Ather Energy - IPO Note

One of the leading pure-play electric two-wheeler (E2W) manufacturers in India, demanding a high P/Sales multiple despite negative EBITDA since inception.

Sector: Automobiles

Industry: Passenger Vehicles

Market Cap: ~₹12,000 crores

Issue size: ~₹2,980 crore (Fresh + OFS)

IPO price: ₹304–₹321 per share

Company Description

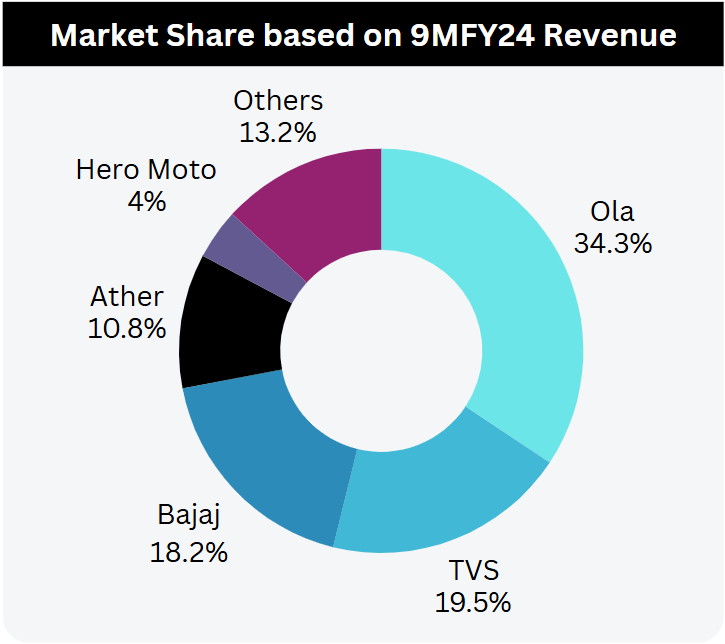

Ather Energy Limited is one of the leading Indian electric two-wheeler (E2W) manufacturers in India, with in-house design, battery pack manufacturing, vehicle assembly, proprietary software (Atherstack), and a dedicated charging infrastructure (Ather Grid). Its first E2W was launched in 2018. For 9 months ending Dec’24, it was the 4th largest player by volume with 10.7% market share. It commands premium brand positioning and strong recall among urban and tech-savvy consumers.

Ather is backed by strategic investors, with Hero MotoCorp holding the largest stake alongside NIIF. In 2013, IIT Madras provided crucial early-stage support, including office space, mentorship, and access to resources in exchange for 5% of Ather’s equity.

Manufacturing:

Tamil Nadu: Total installed capacity of 420,000 E2Ws and 379,800

Maharashtra: Planned 1st phase to be operational in 2027 with 500,000 E2Ws

Despite 420,000 units annual capacity, Tamil Nadu plants operated at 39% utilization. Further, New Maharashtra plant (₹927 crore investment) will add 1 million units capacity by 2027 despite current underutilization.

Objects of IPO:

Maharashtra Factory: ₹927 cr.

Debt repayment: ₹40 cr.

Investment in R&D: ₹750 cr.

Marketing expenses: ₹300 cr.

General corporate exp: ₹600 cr.

Product Portfolio and Distribution Reach

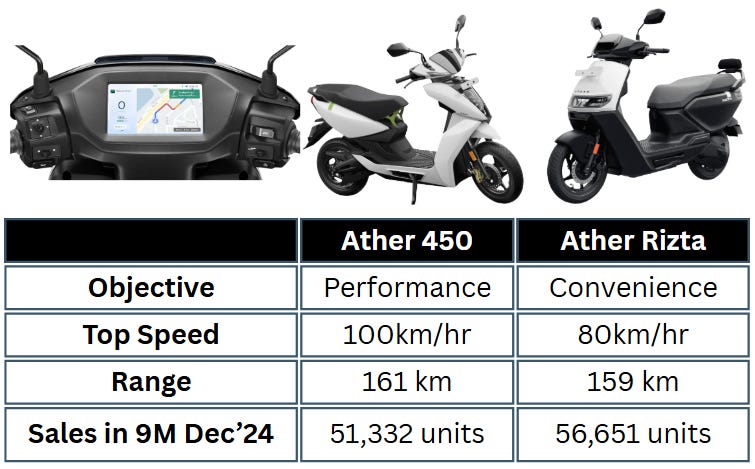

Ather sells ‘Ather 450’ series (450X, 450S, 450 Apex), ‘Ather Rizta’ (family scooter).

Software: Atherstack powers connected features and OTA updates; ~86% of customers use advanced features. Atherstack Pro pack is sold for ₹13,000-20,000.

Charging Infrastructure: Ather has established one of India’s largest dedicated E2W charging networks, branded as Ather Grid. As of Dec. 31, 2024, it operated 2,616 fast chargers and 666 neighborhood chargers, spanning 314 cities across India, Nepal, and Sri Lanka. Additionally, Ather provides portable chargers for home use with every scooter sold.

Distribution: 280 experience centers and 238 service centers in India, with additional presence in Nepal and Sri Lanka.

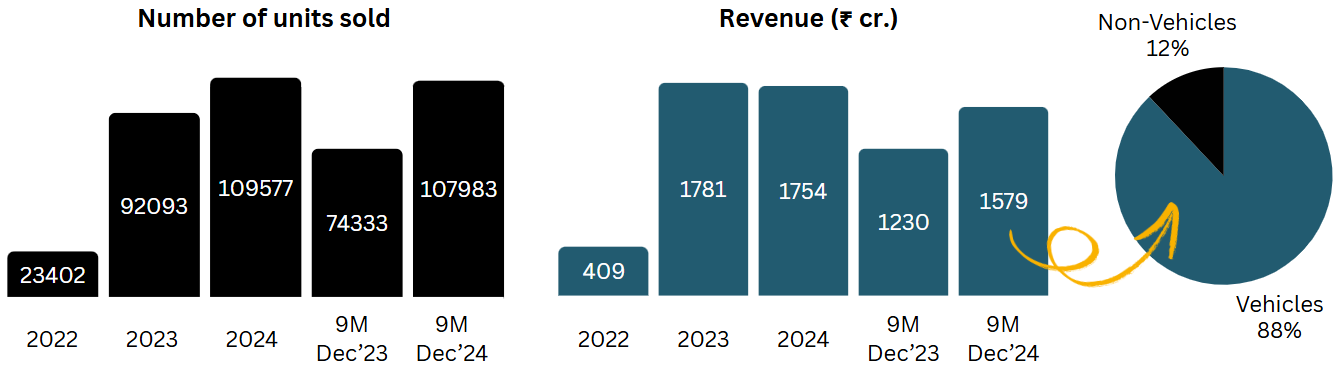

Key Financials

Ather remains loss-making with persistent negative EBITDA margins.

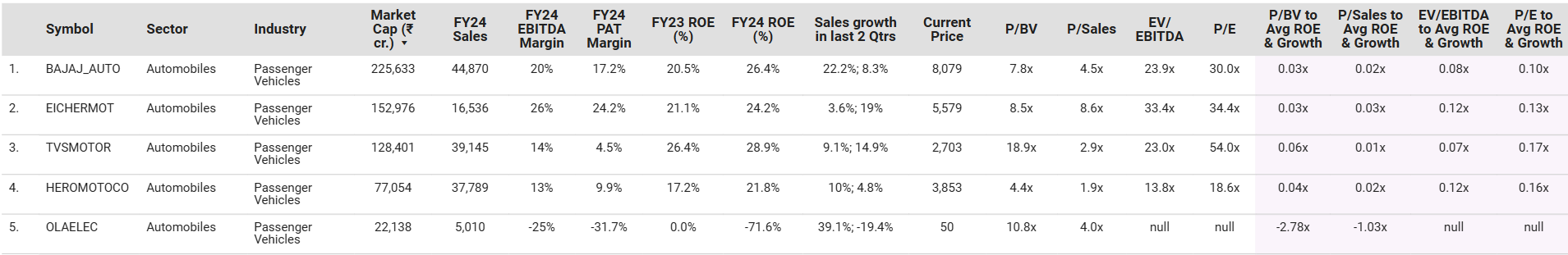

Peer Comparison with listed 2W manufacturers

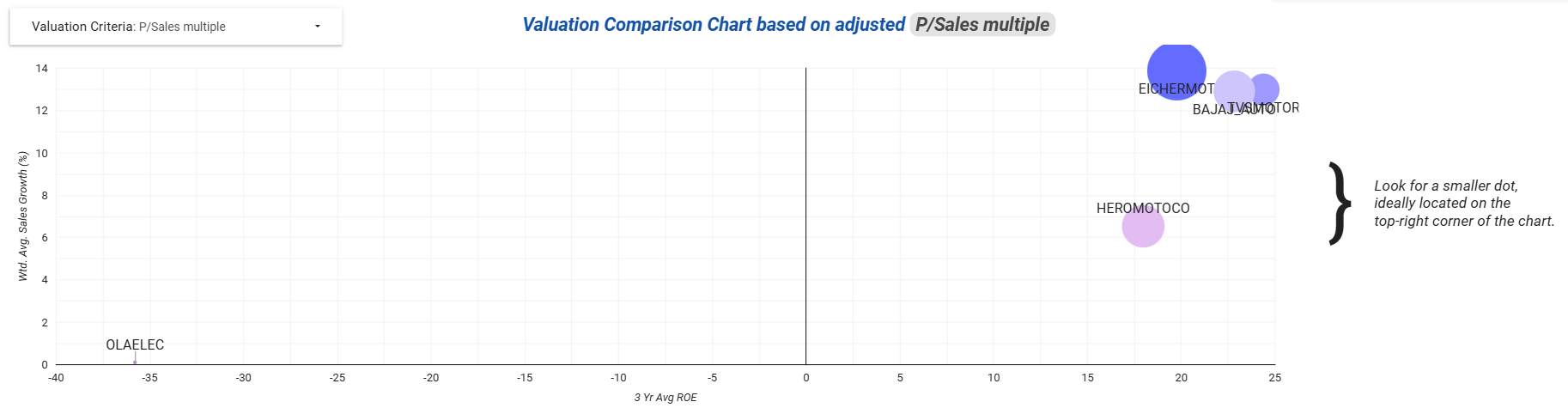

Once Ather lists, it will appear above Ola Electric on the left side of our valuation comparison chart, reflecting its higher growth rates but still negative ROE. In contrast, profitable and high-RoE companies like Bajaj Auto, Eicher Motors, TVS Motor, and Hero MotoCorp are clustered in the top-right corner, highlighting their strong fundamentals and consistent sales growth. This positioning raises the question: given the available choices, do established, profitable players offer a more compelling investment case compared to loss-making, high-valuation peers like Ather and Ola Electric?