Market Reclaims Strength in a Key Turning Point

Bulls cheer as market steps out of the sideways trap, but the sideways ghost isn’t gone yet.

Indian equities closed the week on a strong note, with the Nifty500 gaining 1.34%. The upmove was driven by improving domestic sentiment, solid quarterly earnings, and steady global cues. Large caps led the rally, helped by robust institutional inflows and renewed risk appetite.

Key Indices Performance:

Nifty50: +1.64%

Sensex: +1.62%

Nifty500: +1.34%

Nifty Midcap150: +1.38%

Nifty Smallcap250: +0.36%

Nifty Midsmallcap400: +1.03%

Key Drivers This Week

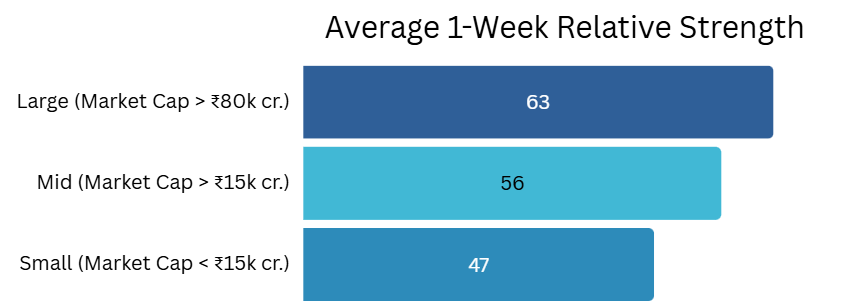

Large-cap stocks displayed stronger relative strength and outperformed mid- and small-cap stocks.

Markets reacted favorably to the Bihar Assembly election results, where the NDA secured a decisive victory.

Technical Perspective

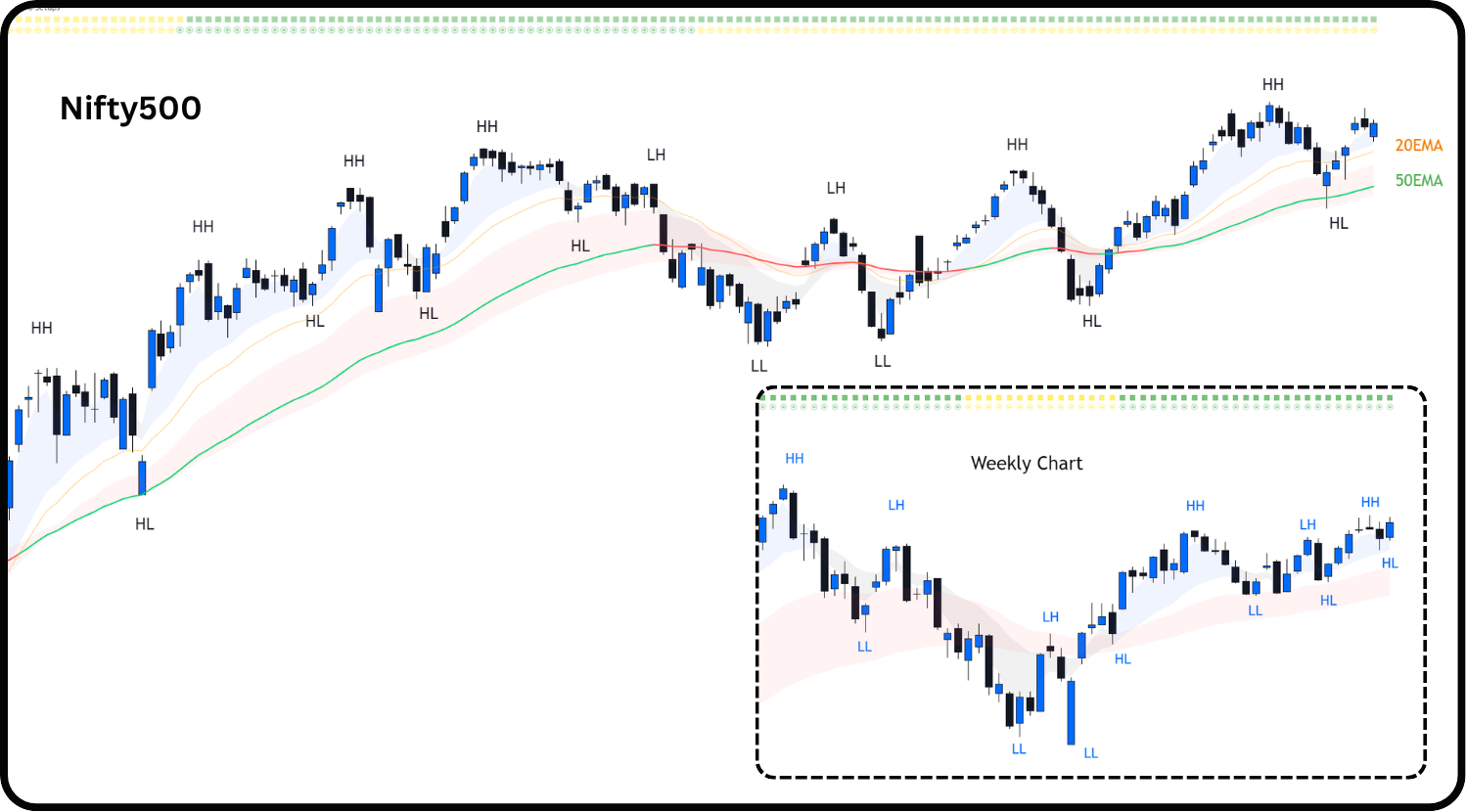

Nifty500 Trend: Nifty500 gained a strong 1.34% for the week, supported by renewed institutional buying and optimism following the Bihar election results, which boosted buying momentum into the market close.

After finding robust support near its rising 50EMA last week, the Nifty500 reaffirmed its bullish price structure. Closing above 23,800 has increased confidence that the current upward momentum can continue.

With the earnings season now behind us, focus will be on management commentary and anticipated growth in consumer demand driven by the implementation of GST 2.0.

The index continues to make higher highs on the weekly chart and is consolidating near the upper boundary of its previous range - a sign of resilience despite recent volatility.

As mentioned in the previous newsletter, on weekly timeframe, the Nifty500 index seems to be forming the handle portion of a Cup-and-Handle pattern, with volatility tightening, which is a sign of pressure building up before a breakout. When this handle resolves, it could be explosive. This setup often precedes a strong breakout, and if that materializes, it could set the tone for a highly rewarding 2026.

The reason we track Nifty500 is because it represents over 90% of the free float market capitalization, making it a comprehensive barometer of market health.

Nifty500’s 10EMA crossed above its 20EMA on 7th October triggering a ‘Stay’ signal that suggests holding onto existing long positions.

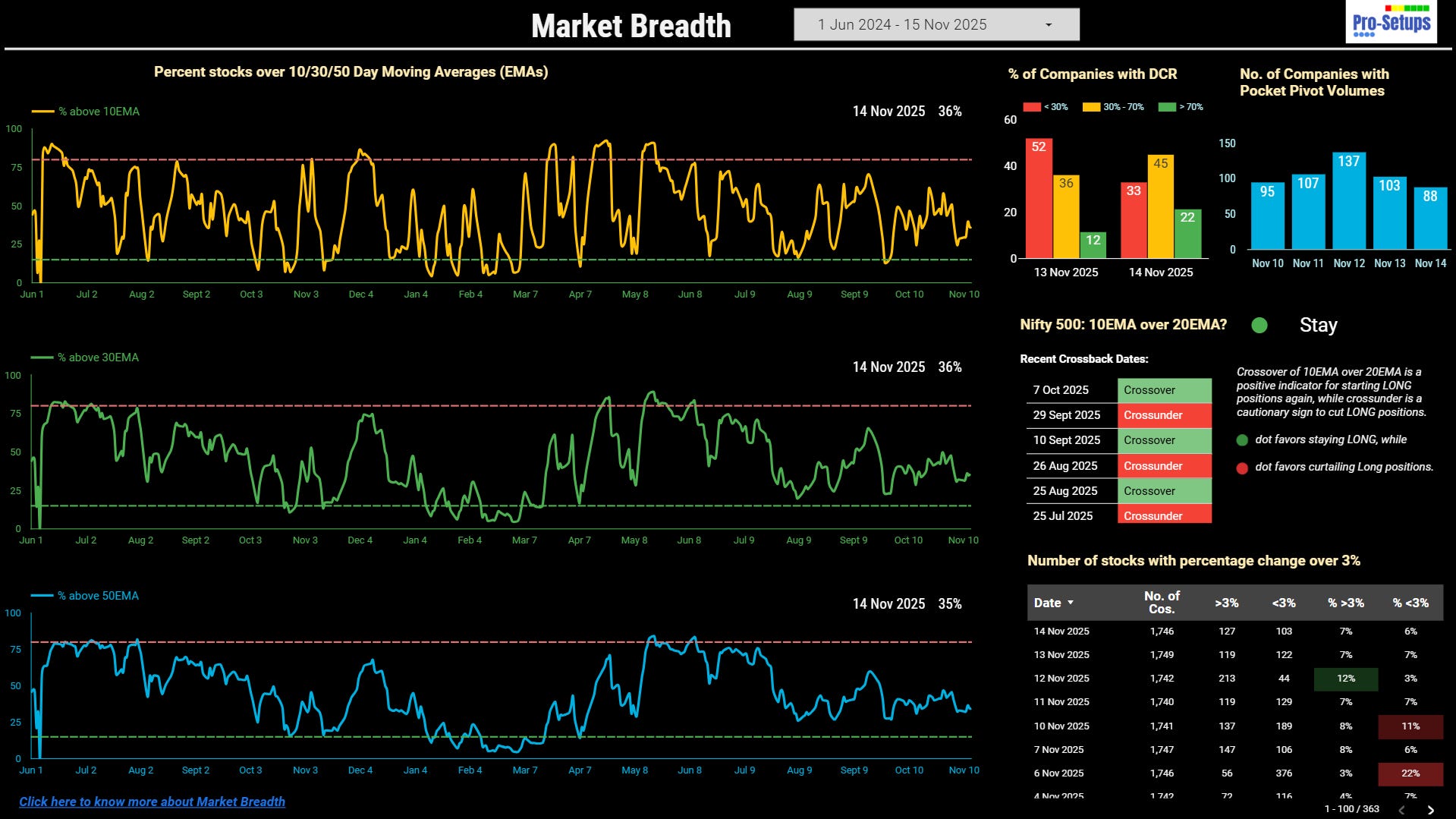

Market Breadth: The percentage of stocks trading above key short-term moving averages was unchanged this week. As of November 14, 2025, only about 36% of stocks are above their 10EMA, 30EMA, and 50EMA. While the index looks bullish, the market breadth readings remain below the midpoint (50% mark), signaling that the majority of stocks are trading below short-to-medium-term trend levels, which is typically a corrective sign for the broader market.

Market breadth continues to be weak, and we are neither in the overbought nor the oversold zone. It’s important to note that overbought or oversold signals are most relevant for swing traders, as they reflect short-term momentum shifts.

Accessing Market Breadth on Pro-Setups Dashboard is available for all readers. Click on the link below.

Can we step back into the Sideways phase?

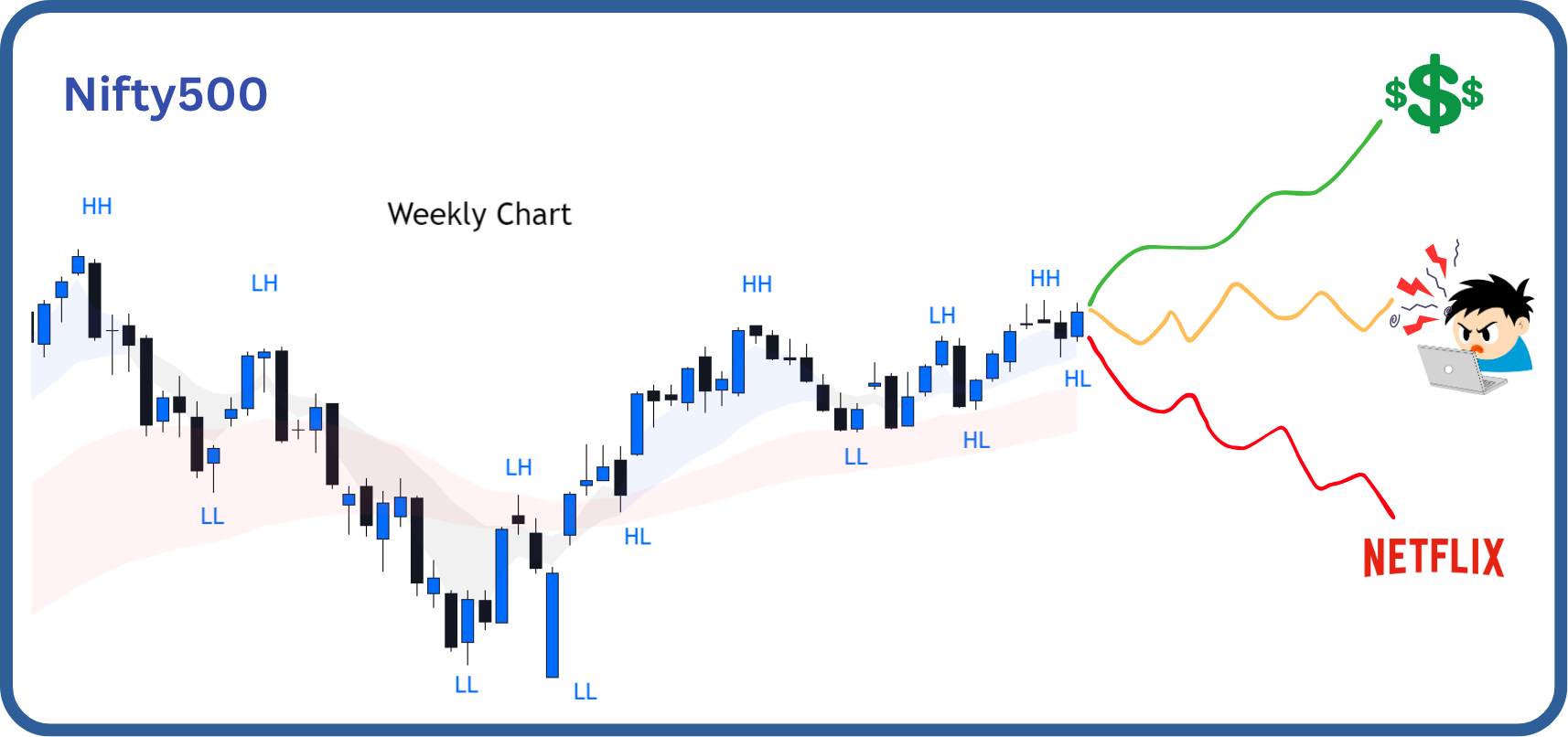

Our market is finally beginning to put its foot out of the prolonged consolidation phase. However, while the market structure has turned bullish, it’s important to note that the market can still slip into a sideways phase, especially if momentum cools or participation doesn’t broaden.

Sideways markets are trickier than bear markets. In a bear market, the direction is clear - everything is falling, so long-only traders simply step aside, protect their capital, and peacefully catch up on Netflix. In a bull market, at least you are making money and feeling good. But sideways markets? That’s where the real trouble begins. Prices keep giving false signals - they go up a bit, making us think it is time to buy, then they fall back down, making us think that it is time to sell. It becomes a cycle of fake signals. You are not making money, you are not staying out, and worst of all, you can’t even enjoy Netflix guilt-free.

Positives for the next rally

Several positive factors are coming together to support the next market rally in India.

RBI projects India’s GDP growth at 6.5% for FY 2025-26, which means that our domestic economy is doing well.

Interest rate cuts will make it cheaper for businesses to borrow money. The next RBI meet is scheduled for December 3-5, 2025.

Reduce GST rates and income taxes, would put more money in people’s pockets and boost spending.

A potential trade deal between the US and India could bring in foreign investment, giving the market the push it needs to move higher.

The Q3 (December quarter) earnings season should showcase strong performance in consumption-driven sectors.

Summary

This week, Indian markets shifted back into a bullish stride. The Nifty500 gained 1.34%, supported by renewed institutional buying and improved sentiment following the Bihar election results, which helped sustain momentum into the week’s close. The index’s rebound from its rising 50EMA has reinforced its bullish structure, and a close above 23,800 has strengthened confidence in the continuation of the current uptrend. That said, even with this improved bullish structure, it’s important to note that the market can still slip into a sideways phase, especially if momentum cools or participation doesn’t broaden.

With the earnings season now wrapped up, market attention will turn to management commentary and expectations around consumer demand. Overall, the tone has turned decisively positive, with conditions favoring further upside if supportive flows persist.