Tariffs & Earnings Weigh Heavy: Indian Markets Extend Bearish Streak

Nifty500 declines 1.48% as trade tensions and disappointing Q1 results pressure sentiment.

The Indian stock market concluded yet another challenging week as NIFTY500 extended its bearish streak, declining by approximately 1.48% for the week. The market faced headwinds from new US tariffs on Indian exports, weak corporate earnings that failed to meet market expectations, and sustained foreign institutional selling pressure.

Key Drivers This Week

US Tariff Impact: New US tariffs on Indian exports led to weak openings and selling pressure in export-heavy industries. However, even though Trump announced 25% tariffs on Indian goods, the Indian stock market tried to stay positive. US will eventually strike a deal with India and both sides will give away some ground.

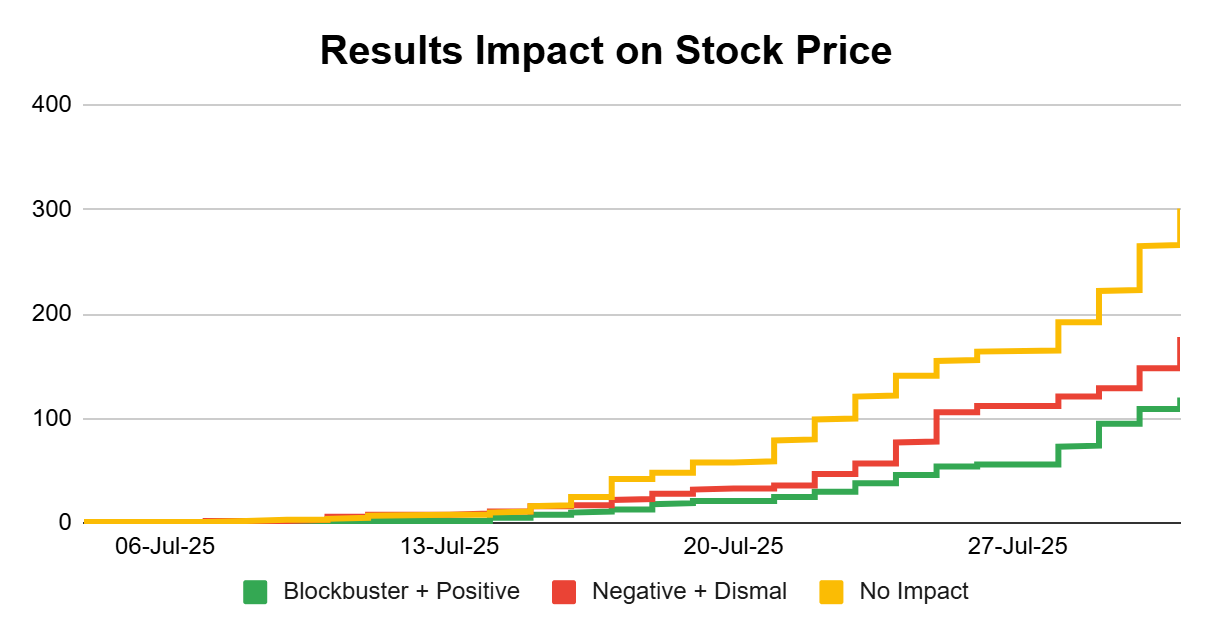

Corporate Earnings Disappointment: Mixed Q1 earnings results weighed on sentiment. With around 600 companies that have got market reactions on their results till Friday, 1st Aug 2025, a higher number of companies reported negative or dismal reaction to results compared to blockbuster or positive reaction.

FII Selling Pressure: Continued foreign institutional selling offset by robust domestic institutional buying throughout the week.

Technical Perspective

Nifty500 Trend: The Nifty500 closed at 22,673.65 on Aug 1, down 1.48% for the week. Bulls tried their luck on Tuesday and Thursday, but bears had an upper hand.

Nifty500 tested its 50EMA this week but could not reclaim it, warning us for a further downside. Nifty500 is now trading below both 20EMA and 50EMA, which is a bearish signal and suggests that sellers are in control in the short term.

Short-Term Levels: Nifty500 needs to reclaim its 50EMA, to regain bullish momentum. Until then, short-term trend remains negative with risk of further correction. Momentum and structure favor bears in the short term.

Market Breadth: The % of stocks above all key short-term moving averages declined further this week, and is yet to reach the oversold levels. We got a signal on Crossunder of Nifty500’s 10EMA below its 20EMA last week. Crossunder is a cautionary sign to cut LONG positions. Accessing Market Breadth on Pro-Setups Dashboard is now available for free for all readers. Click on the link below.

Trading & Investment Strategy

Swing Traders: Likely found limited opportunities this week, plus would have exited positions amid volatility.

Positional Traders: Monitoring how holdings react around the 50EMA levels for signs of trend continuation or reversal. Any breakdown of 50EMA is an exit signal for positional traders.

Key triggers:

Resolution of US-India trade tensions and potential tariff reductions.

Q1 earnings season results and management guidance.

RBI Monetary Policy Meeting: The RBI’s upcoming meeting scheduled for August 4-6, 2025 will be closely watched for interest rate guidance and liquidity measures, which could significantly impact market sentiment. Most economists expect the RBI to keep the repo rate unchanged during this meeting, especially given the recent rate cuts and the current global uncertainties including the new US tariffs on Indian exports.

Although medium to long-term bias remains positive, further downside in short-term can be expected.

Earnings This Week

Disappointments: FIVESTAR, KOTAKBANK, LODHA, MAZDOCK, BLUEDART, TRIVENI, INDUSTOWER, CAMS, MOIL, TATASTEEL, RELAXO, BIRLACORPN, CESC, IIFL, PNB, GMRP&UI, TIMKEN, SUNPHARMA, JSWHL, SANOFI, JUBLINGREA, AARTIIND, ADANIENT, CHOLAFIN led downside after underwhelming Q1FY26 numbers.

Positive surprises: MANGCHEFER, GODIGIT, ADANIGREEN, TORNTPHARM, PARADEEP, CARTRADE, CRAFTSMAN, STARHEALTH, L&T, APARINDS, GVT&D, VBL, PGHH, SAGILITY, HEG, GREAVESCOT, NESCO, ACUTAAS, KAYNES, EMAMILTD had positive reaction to their reported results and saw relative strength.

Power Earnings Gaps (PEG): NIACL, GALLANTT, BLISSGVS, HIRECT, INDGN were some of the companies, among others, that had power earnings gap-ups next day after reporting their earnings.

Upcoming Earnings: Keep track of the upcoming earnings through Pro-Setups Dashboard. The page gives you technical analysis along with important financial notes (such as Easy Earnings Comparison, check MALLCOM below).

In summary, the market is currently going through a correction phase, with negative trends taking over. The main concerns are the impact of new tariffs and weak company earnings results. Market conditions have gotten worse compared to last week, and technical charts look weak until the Nifty500 reclaims its 50EMA.

Market will be keeping a close watch on any news about trade deals and tariff changes. All we want is clarity on tariff policies rather than uncertainty. The next big boost for markets will likely come from companies reporting better earnings.

Despite current challenges, India's long-term economic story remains strong. Investors always look for a long-term view and take major short-term market drops as good chances to buy solid companies at cheaper prices.