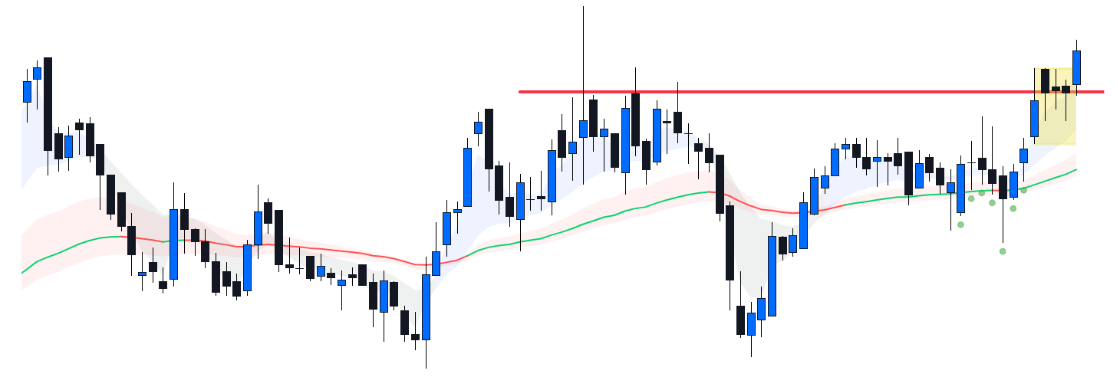

Picture this: you’ve spotted the perfect setup - ready to breakout from a solid six-month base. You decide to enter the trade just as the price breaks through mini coil forming at the resistance, setting your stop loss at the low of the mother bar (about 5% below your entry).

But then the stock says, “Nope.” Instead of rocketing up, it hits your stop-loss, and boom - you’re out! You stick to your plan like a Pro.

Then, the unexpected happens. The stock finds support at the rising 50EMA and starts climbing again, leaving you behind. You followed your plan, but the market had other ideas.

Now, if you'd used a staggered stop-loss approach, things could have turned out differently. Let’s explore how a small tweak to your plan could’ve kept you in the trade, while managing the risk at the same time.

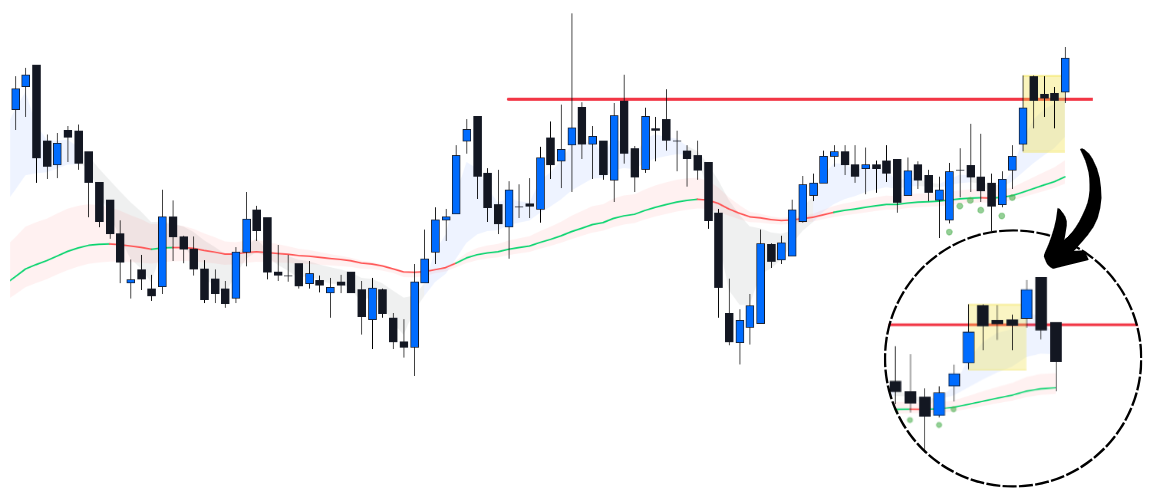

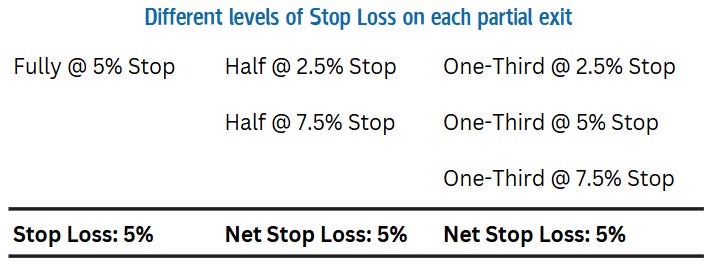

With staggered stop loss, you set multiple stop loss levels at different price points, instead of setting a single stop loss level. This approach allows you to reduce your position size gradually as the market moves against you, rather than exiting the entire position at once.

By using staggered stop losses, you manage your risk more dynamically. If the market rebounds after hitting the first stop-loss level, you still have a portion of your position to benefit from the move. On the other hand, if the market continues to move against you, your losses are controlled, but you’re not exiting your position prematurely.

In the above example, if you would have kept staggered stops at 2.5% and 7.5% each, you would have made money on your entire position even if the first tranche was exited at a loss.

In the end, your loss remains the same, but with staggered stops, you give yourself a better chance to stay in the game for the rebound.

The concept of Staggered Stop Loss is taken from Mark Minervini’s Book - ‘Think & Trade Like a Champion’. One must read all his books to become a better trader.