Watch for Breakout: Markets Set for Next Leg of Rally

Nifty500 approaches critical 23,230 resistance level after strong weekly gains. Broad participation across market segments signals strength in current uptrend.

Indian equity market extended its gains this week, with the Nifty500 gaining over 1.58%. The week witnessed a broad-based rally across market segments, supported by domestic institutional buying and positive sentiment around potential GST reforms and US-India trade developments.

Key Drivers This Week

GST reform optimism: Expectations of GST rate cuts boosted sentiment.

Key market indices like Nifty50 and Sensex gained around 1.5% each. This week’s rally was not limited to large-cap stocks but extended across different market cap, demonstrating broad participation. Both Midcap and Smallcap indices rose by over 1.8% and 1.4% respectively.

The European Union has rejected US President Trump’s call for imposing 100% tariffs on India and China over their Russian oil purchases. Our stock market reacted positively to the EU’s stance.

A key global event to watch is the upcoming U.S. Federal Reserve meeting on September 16-17, where markets are pricing in a probable interest rate cut, which could attract FII inflows back into the Indian markets.

Traders continue to keep a close watch on US-India trade tensions as any development on this front is likely to shape near-term market direction.

The upcoming RBI meeting date (Sept 29-Oct 1) will also be a key event to watch in coming month.

Technical Perspective

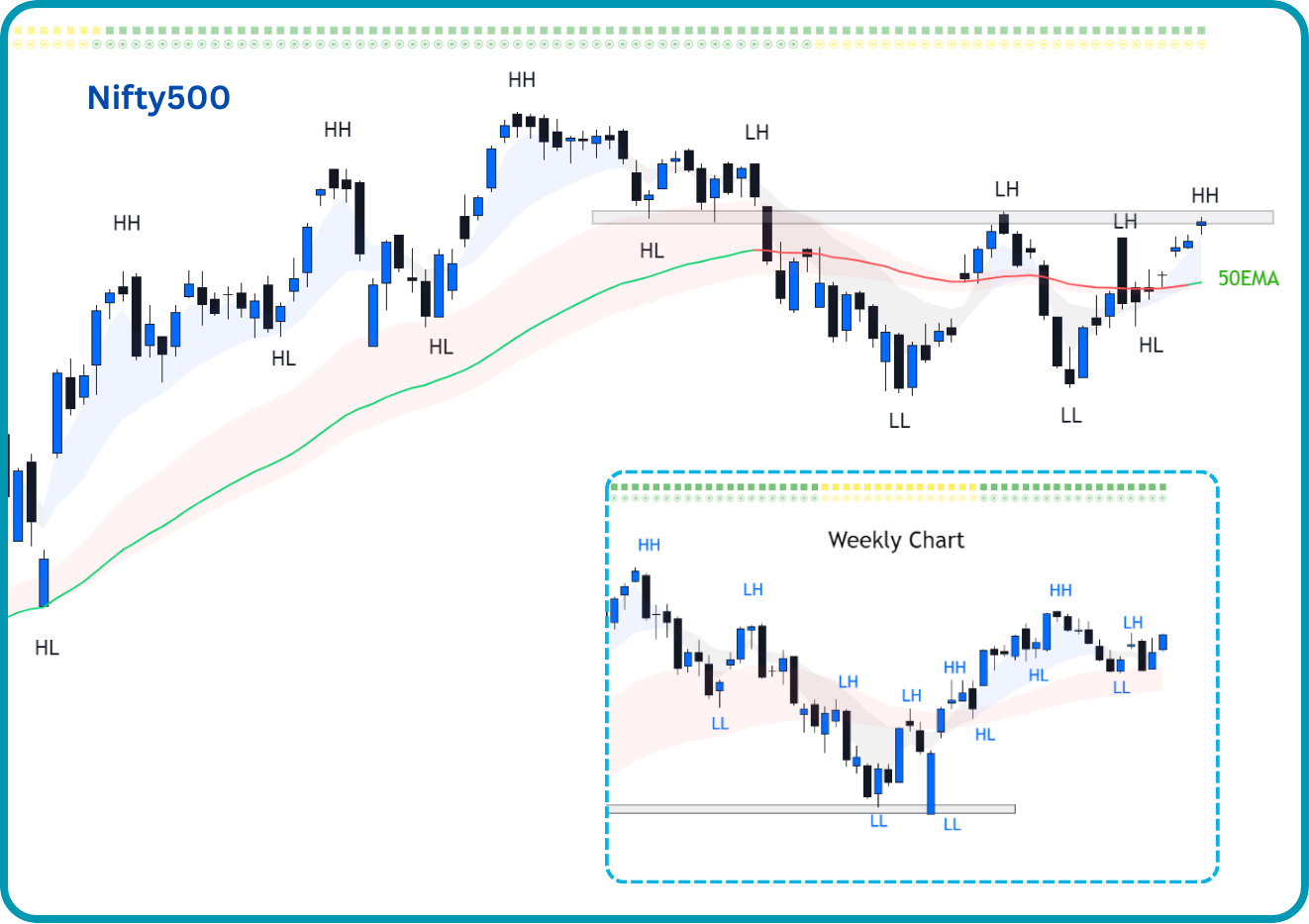

Nifty500 Trend: The Nifty500 successfully bounced from its previous swing lows (around 22,450), suggesting that the price has found support at that level and a shift in market sentiment from bearish to potentially bullish. It also made a new Higher High this week on daily timeframe chart.

Short-Term Levels: Nifty500 has been consolidating between 22,400-23,230 range since last 4-5 weeks. At the moment, Nifty500 is knocking at the previous support-turned-resistance level, and can face some short-term resistance here. A decisive breakout above this consolidation range could trigger strong upward momentum and create favorable conditions for significant portfolio gains.

Market Breadth: The % of stocks above all key short-term moving averages gained this week. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts. As of now, the market is neither overbought nor oversold.

We got a signal on Crossover of Nifty500’s 10EMA above its 20EMA on 10th September. Crossover is a encouraging signal to add LONG positions.

Accessing Market Breadth on Pro-Setups Dashboard is now available for free for all readers. Click on the link below.

Trading & Investment Strategy

Swing Traders: The trading environment has changed from bearish to cautiously bullish. A break above the consolidating range of 22,400-23,230 will be positive for swing traders to aggressively take long positions. Given the

Positional Traders: Positional traders should continue to focus on stocks showing strong relative strength.

Summary

The current environment has turned cautiously bullish this week, with Nifty500 gaining 1.58% amid broad-based participation across market segments. Watch for a sustained move above the 23,230 consolidation resistance for the next leg of rally. GST Council decisions, US Federal Reserve meeting outcomes (Sept 16-17), and continued FII flows will be crucial market drivers in the near term. On breakout of the consolidation range above 23,230, swing traders can get aggressively long, while positional traders should concentrate on stocks demonstrating strong relative strength.