Market Momentum Pauses: All Eyes on Trade Deal and Regulation

Market rally pauses as all eyes remain on the outcome of trade talks.

Market Outlook

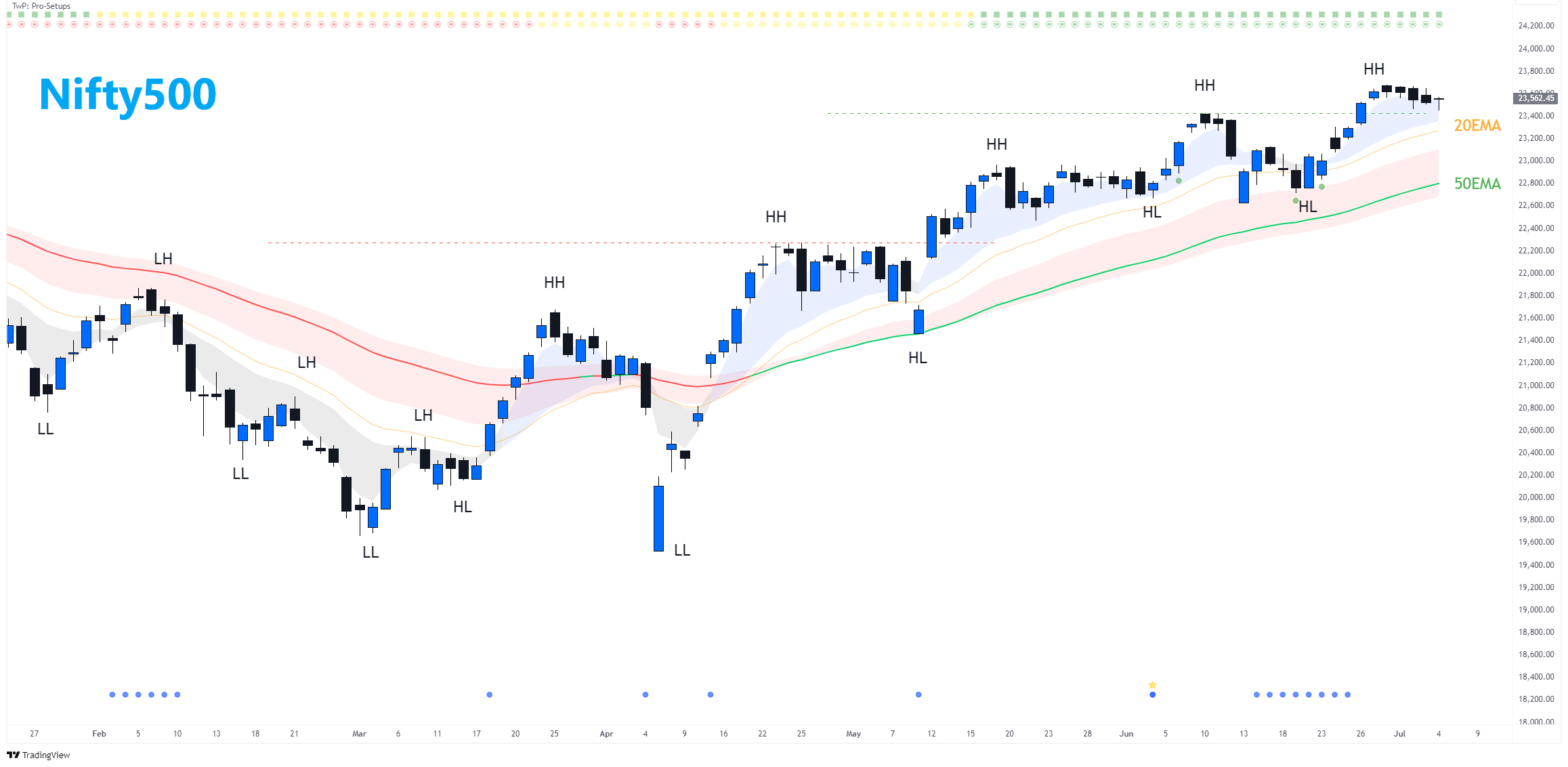

This week, the Indian stock market paused its previous week's rally, with the Nifty500 ending almost flat, down 0.24%. Investors remained cautious ahead of the July 9 deadline for US tariffs on Indian goods. According to the Economic Advisory Council, most issues between the India and US have been resolved, though some sticking points still remain. There might be a mini-deal by July 9, which would help alleviate some of the current trade-related uncertainties.

Regulatory action by SEBI on Jane Street for alleged derivatives manipulation was the biggest talk of the week, as it will likely affect trading volumes in the near term.

On Nifty500, next pullback will probably retest 20EMA again. But such dips are likely to attract renewed buying interest. Overall, the market outlook continues to remain bullish, supported by strong institutional flows, improving global sentiment, Wall Street indices at record highs. Anticipation of strong Q1 earnings and progress in trade talks could act as catalysts for further gains. At the outset, there seems to be no negative factor that can impact markets, other than failing to reach a trade deal within the stipulated time.

RBI has issued its Financial Stability Report, and if you're interested, you may read Chapter 1: Macro-financial Risks from page 17 onwards about Domestic Financial Markets.

Market Breadth

This week’s market action reflected more of a pause in momentum rather than a significant decline in prices (read our post on Price correction and Time correction). This week’s pause was nothing different and the ‘What If’ scenarios discussed in that post hold equally true for the coming week as well.

A clear majority of stocks continue to trade above their short and medium-term EMAs, signaling broad-based market strength. While the market is not yet in the overbought zone, just a few more days of upward movement could push it into that territory. At that point, swing traders may start locking in profits, which could lead to short-term pullbacks.