Trade Tensions Deepen Market Correction

Nifty500 Hits Six-Week Low; Swing traders face hostile environment.

Indian equity markets faced significant headwinds this week as global trade tensions and persistent foreign fund outflows weighed heavily on sentiment. The Nifty500 declined to 22,443 on August 8, marking its sixth consecutive weekly loss.

Key Drivers This Week

US Tariff Impact: President Trump imposed further 25% reciprocal tariffs on Indian goods, along with additional penalties for India's crude oil and military purchases from Russia, creating significant trade policy uncertainty.

FII Outflow Continues: Continued foreign institutional selling throughout the week put pressure on equities.

RBI Policy Hold: RBI maintained the repo rate at 5.5%, following a 50 basis points cut in June 2025.

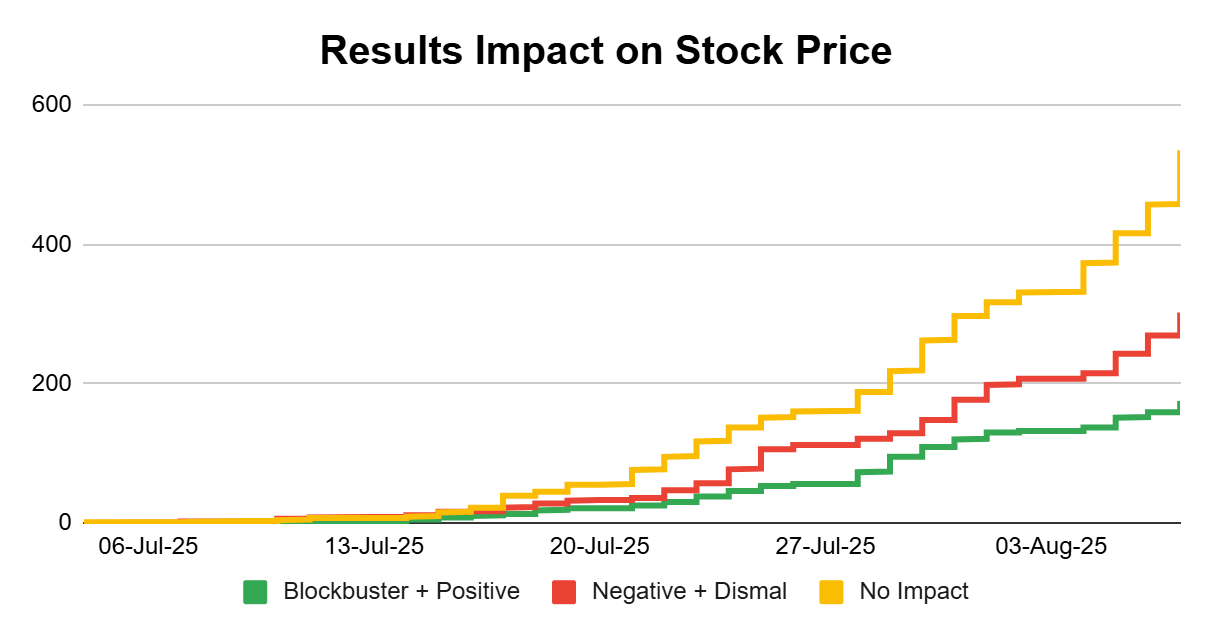

Mixed Earnings: With over 1,000 companies having received market reactions to their results by Friday, August 8, 2025, a significantly higher number of companies experienced negative or dismal market reactions compared to those with blockbuster or positive responses.

However, the current cycle of disappointing results may be setting up favorable low base effects, potentially paving the way for higher growth rates in subsequent quarters as companies benefit from easier year-over-year comparisons.

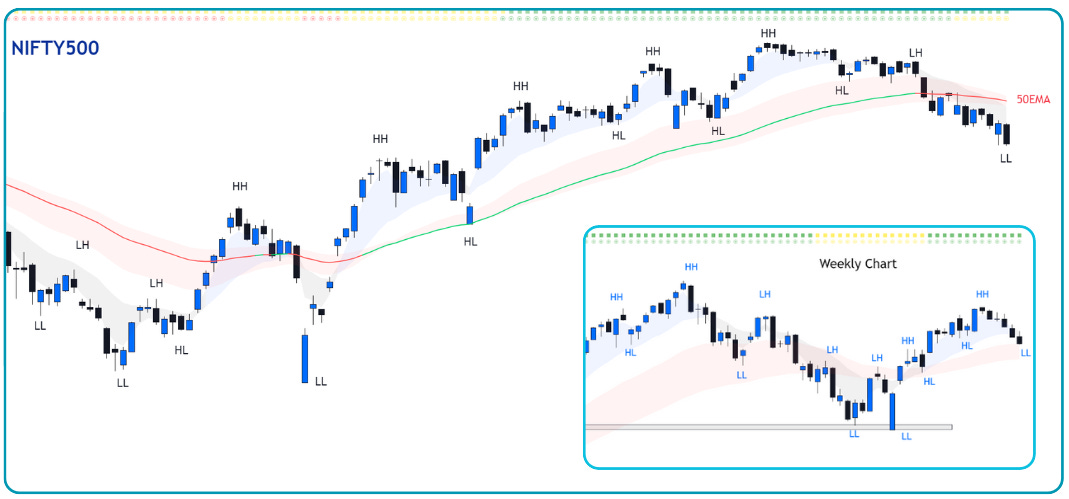

Technical Perspective

Nifty500 Trend: The Nifty500 closed at 22,443 on August 8, down 1.02% for the week. It is trading below both 20EMA & 50EMA and also made a new Lower Low this week, which is a bearish signal and suggests that sellers are in control in the short term.

Short-Term Levels: Nifty500 needs to reclaim its 50EMA, to regain bullish momentum. Until then, short-term trend remains negative with risk of further correction. Momentum and structure continue to favor bears.

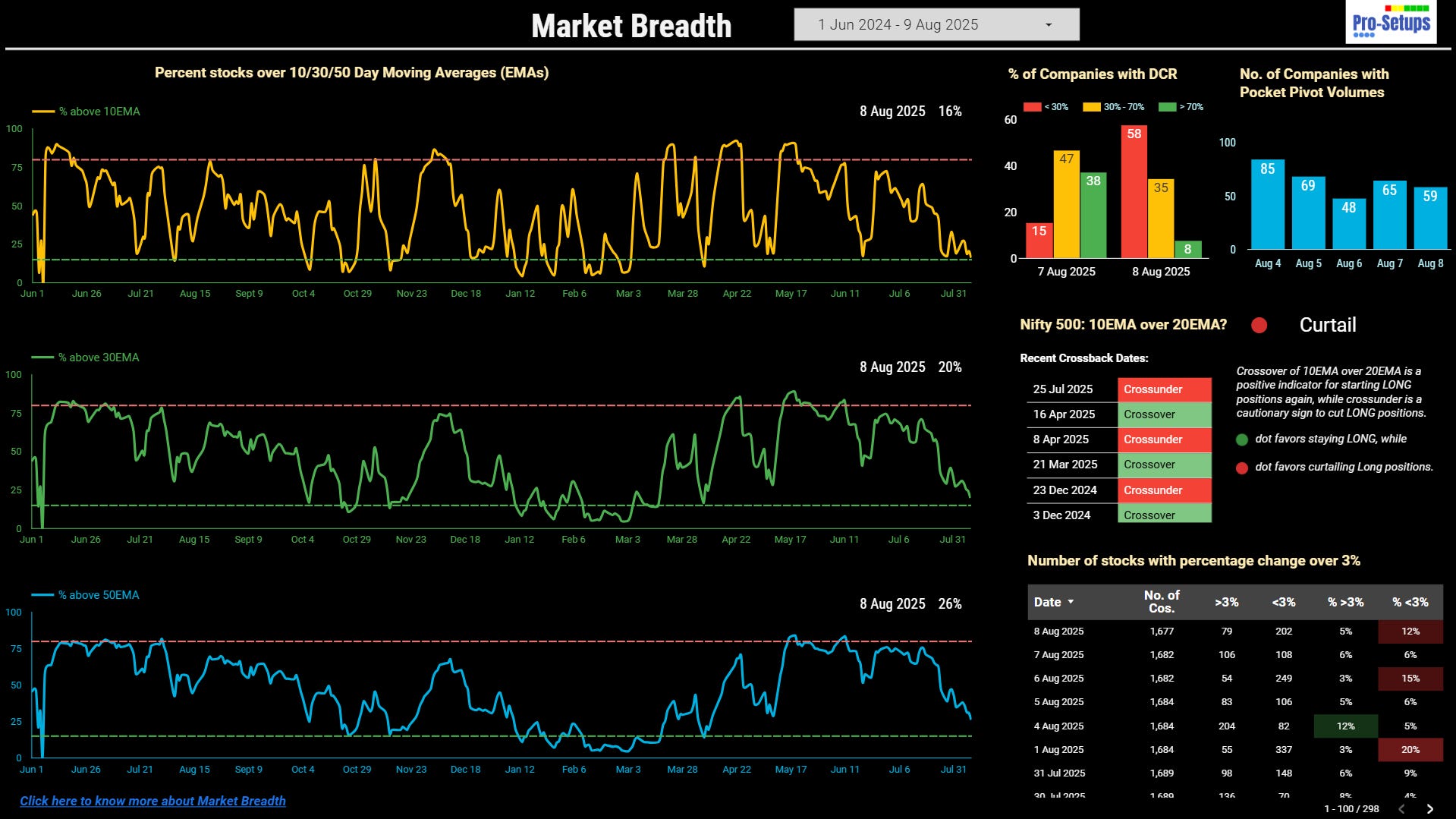

Market Breadth: The % of stocks above all key short-term moving averages declined further this week, and are very close to the oversold levels. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts. We got a signal on Crossunder of Nifty500’s 10EMA below its 20EMA on 25th July. Crossunder is a cautionary sign to cut LONG positions.

Accessing Market Breadth on Pro-Setups Dashboard is now available for free for all readers. Click on the link below.

Trading & Investment Strategy

Typically, when 10EMA is above Rising 20EMA, it indicates strong short-term momentum and provides favorable conditions for swing trading entries. However, currently only 13% of stocks (that have market cap greater than Rs. 300 crores & listed on NSE) have their 10EMA over Rising 20EMA, and declining continuously since July. This deterioration indicates a persistently difficult swing-trading environment where most swing positions would have hit stop losses. Plus, only 24% of stocks have their 50EMA rising as of today signifying broader market weakness, compared to around 70% in the beginning of July.

Swing Traders: Given afore-mentioned unfavorable conditions, aggressive bullish swing trades should be avoided until market breadth improves significantly. Traders should wait for both the percentage of stocks with rising 50EMAs to increase and the percentage of stocks with 10EMA above rising 20EMA to show an uptick. For broader market assessment, one can track the EMAs on Nifty500 also for this purpose.

Positional Traders: Any breakdown of holdings from 50EMA is an exit signal for positional traders. This week would have caused quite some exits here as well.

Key triggers:

Resolution of US-India trade tensions and potential tariff reductions.

Next week will be the last leg of Q1 earnings season.

Although medium to long-term bias remains positive, further downside in short-term can be expected. Since market breadth is very close to the oversold zone, we might even see a good bounce soon.

Position Sizing: Your Shield Against Trading Disasters

There’s no way to guarantee profits, no matter how skilled or experienced you are. Losses are inevitable, and sometimes those losses can be unexpectedly large. The challenge for every trader is to pr…

Summary

The market is currently in a correction phase, with negative trends dominating sentiment. Concerns are centered around the impact of new tariffs and disappointing company earnings, both of which have weighed heavily on performance. Conditions have worsened compared to last week, and technical charts remain weak until the Nifty500 manages to reclaim its 50EMA. Although the Q1 earnings season has been underwhelming so far, it could set the stage for favorable low base effects in the coming quarters.

Despite these short-term challenges, India’s long-term economic outlook remains strong. Long-term investors often view sharp market declines as opportunities to accumulate high-quality companies at attractive valuations.